Please show work

Please show work

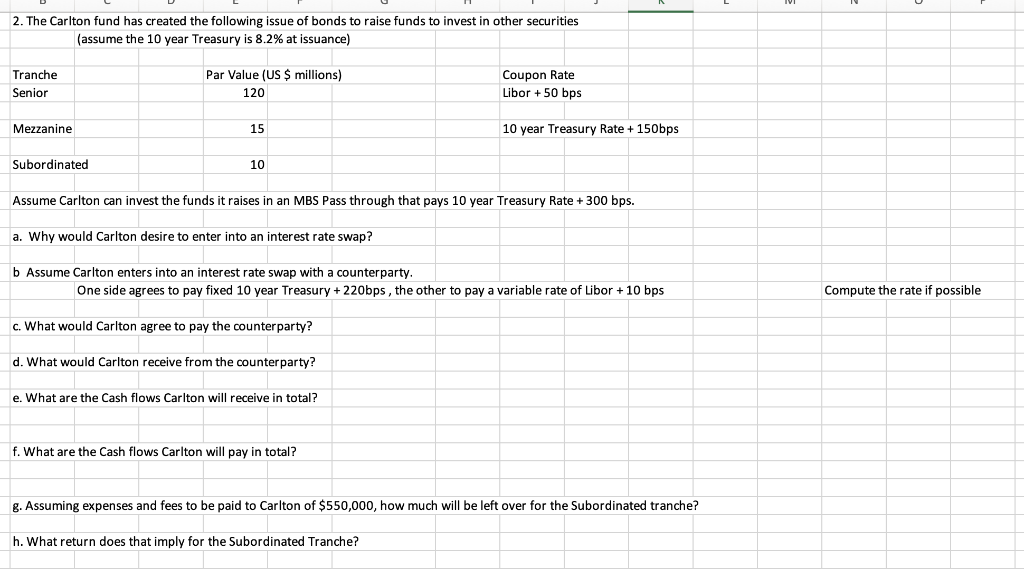

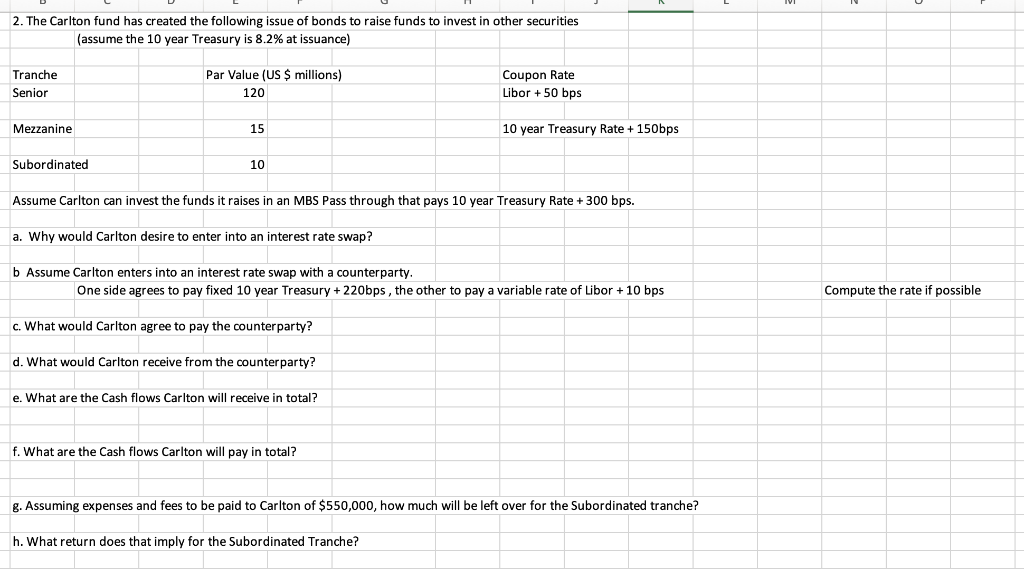

other securities 2. The Carlton fund has created the following issue of bonds to raise funds to invest (assume the 10 year Treasury is 8.2% at issuance) Tranche Senior Par Value (US $ millions) 120 Coupon Rate Libor + 50 bps Mezzanine 15 10 year Treasury Rate + 150bps Subordinated 10 Assume Carlton can invest the funds it raises in an MBS Pass through that pays 10 year Treasury Rate + 300 bps. a. Why would Carlton desire to enter into an interest rate swap? b Assume Carlton enters into an interest rate swap with a counterparty. One side agrees to pay fixed 10 year Treasury + 220bps, the other to pay a variable rate of Libor + 10 bps Compute the rate possible c. What would Carlton agree to pay the counterparty? d. What would Carlton receive from the counterparty? e. What are the Cash flows Carlton will receive in total? f. What are the Cash flows Carlton will pay in total? g. Assuming expenses and fees to be paid to Carlton of $550,000, how much will be left over for the Subordinated tranche? h. What return does that imply for the Subordinated Tranche? other securities 2. The Carlton fund has created the following issue of bonds to raise funds to invest (assume the 10 year Treasury is 8.2% at issuance) Tranche Senior Par Value (US $ millions) 120 Coupon Rate Libor + 50 bps Mezzanine 15 10 year Treasury Rate + 150bps Subordinated 10 Assume Carlton can invest the funds it raises in an MBS Pass through that pays 10 year Treasury Rate + 300 bps. a. Why would Carlton desire to enter into an interest rate swap? b Assume Carlton enters into an interest rate swap with a counterparty. One side agrees to pay fixed 10 year Treasury + 220bps, the other to pay a variable rate of Libor + 10 bps Compute the rate possible c. What would Carlton agree to pay the counterparty? d. What would Carlton receive from the counterparty? e. What are the Cash flows Carlton will receive in total? f. What are the Cash flows Carlton will pay in total? g. Assuming expenses and fees to be paid to Carlton of $550,000, how much will be left over for the Subordinated tranche? h. What return does that imply for the Subordinated Tranche

Please show work

Please show work