Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show workings on calculations thanks there was some inconsistency from thr previous tutor The managers of Gizmo Manufacturing Limited have gathered the following information

please show workings on calculations thanks

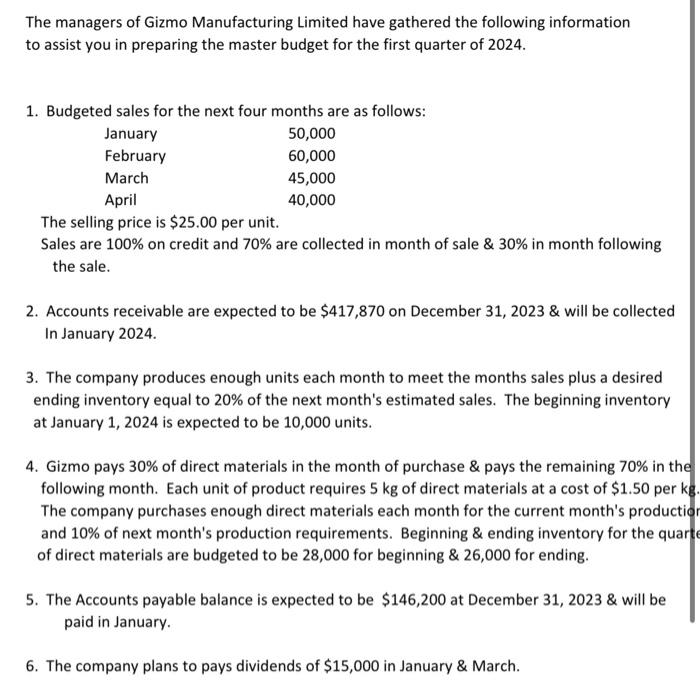

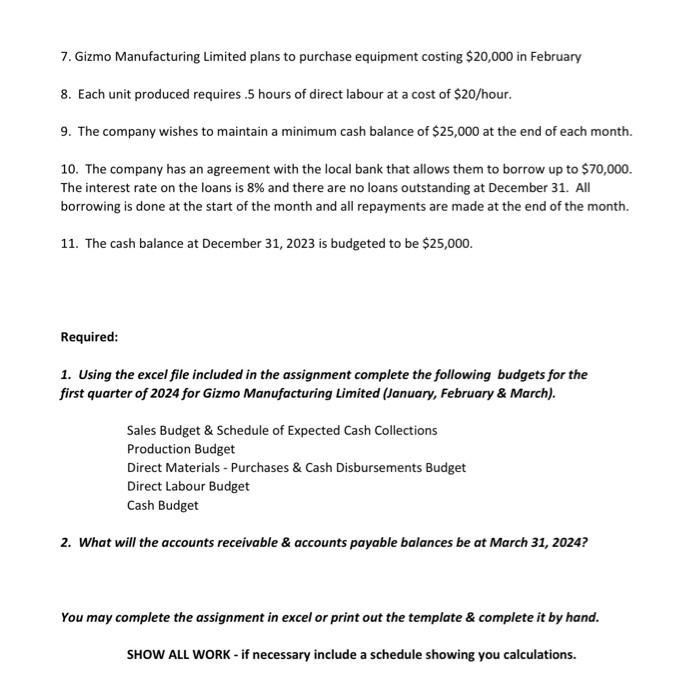

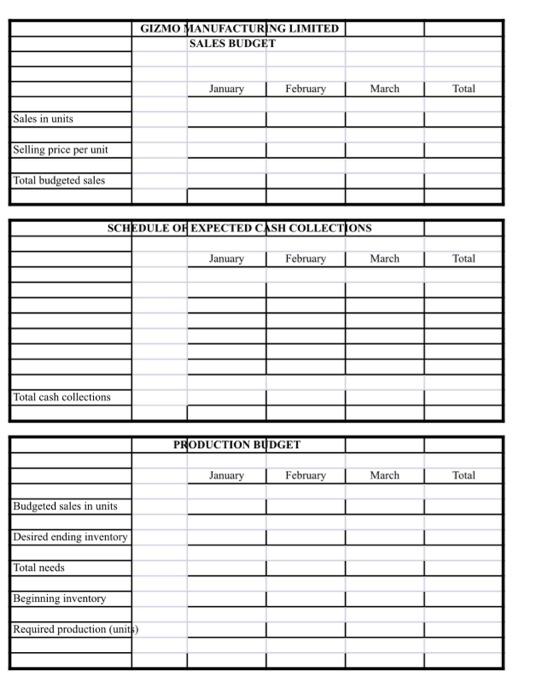

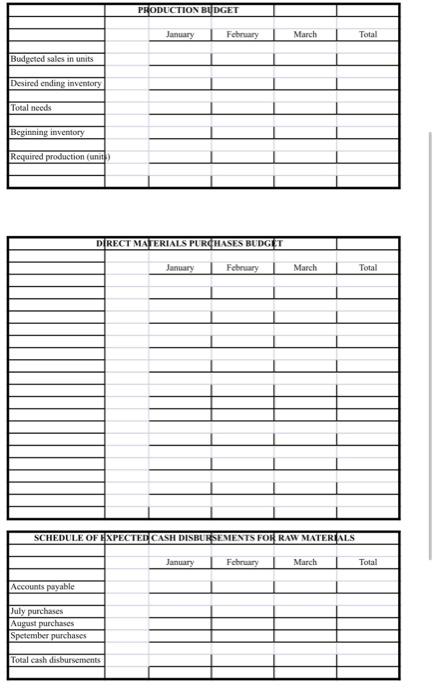

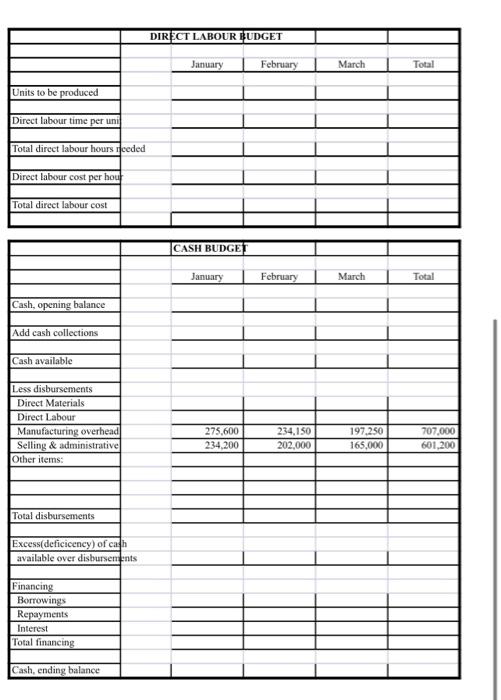

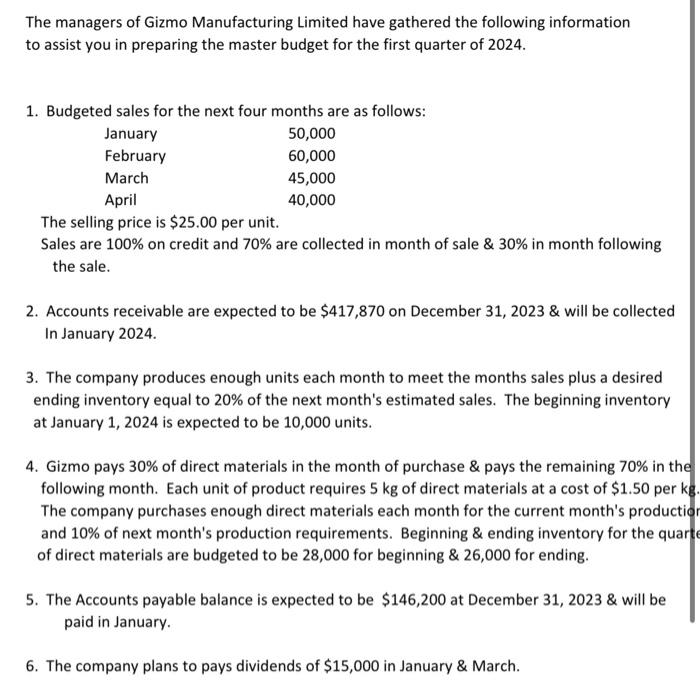

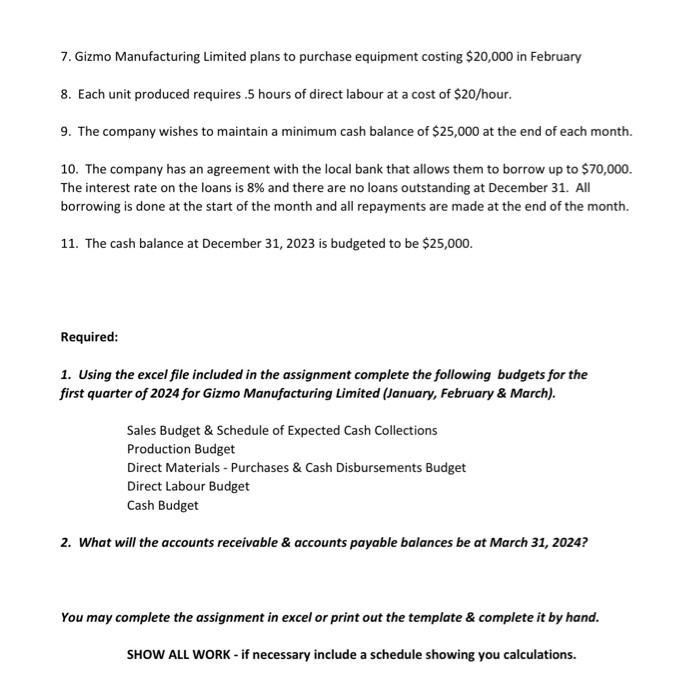

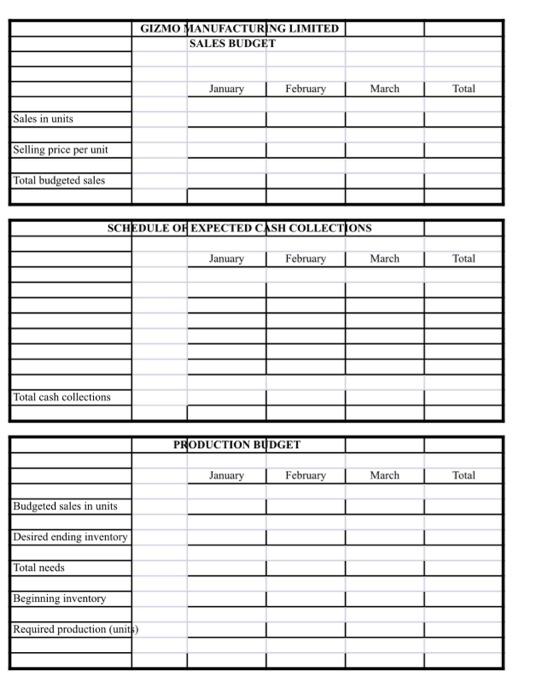

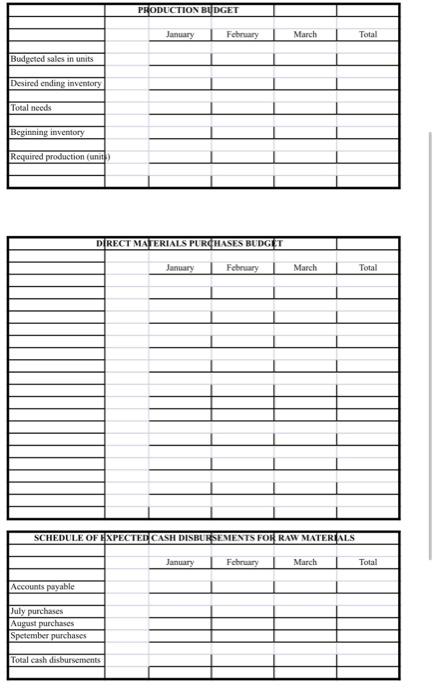

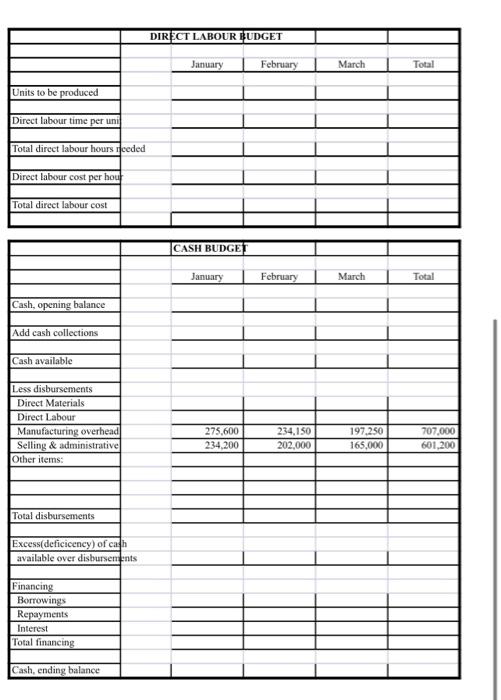

The managers of Gizmo Manufacturing Limited have gathered the following information to assist you in preparing the master budget for the first quarter of 2024. 1. Budgeted sales for the next four months are as follows: The selling price is $25.00 per unit. Sales are 100% on credit and 70% are collected in month of sale \& 30% in month following the sale. 2. Accounts receivable are expected to be $417,870 on December 31,2023 \& will be collected In January 2024. 