Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work that explain Exercise 21-2 (Part Level Submission) Sweet Company leases an automobile with a fair value of $12,501 from John Simon Motors,

Please show work that explain

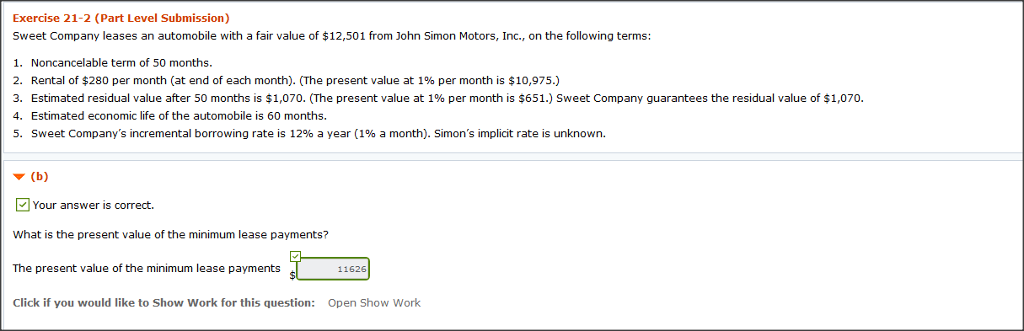

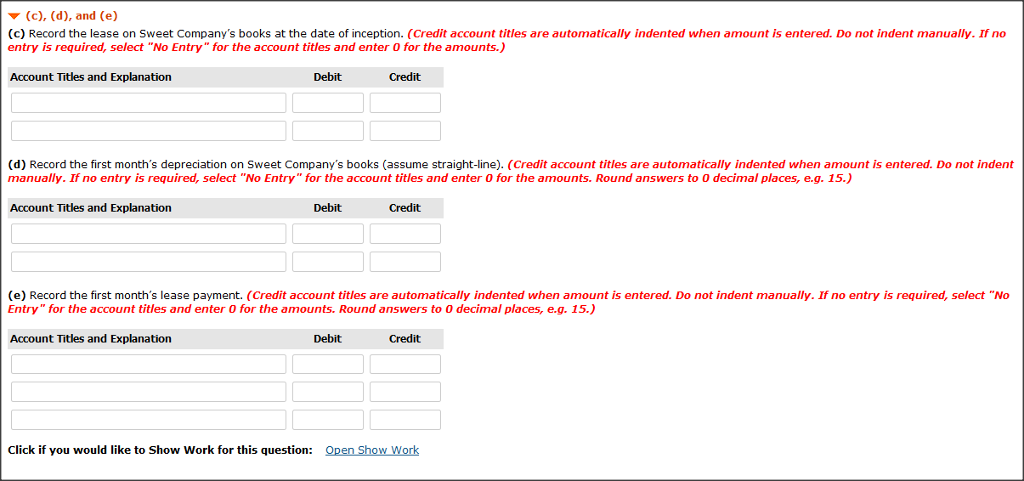

Exercise 21-2 (Part Level Submission) Sweet Company leases an automobile with a fair value of $12,501 from John Simon Motors, Inc., on the following terms: 1. Noncancelable term of 50 months. 2. Rental of $280 per month (at end of each month). (The present value at 1% per month is $10,975.) 3. Estimated residual value after 50 months is $1,070. (The present value at 1% per month is $651.) Sweet Company guarantees the residual value of $1,070. 4. Estimated economic life of the automobile is 60 months. 5. Sweet Company's incremental borrowing rate is 12% a year (196 a month). Simon's implicit rate is unknown. ? (b) Your answer is correct. What is the present value of the minimum lease payments? The present value of the minimum lease payments Click if you would like to Show Work for this question: Open Show Work 11626Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started