Answered step by step

Verified Expert Solution

Question

1 Approved Answer

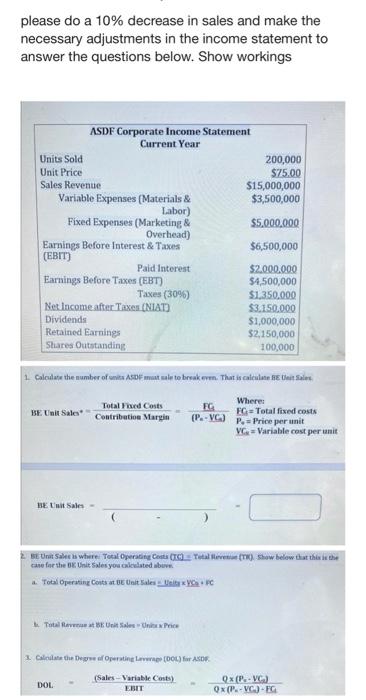

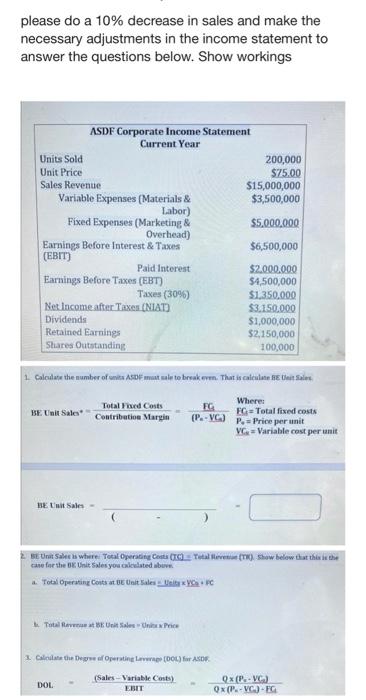

please show workings of the change in the income statement like EBIT, EBT, NIAT, RETAINED EARNINGS and how the new ones are gotten please do

please show workings of the change in the income statement like EBIT, EBT, NIAT, RETAINED EARNINGS and how the new ones are gotten

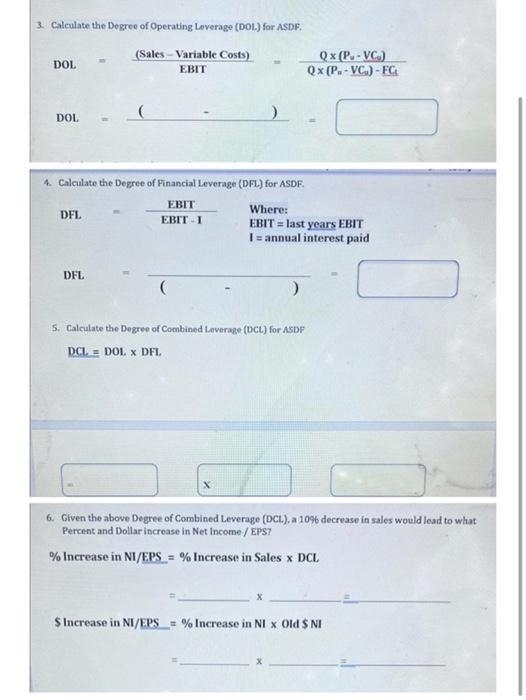

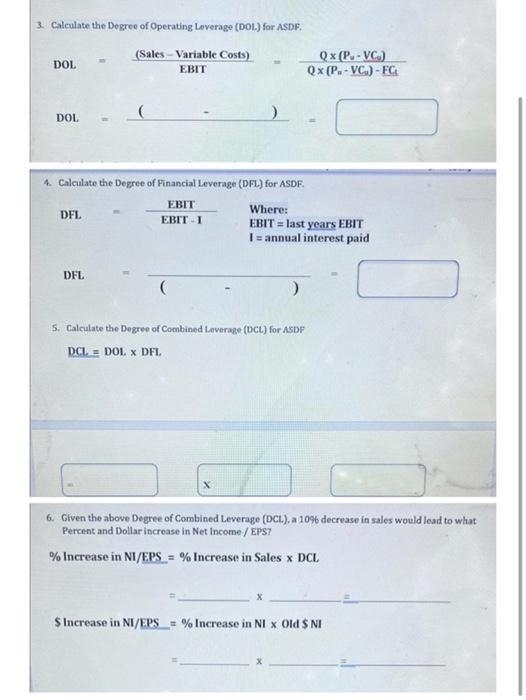

please do a 10% decrease in sales and make the necessary adjustments in the income statement to answer the questions below. Show workings 1. Calculaye the number of enits A AD F mat sale to break eren. That is caiculne HE Dein Salme. cane far the 0E. Wnit sxles yoa coklchlated abors. a. Total Operating Conts at Ue Unit Sales \pm Heita x WCa + FC 4. Tutal fowera at bb Urit sales = Drira w Price 1. Cdidlas the Degee of Oreratine Lrwmee (0ot) far Asoe DOL.=BBTT(Sales-VariableCosts)=9(P2VC2)FC4Q(PwVC2) 3. Calculate the Degree of Operating Leverage (DOL.) for ASDF. DOL=EBIT(Sales-VariableCosts)=Q(PaVCa)FC4Q(PaVCj)DoL.=(1)= 4. Calculate the Degree of Financial Leverage (DFL) for ASDF. DFL=EBTTEBTT-IWhere:EBTT=lastyearsEBITI=annualinterestpaid DFL=(2)= 5. Calculate the Degree of Combined Leverage (DCL) for ASDF DCL=DOLDFL 6. Given the above Degree of Combined Leverage (DCL), a 10% decrease in sales would lead to what Percent and Dollar increase in Net income / EPS? % Increase in NI/EPS =% Increase in Sales DCL =xSIncreaseinNI/EPS=%IncreaseinNIOld$NIx

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started