Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE show work. Thank you! Direct Labor Wage and Efficiency Variances Two basic ways in which the actual cost of direct labor can deviate from

PLEASE show work. Thank you!

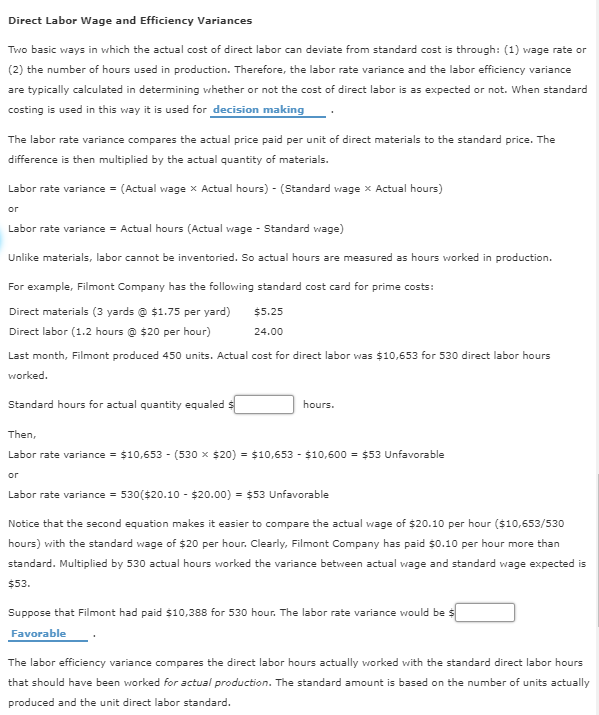

Direct Labor Wage and Efficiency Variances Two basic ways in which the actual cost of direct labor can deviate from standard cost is through: (1) wage rate or (2) the number of hours used in production. Therefore, the labor rate variance and the labor efficiency variance are typically calculated in determining whether or not the cost of direct labor is as expected or not. When standard costing is used in this way it is used for decision making The labor rate variance compares the actual price paid per unit of direct materials to the standard price. The difference is then multiplied by the actual quantity of materials. Labor rate variance (Actual wage Actual hours)-(Standard wage x Actual hours) or Labor rate varianceActual hours (Actual wage Standard wage) Unlike materials, labor cannot be inventoried. So actual hours are measured as hours worked in production. For example, Filmont Company has the following standard cost card for prime costs Direct materials (3 yards @ $1.75 per yard) $5.25 Direct labor (1.2 hours @ $20 per hour) Last month, Filmont produced 450 units. Actual cost for direct labor was $10,653 for 530 direct labor hours worked 24.00 Standard hours for actual quantity equaled hours. Then, Labor rate variance $10,653 (530 x $20)$10,653 $10,600$53 Unfavorable Labor rate variance 530($20.10 $20.00) $53 Unfavorable Notice that the second equation makes it easier to compare the actual wage of $20.10 per hour ($10,653/530 hours) with the standard wage of $20 per hour. Clearly, Filmont Company has paid $0.10 per hour more than standard. Multiplied by 530 actual hours worked the variance between actual wage and standard wage expected is $53. Suppose that Filmont had paid $10,388 for 530 hour. The labor rate variance would be Favorable The labor efficiency variance compares the direct labor hours actually worked with the standard direct labor hours that should have been worked for actual production. The standard amount is based on the number of units actually produced and the unit direct labor standardStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started