Answered step by step

Verified Expert Solution

Question

1 Approved Answer

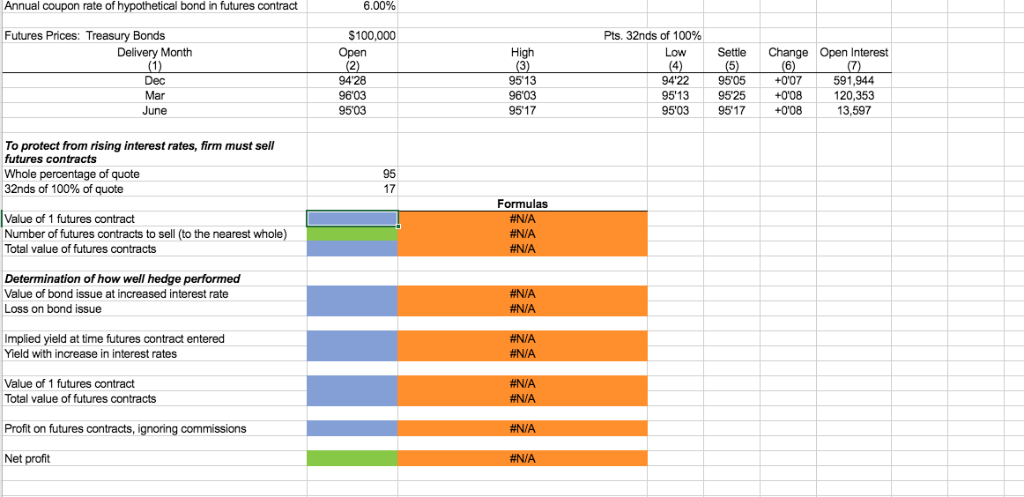

Please show work. Thank you ! Annual coupon rate of hypothetical bond in futures contract 6.00% Futures Prices: Treasury Bonds Delivery Month (1) Dec Mar

Please show work. Thank you !

Annual coupon rate of hypothetical bond in futures contract 6.00% Futures Prices: Treasury Bonds Delivery Month (1) Dec Mar June $100,000 Open (2) 94'28 96'03 9503 High (3) 9513 9603 95'17 Pts. 32nds of 100% Low (4) 94'22 95'13 95'03 Settle (5) 9505 95'25 95'17 Change Open Interest (6) +0'07 591,944 +0'08 120,353 +0'08 13,597 To protect from rising interest rates, firm must sell futures contracts Whole percentage of quote 32nds of 100% of quote 95 17 Value of 1 futures contract Number of futures contracts to sell to the nearest whole) Total value of futures contracts Formulas #N/A #N/A #N/A Determination of how well hedge performed Value of bond issue at increased interest rate Loss on bond issue #N/A #N/A Implied yield at time futures contract entered Yield with increase in interest rates #N/A #N/A Value of 1 futures contract Total value of futures contracts #N/A #N/A Profit on futures contracts, ignoring commissions #N/A Net profit #N/A Annual coupon rate of hypothetical bond in futures contract 6.00% Futures Prices: Treasury Bonds Delivery Month (1) Dec Mar June $100,000 Open (2) 94'28 96'03 9503 High (3) 9513 9603 95'17 Pts. 32nds of 100% Low (4) 94'22 95'13 95'03 Settle (5) 9505 95'25 95'17 Change Open Interest (6) +0'07 591,944 +0'08 120,353 +0'08 13,597 To protect from rising interest rates, firm must sell futures contracts Whole percentage of quote 32nds of 100% of quote 95 17 Value of 1 futures contract Number of futures contracts to sell to the nearest whole) Total value of futures contracts Formulas #N/A #N/A #N/A Determination of how well hedge performed Value of bond issue at increased interest rate Loss on bond issue #N/A #N/A Implied yield at time futures contract entered Yield with increase in interest rates #N/A #N/A Value of 1 futures contract Total value of futures contracts #N/A #N/A Profit on futures contracts, ignoring commissions #N/A Net profit #N/AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started