Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work in excel A new biofuel company, CleanTech, is building its first plant in the Tampa Bay area where algae farms will turn

Please show work in excel

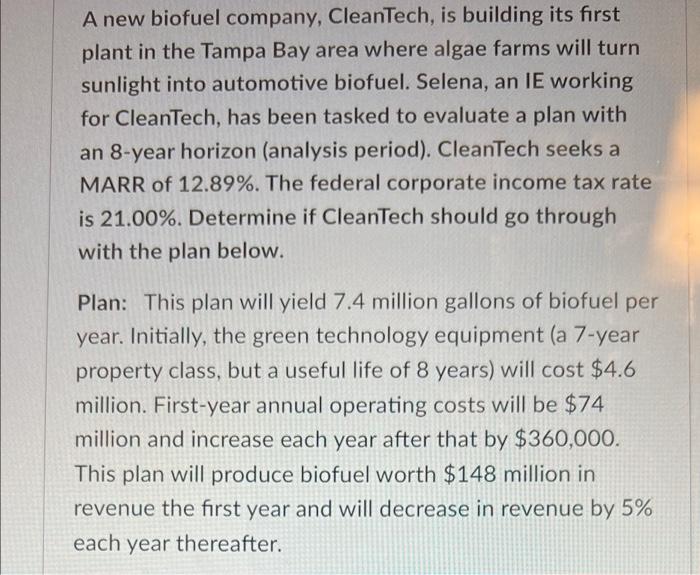

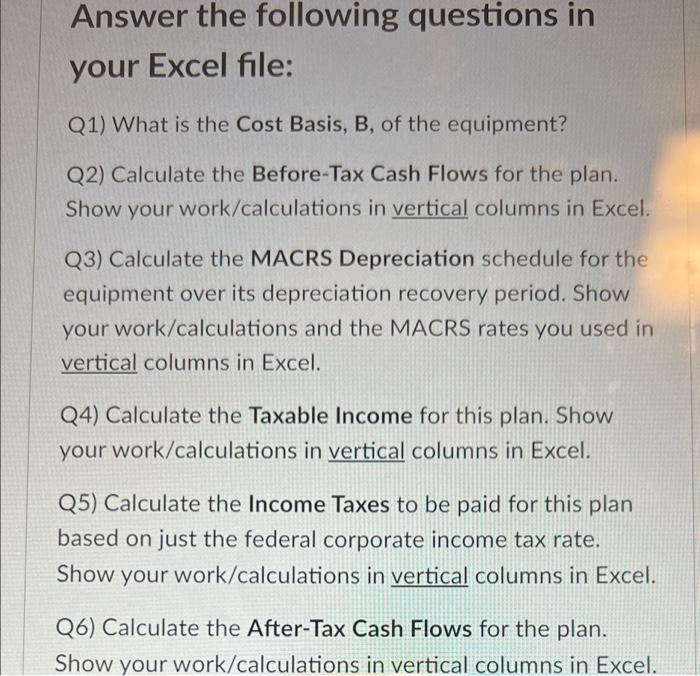

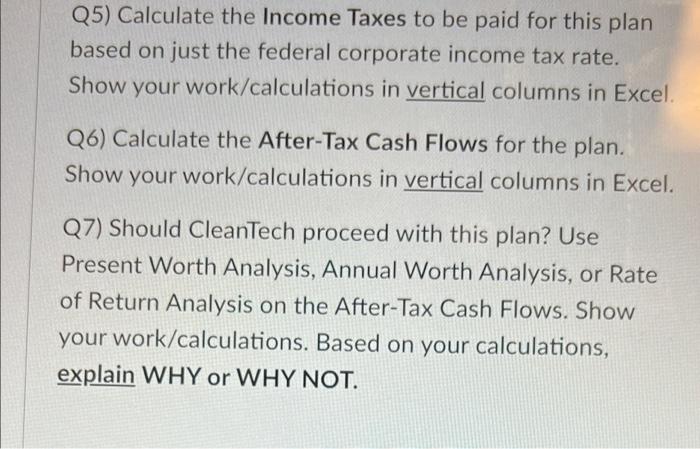

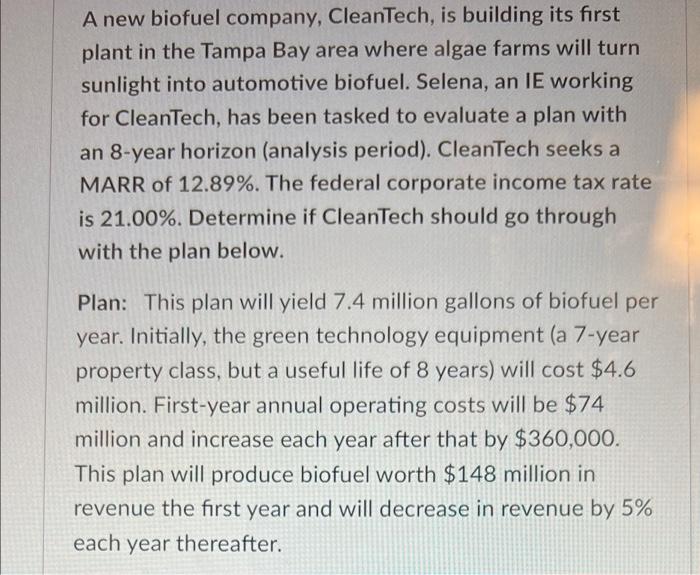

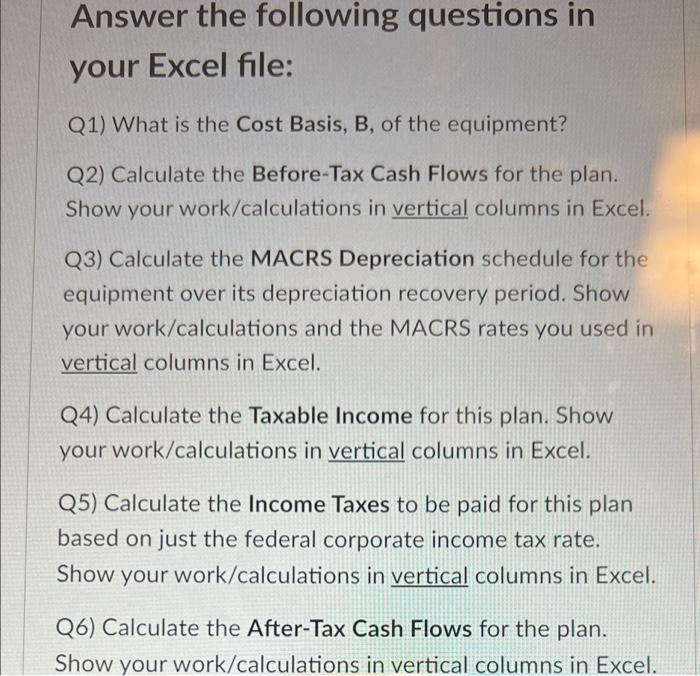

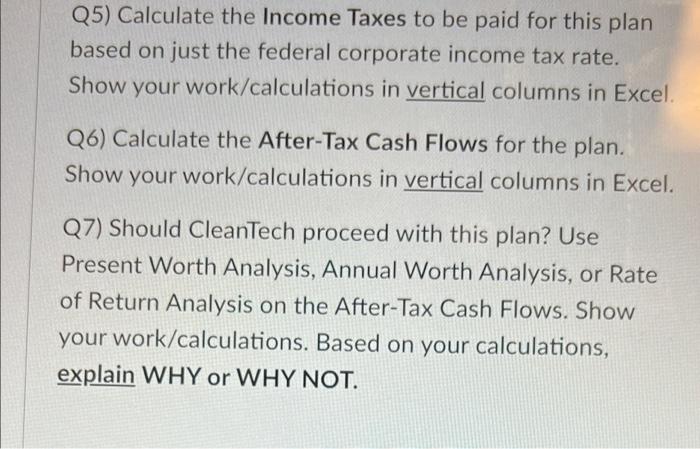

A new biofuel company, CleanTech, is building its first plant in the Tampa Bay area where algae farms will turn sunlight into automotive biofuel. Selena, an IE working for CleanTech, has been tasked to evaluate a plan with an 8-year horizon (analysis period). CleanTech seeks a MARR of 12.89%. The federal corporate income tax rate is 21.00%. Determine if CleanTech should go through with the plan below. Plan: This plan will yield 7.4 million gallons of biofuel per year. Initially, the green technology equipment (a 7-year property class, but a useful life of 8 years) will cost $4.6 million. First-year annual operating costs will be $74 million and increase each year after that by $360,000. This plan will produce biofuel worth $148 million in revenue the first year and will decrease in revenue by 5% each year thereafter. Answer the following questions in your Excel file: Q1) What is the Cost Basis, B, of the equipment? Q2) Calculate the Before-Tax Cash Flows for the plan. Show your work/calculations in vertical columns in Excel. Q3) Calculate the MACRS Depreciation schedule for the equipment over its depreciation