Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The portfolio manager for the $200 million Brent College Endowment. He is planning on a making a presentation to the trustees of the endowment. He

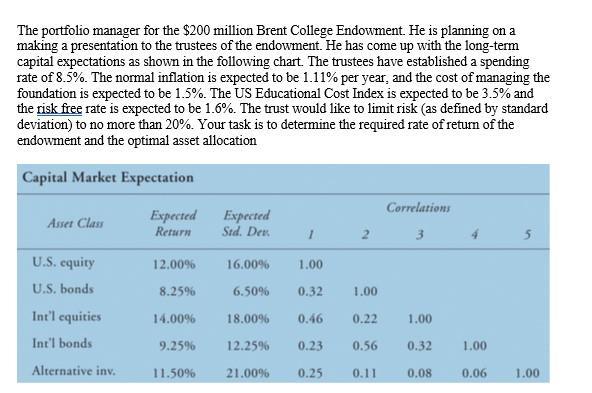

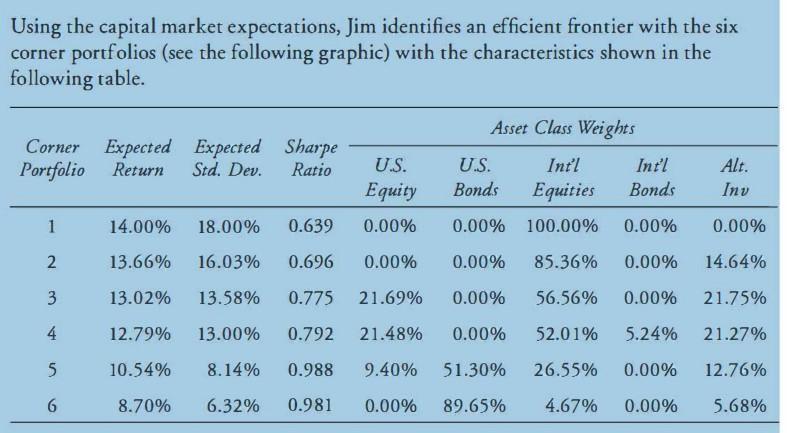

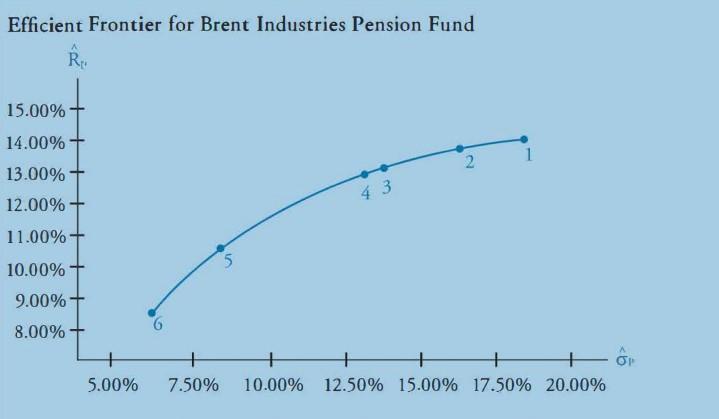

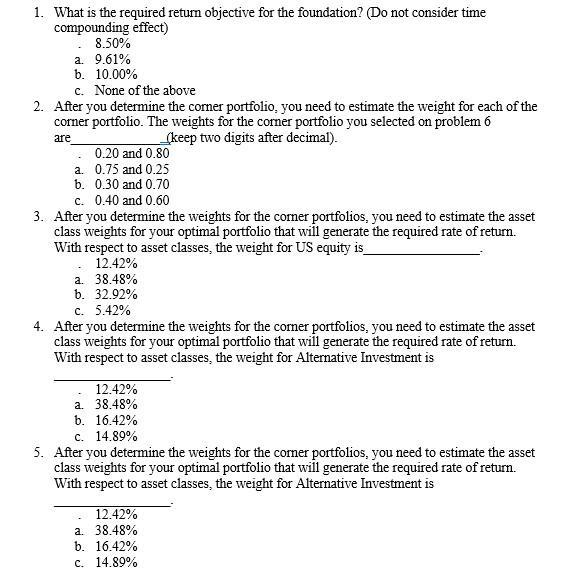

The portfolio manager for the $200 million Brent College Endowment. He is planning on a making a presentation to the trustees of the endowment. He has come up with the long-term capital expectations as shown in the following chart. The trustees have established a spending rate of 8.5%. The normal inflation is expected to be 1.11% per year, and the cost of managing the foundation is expected to be 1.5%. The US Educational Cost Index is expected to be 3.5% and the risk free rate is expected to be 1.6%. The trust would like to limit risk (as defined by standard deviation) to no more than 20%. Your task is to determine the required rate of return of the endowment and the optimal asset allocation Capital Market Expectation Asset Class U.S. equity U.S. bonds Int'l equities Int'l bonds Alternative inv. Expected Return 12.00% 8.25% 14.00% 9.25% 11.50% Expected Std. Dev. 1 1.00 0.32 1.00 0.46 0.22 0.56 0.25 0.11 16.00% 6.50% 18.00% 12.25% 0.23 21.00% Correlations 3 1.00 0.32 0.08 1.00 5 0.06 1.00 Using the capital market expectations, Jim identifies an efficient frontier with the six corner portfolios (see the following graphic) with the characteristics shown in the following table. Corner Expected Expected Sharpe Return Std. Dev. Portfolio Ratio 1 2 3 4 5 6 Asset Class Weights U.S. U.S. Int'l Int'l Alt. Equity Bonds Equities Bonds Inv 0.00% 0.00% 100.00% 0.00% 0.00% 0.00% 85.36% 0.00% 14.64% 0.00% 56.56% 0.00% 21.75% 0.00% 52.01% 5.24% 21.27% 9.40% 51.30% 26.55% 0.00% 12.76% 0.00% 89.65% 4.67% 0.00% 5.68% 14.00% 13.66% 13.02% 13.58% 12.79% 13.00% 10.54% 8.14% 8.70% 6.32% 18.00% 0.639 16.03% 0.696 0.00% 0.775 21.69% 0.792 21.48% 0.988 0.981 Efficient Frontier for Brent Industries Pension Fund R 15.00% 14.00% 13.00% 12.00% 11.00% - 10.00% T 9.00% T 8.00% 5 43 2 1 5.00% 7.50% 10.00% 12.50% 15.00 % 17.50% 20.00% 1. What is the required return objective for the foundation? (Do not consider time compounding effect) 8.50% a. 9.61% b. 10.00% c. None of the above 2. After you determine the corner portfolio, you need to estimate the weight for each of the corner portfolio. The weights for the corner portfolio you selected on problem 6 (keep two digits after decimal). are 0.20 and 0.80 0.75 and 0.25 a. b. 0.30 and 0.70 c. 0.40 and 0.60 3. After you determine the weights for the corner portfolios, you need to estimate the asset class weights for your optimal portfolio that will generate the required rate of return. With respect to asset classes, the weight for US equity is 12.42% a. 38.48% b. 32.92% c. 5.42% 4. After you determine the weights for the corner portfolios, you need to estimate the asset class weights for your optimal portfolio that will generate the required rate of return. With respect to asset classes, the weight for Alternative Investment is 12.42% a. 38.48% b. 16.42% c. 14.89% 5. After you determine the weights for the corner portfolios, you need to estimate the asset class weights for your optimal portfolio