Answered step by step

Verified Expert Solution

Question

1 Approved Answer

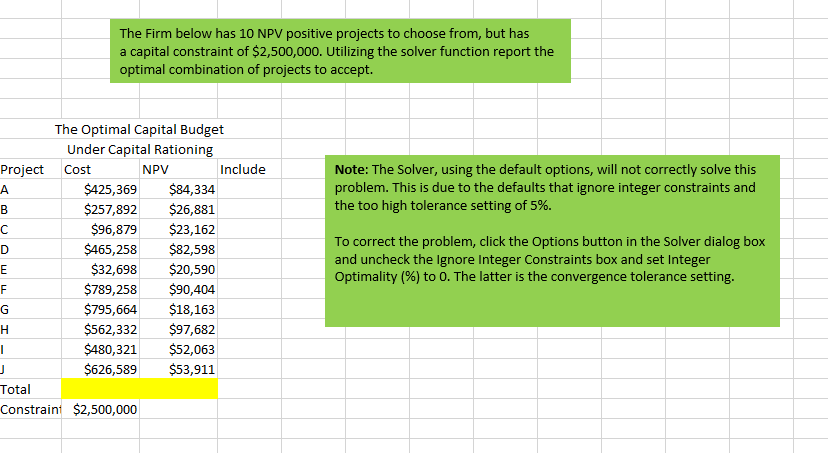

The Firm below has 10 NPV positive projects to choose from, but has a capital constraint of $2,500,000. Utilizing the solver function report the optimal

The Firm below has 10 NPV positive projects to choose from, but has

a capital constraint of $2,500,000. Utilizing the solver function report the

optimal combination of projects to accept.

The Firm below has 10 NPV positive projects to choose from, but has a capital constraint of $2,500,000. Utilizing the solver function report the optimal combination of projects to accept. Note: The Solver, using the default options, will not correctly solve this problem. This is due to the defaults that ignore integer constraints and the too high tolerance setting of 5%. The Optimal Capital Budget Under Capital Rationing Project Cost NPV Include A $425,369 $84,334 B $257,892 $26,881 $96,879 $23,162 D $465,258 $82,598 E $32,698 $20,590 F $789,258 $90,404 G $795,664 $18,163 . $562,332 $97,682 I $480,321 $52,063 J $626,589 $53,911 Total Constraint $2,500,000 To correct the problem, click the Options button in the Solver dialog box and uncheck the Ignore Integer Constraints box and set Integer Optimality (%) to 0. The latter is the convergence tolerance settingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started