recovery period. Show your work/calculations and the MACRS rates you used in vertical columns in Excel. Q4) Calculate the Taxable income for this plan. Show your work/calculations in vertical columns in Excel. Q5) Calculate the Income Taxes to be paid for this plan based on just the federal corporate income tax rate. Show your work/calculations in vertical columns in Excel. Q6) Calculate the After-Tax Cash Flows for the plan. Show your work/calculations in vertical columns in Excel. Q5) Calculate the Income Taxes to be paid for this plan based on just the federal corporate income tax rate. Show your work/calculations in vertical columns in Excel. Q6) Calculate the After-Tax Cash Flows for the plan. Show your work/calculations in vertical columns in Excel. Q7) Should CleanTech proceed with this plan? Use Present Worth Analysis, Annual Worth Analysis, or Rate of Return Analysis on the After-Tax Cash Flows. Show your work/calculations. Based on your calculations, explain WHY or WHY NOT. A new biofuel company, CleanTech, is building its first plant in the Tampa Bay area where algae farms will turn sunlight into automotive biofuel. Selena, an IE working for CleanTech, has been tasked to evaluate a plan with an 8-year horizon (analysis period). CleanTech seeks a MARR of 12.89%. The federal corporate income tax rate is 21.00%. Determine if CleanTech should go through with the plan below. Plan: This plan will yield 7.4 million gallons of biofuel per year. Initially, the green technology equipment (a 7-year property class, but a useful life of 8 years) will cost $4.6 