Answered step by step

Verified Expert Solution

Question

1 Approved Answer

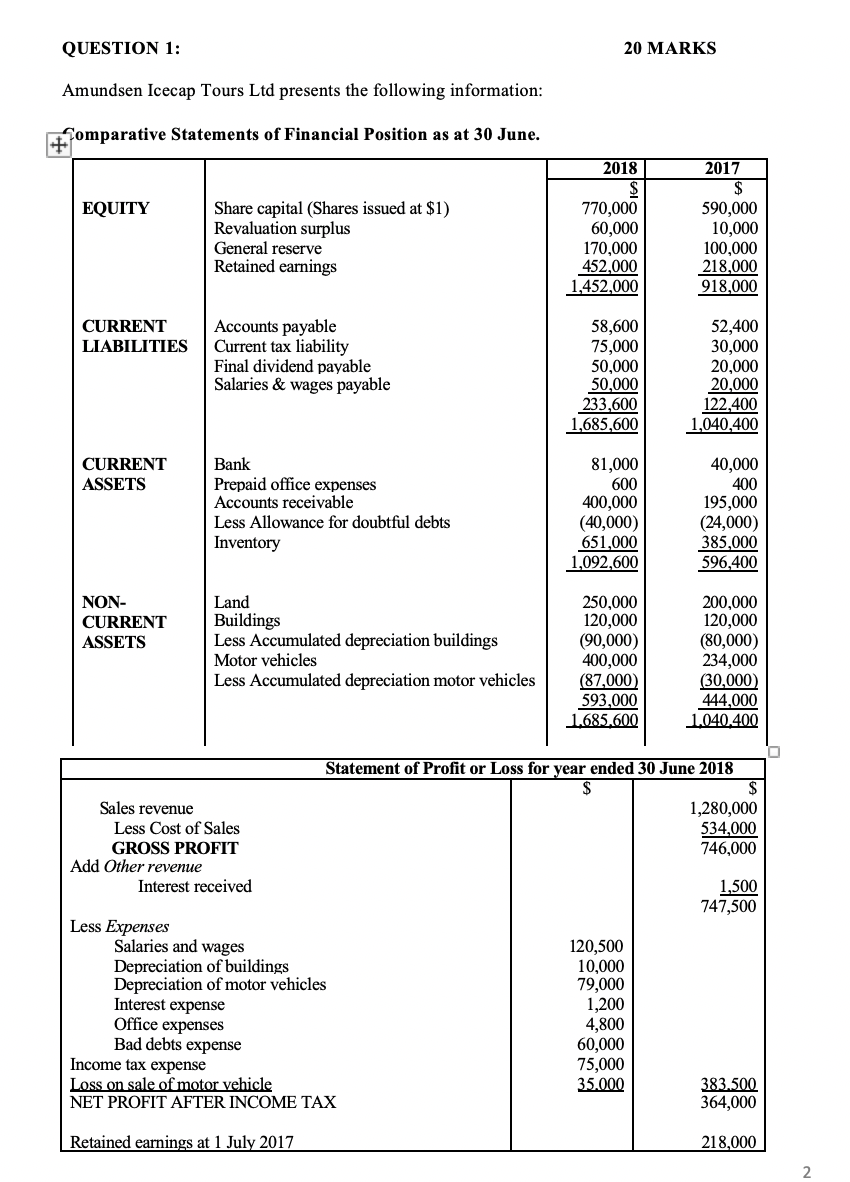

Please show working for calculation of cash proceeds from sale of motor vehicle QUESTION 1: 20 MARKS Amundsen Icecap Tours Ltd presents the following information:

Please show working for calculation of cash proceeds from sale of motor vehicle

QUESTION 1: 20 MARKS Amundsen Icecap Tours Ltd presents the following information: Comparative Statements of Financial Position as at 30 June. 2018 EQUITY Share capital (Shares issued at $1) Revaluation surplus General reserve Retained earnings 770,000 60,000 170,000 452,000 1,452,000 2017 $ 590,000 10,000 100,000 218,000 918,000 CURRENT LIABILITIES Accounts payable Current tax liability Final dividend payable Salaries & wages payable 58,600 75,000 50,000 50,000 233,600 1,685,600 52,400 30,000 20,000 20,000 122,400 1,040,400 81,000 CURRENT ASSETS 600 Bank Prepaid office expenses Accounts receivable Less Allowance for doubtful debts Inventory 400,000 (40,000) 651,000 1,092,600 40,000 400 195,000 (24,000) 385,000 596,400 NON- CURRENT ASSETS Land Buildings Less Accumulated depreciation buildings Motor vehicles Less Accumulated depreciation motor vehicles 250,000 120,000 (90,000) 400,000 (87,000) 593,000 1.685.600 200,000 120,000 (80,000) 234,000 (30,000) 444,000 1.040.400 Sales revenue Less Cost of Sales GROSS PROFIT Add Other revenue Interest received Statement of Profit or Loss for year ended 30 June 2018 $ 1,280,000 534,000 746,000 1,500 747,500 Less Expenses Salaries and wages Depreciation of buildings Depreciation of motor vehicles Interest expense Office expenses Bad debts expense Income tax expense Loss on sale of motor vehicle NET PROFIT AFTER INCOME TAX 120,500 10,000 79,000 1,200 4,800 60,000 75,000 35.000 383.500 364,000 Retained earnings at 1 July 2017 218,000 2 582,000 Less: Interim dividend paid 10,000 Dividend provided 50,000 Transfer to general reserve 70.000 130.000 Retained earnings at 30 June 2018 452,000 Additional information about items included in the above reports: On 29 June 2018, another motor vehicle was purchased, whilst the old vehicle, which had originally cost $130,000 and had been depreciated by $20,000, was sold for cash. The final dividend for the year ended 30 June 2017 was paid on 1 October 2017. Land was acquired at a cost of $200,000 in 2015 but was revalued by an independent valuer during the 2017-18 financial year. Interest received is treated by the company as an investing activity. . Prepare a Statement of Cash Flows for the year ended 30 June 2018 using the direct method. Cash Flow Statement (Extract) for the vear ended 30 June 2018 OPERATING ACTIVITIES Cash receipts from customers Cash payments to suppliers Cash payments for operating costs Cash payments for interest Cash payments for income tax Net cash flow from operating activities Emphasis INVESTING ACTIVITIES Net cash flow from investing activities FINANCING ACTIVITIES Net cash flow from financing activities TOTAL CHANGE IN CASH HELD CASH AT BEGINNING CASH AT END (Total for Question One: 20 marks) 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started