Answered step by step

Verified Expert Solution

Question

1 Approved Answer

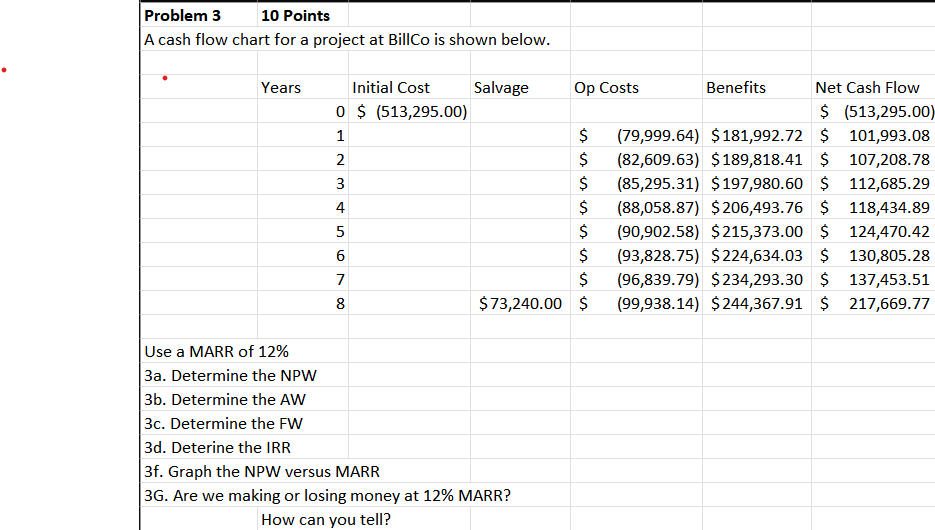

please show work in excel Problem 3 10 Points A cash flow chart for a project at BillCo is shown below. Years Initial Cost Salvage

please show work in excel

Problem 3 10 Points A cash flow chart for a project at BillCo is shown below. Years Initial Cost Salvage Op Costs Benefits Net Cash Flow 0 $ (513,295.00) $ (513,295.00) 1 $ (79,999.64) $181,992.72 $ 101,993.08 2 $ (82,609.63) $189,818.41 $ 107,208.78 3 $ (85,295.31) $ 197,980.60 $ 112,685.29 4 $ (88,058.87) $206,493.76 $ 118,434.89 5 $ (90,902.58) $215,373.00 $ 124,470.42 6 $ (93,828.75) $ 224,634.03 $ 130,805.28 7 $ (96,839.79) $234,293.30 $ 137,453.51 8 $73,240.00 $ (99,938.14) $ 244,367.91 $ 217,669.77 UT 00 Use a MARR of 12% 3a. Determine the NPW 3b. Determine the AW 3c. Determine the FW 3d. Deterine the IRR 3f. Graph the NPW versus MARR 36. Are we making or losing money at 12% MARR? How can you tell? Problem 3 10 Points A cash flow chart for a project at BillCo is shown below. Years Initial Cost Salvage Op Costs Benefits Net Cash Flow 0 $ (513,295.00) $ (513,295.00) 1 $ (79,999.64) $181,992.72 $ 101,993.08 2 $ (82,609.63) $189,818.41 $ 107,208.78 3 $ (85,295.31) $ 197,980.60 $ 112,685.29 4 $ (88,058.87) $206,493.76 $ 118,434.89 5 $ (90,902.58) $215,373.00 $ 124,470.42 6 $ (93,828.75) $ 224,634.03 $ 130,805.28 7 $ (96,839.79) $234,293.30 $ 137,453.51 8 $73,240.00 $ (99,938.14) $ 244,367.91 $ 217,669.77 UT 00 Use a MARR of 12% 3a. Determine the NPW 3b. Determine the AW 3c. Determine the FW 3d. Deterine the IRR 3f. Graph the NPW versus MARR 36. Are we making or losing money at 12% MARR? How can you tellStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started