Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work This assignment was locked Feb 13 at 11:59pm. Beth & Ed Carlton want to begin some serious financial planning to fund the

Please show work

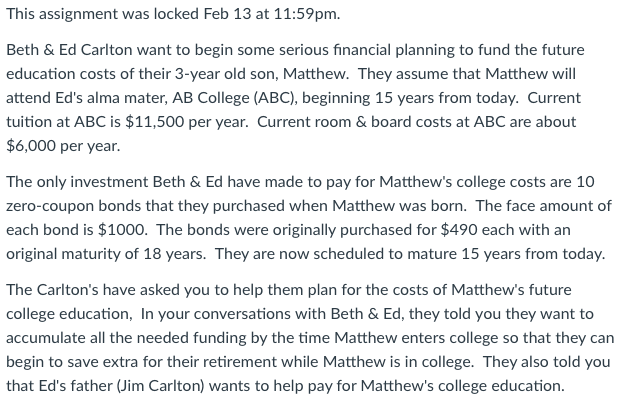

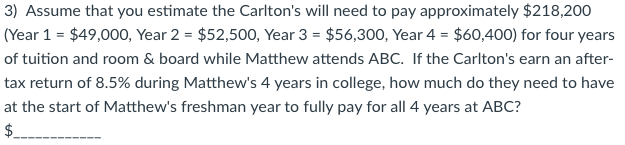

This assignment was locked Feb 13 at 11:59pm. Beth & Ed Carlton want to begin some serious financial planning to fund the future education costs of their 3-year old son, Matthew. They assume that Matthew will attend Ed's alma mater, AB College (ABC), beginning 15 years from today. Current tuition at ABC is $11,500 per year. Current room & board costs at ABC are about $6,000 per year. The only investment Beth & Ed have made to pay for Matthew's college costs are 10 zero-coupon bonds that they purchased when Matthew was born. The face amount of each bond is $1000. The bonds were originally purchased for $490 each with an original maturity of 18 years. They are now scheduled to mature 15 years from today. The Carlton's have asked you to help them plan for the costs of Matthew's future college education, In your conversations with Beth & Ed, they told you they want to accumulate all the needed funding by the time Matthew enters college so that they can begin to save extra for their retirement while Matthew is in college. They also told you that Ed's father (Jim Carlton) wants to help pay for Matthew's college education. 3) Assume that you estimate the Carlton's will need to pay approximately $218,200 (Year 1 = $49,000, Year 2 = $52,500, Year 3 = $56,300, Year 4 = $60,400) for four years of tuition and room & board while Matthew attends ABC. If the Carlton's earn an after- tax return of 8.5% during Matthew's 4 years in college, how much do they need to have at the start of Matthew's freshman year to fully pay for all 4 years at ABC? $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started