Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work within Excel format shown!! The advantage of using the MIRR, relative to the IRR, is that the MIRR assumes that cash flows

Please show work within Excel format shown!!

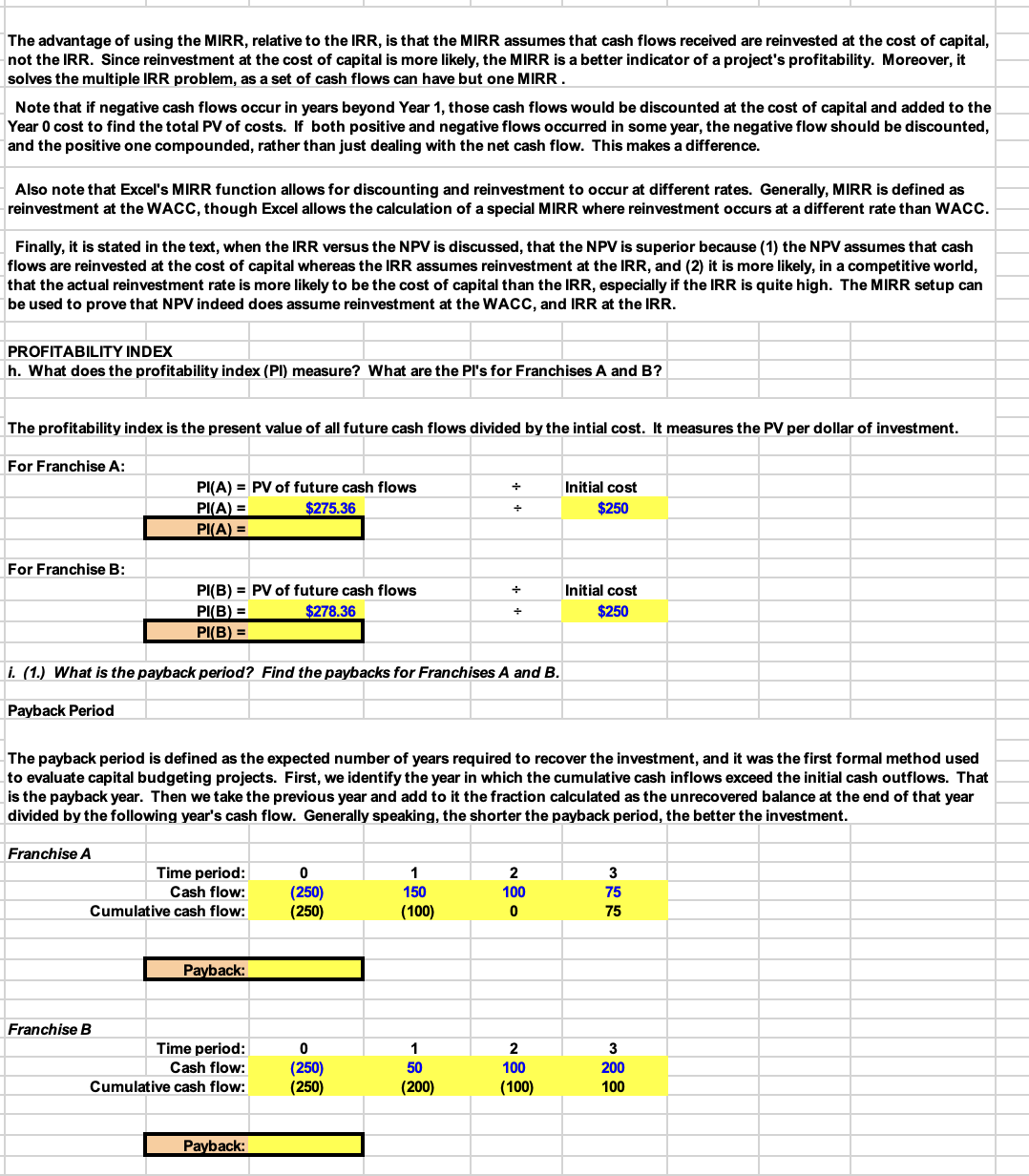

The advantage of using the MIRR, relative to the IRR, is that the MIRR assumes that cash flows received are reinvested at the cost of capital, not the IRR. Since reinvestment at the cost of capital is more likely, the MIRR is a better indicator of a project's profitability. Moreover, it solves the multiple IRR problem, as a set of cash flows can have but one MIRR

Note that if negative cash flows occur in years beyond Year those cash flows would be discounted at the cost of capital and added to the Year cost to find the total PV of costs. If both positive and negative flows occurred in some year, the negative flow should be discounted, and the positive one compounded, rather than just dealing with the net cash flow. This makes a difference.

Also note that Excel's MIRR function allows for discounting and reinvestment to occur at different rates. Generally, MIRR is defined as reinvestment at the WACC, though Excel allows the calculation of a special MIRR where reinvestment occurs at a different rate than WACC.

Finally, it is stated in the text, when the IRR versus the NPV is discussed, that the NPV is superior because the NPV assumes that cash flows are reinvested at the cost of capital whereas the IRR assumes reinvestment at the IRR, and it is more likely, in a competitive world, that the actual reinvestment rate is more likely to be the cost of capital than the IRR, especially if the IRR is quite high. The MIRR setup can be used to prove that NPV indeed does assume reinvestment at the WACC, and IRR at the IRR.

PROFITABILITY INDEX

h What does the profitability index PI measure? What are the PI's for Franchises A and B

The profitability index is the present value of all future cash flows divided by the intial cost. It measures the PV per dollar of investment.

For Franchise A:

tablePV of future cash flows,Initial cost$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started