Answered step by step

Verified Expert Solution

Question

1 Approved Answer

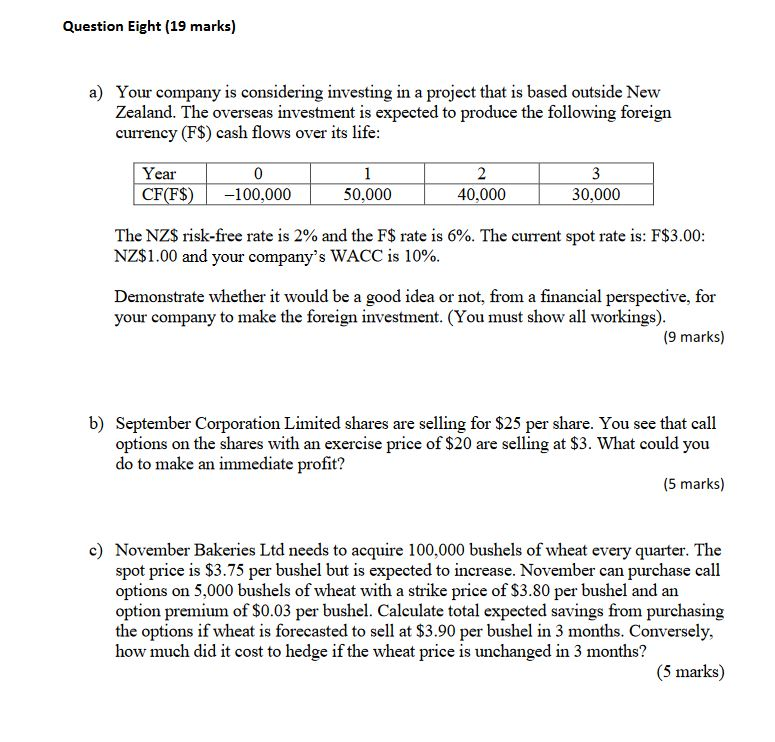

Please show working using formulas not on excel, thanks. Question Eight (19 marks) a) Your company is considering investing in a project that is based

Please show working using formulas not on excel, thanks.

Question Eight (19 marks) a) Your company is considering investing in a project that is based outside New Zealand. The overseas investment is expected to produce the following foreign currency (F$) cash flows over its life: 2 Year 0 1 3 CF(F$) -100,000 50,000 40,000 30,000 The NZ$ risk-free rate is 2% and the F$ rate is 6%. The current spot rate is: F$3.00: NZ$1.00 and your company's WACC is 10%. Demonstrate whether it would be a good idea or not, from a financial perspective, for your company to make the foreign investment. (You must show all workings). (9 marks) b) September Corporation Limited shares are selling for $25 per share. You see that call options on the shares with an exercise price of $20 are selling at $3. What could you do to make an immediate profit? (5 marks) c) November Bakeries Ltd needs to acquire 100,000 bushels of wheat every quarter. The spot price is $3.75 per bushel but is expected to increase. November can purchase call options on 5,000 bushels of wheat with a strike price of $3.80 per bushel and an option premium of $0.03 per bushel. Calculate total expected savings from purchasing the options if wheat is forecasted to sell at $3.90 per bushel in 3 months. Conversely, how much did it cost to hedge if the wheat price is unchanged in 3 monthsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started