that will generate the required rate of return. With respect to asset classes, the weight for Alternative Investment is 12.42% a. 38.48% b. 16.42% c. 14.89% The portfolio manager for the $200 million Brent College Endowment. He is planning on a making a presentation to the trustees of the endowment. He has come up with the long-term capital expectations as shown in the following chart. The trustees have established a spending rate of 8.5%. The normal inflation is expected to be 1.11% per year, and the cost of managing the foundation is expected to be 1.5%. The US Educational Cost Index is expected to be 3.5% and the risk free rate is expected to be 1.6%. The trust would like to limit risk (as defined by standard deviation) to no more than 20%. Your task is to determine the required rate of return of the endowment and the optimal asset allocation Capital Market Expectation Asset Class U.S. equity U.S. bonds Int'l equities Int'l bonds Alternative inv. Expected Return 12.00% 8.25% 14.00% 9.25% 11.50% Expected Std. Dev. 1 1.00 0.32 1.00 0.46 0.22 0.56 0.25 0.11 16.00% 6.50% 18.00% 12.25% 0.23 21.00% Correlations 3 1.00 0.32 0.08 1.00 5 0.06 1.00 Using the capital market expectations, Jim identifies an efficient frontier with the six corner portfolios (see the following graphic) with the characteristics shown in the following table. Corner Expected Expected Sharpe Return Std. Dev. Portfolio Ratio 1 2 3 4 5 6 Asset Class Weights U.S. U.S. Int'l Int'l Alt. Equity Bonds Equities Bonds Inv 0.00% 0.00% 100.00% 0.00% 0.00% 0.00% 85.36% 0.00% 14.64% 0.00% 56.56% 0.00% 21.75% 0.00% 52.01% 5.24% 21.27% 9.40% 51.30% 26.55% 0.00% 12.76% 0.00% 89.65% 4.67% 0.00% 5.68% 14.00% 13.66% 13.02% 13.58% 12.79% 13.00% 10.54% 8.14% 8.70% 6.32% 18.00% 0.639 16.03% 0.696 0.00% 0.775 21.69% 0.792 21.48% 0.988 0.981 Efficient Frontier for Brent Industries Pension Fund R 15.00% 14.00% 13.00% 12.00% 11.00% - 10.00% T 9.00% T 8.00% 5 43 2 1 5.00% 7.50% 10.00% 12.50% 15.00 % 17.50% 20.00% 1. What is the required return objective for the foundation? (Do not consider time compounding effect) 8.50% a. 9.61% b. 10.00% c. None of the above 2. After you determine the corner portfolio, you need to estimate the weight for each of the corner portfolio. The weights for the corner portfolio you selected on problem 6 (keep two digits after decimal). are 0.20 and 0.80 0.75 and 0.25 a. b. 0.30 and 0.70 c. 0.40 and 0.60 3. After you determine the weights for the corner portfolios, you need to estimate the asset class weights for your optimal portfolio that will generate the required rate of return. With respect to asset classes, the weight for US equity is 12.42% a. 38.48% b. 32.92% c. 5.42% 4. After you determine the weights for the corner portfolios, you need to estimate the asset class weights for your optimal portfolio that will generate the required rate of return. With respect to asset classes, the weight for Alternative Investment is 12.42% a. 38.48% b. 16.42% c. 14.89% 5. After you determine the weights for the corner portfolios, you need to estimate the asset class weights for your optimal portfolio that will generate the required rate of return. With respect to asset classes, the weight for Alternative Investment is 12.42% a. 38.48% b. 16.42% c. 14.89%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started