million. First-year annual operating costs will be $74 million and increase each year after that by $360,000. This plan will produce biofuel worth $148 million in revenue the first year and will decrease in revenue by 5% each year thereafter. Answer the following questions in your Excel file: Q1) What is the Cost Basis, B, of the equipment? Q2) Calculate the Before-Tax Cash Flows for the plan. Show your work/calculations in vertical columns in Excel. Q3) Calculate the MACRS Depreciation schedule for the equipment over its depreciation recovery period. Show your work/calculations and the MACRS rates you used in vertical columns in Excel. Q4) Calculate the Taxable income for this plan. Show your work/calculations in vertical columns in Excel. Q5) Calculate the Income Taxes to be paid for this plan based on just the federal corporate income tax rate. Show your work/calculations in vertical columns in Excel. Q6) Calculate the After-Tax Cash Flows for the plan. Show your work/calculations in vertical columns in Excel. Q5) Calculate the Income Taxes to be paid for this plan based on just the federal corporate income tax rate. Show your work/calculations in vertical columns in Excel. Q6) Calculate the After-Tax Cash Flows for the plan. Show your work/calculations in vertical columns in Excel. Q7) Should CleanTech proceed with this plan? Use Present Worth Analysis, Annual Worth Analysis, or Rate of Return Analysis on the After-Tax Cash Flows. Show your work/calculations. Based on your calculations, explain WHY or WHY NOT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started