3. The company produces enough units each month to meet the months sales plus a desired ending inventory equal to 20% of the next month's estimated sales. The beginning inventory at January 1, 2024 is expected to be 10,000 units. 4. Gizmo pays 30% of direct materials in the month of purchase \& pays the remaining 70% in the following month. Each unit of product requires 5kg of direct materials at a cost of $1.50 per k The company purchases enough direct materials each month for the current month's producti and 10% of next month's production requirements. Beginning \& ending inventory for the quar of direct materials are budgeted to be 28,000 for beginning \& 26,000 for ending. 5. The Accounts payable balance is expected to be $146,200 at December 31,2023 \& will be paid in January. 6. The company plans to pays dividends of $15,000 in January \& March. 7. Gizmo Manufacturing Limited plans to purchase equipment costing $20,000 in February 8. Each unit produced requires .5 hours of direct labour at a cost of $20/ hour. 9. The company wishes to maintain a minimum cash balance of $25,000 at the end of each month. 10. The company has an agreement with the local bank that allows them to borrow up to $70,000. The interest rate on the loans is 8% and there are no loans outstanding at December 31 . All borrowing is done at the start of the month and all repayments are made at the end of the month. 11. The cash balance at December 31,2023 is budgeted to be $25,000. Required: 1. Using the excel file included in the assignment complete the following budgets for the first quarter of 2024 for Gizmo Manufacturing Limited (January, February \& March). Sales Budget \& Schedule of Expected Cash Collections Production Budget Direct Materials - Purchases \& Cash Disbursements Budget Direct Labour Budget Cash Budget 2. What will the accounts receivable \& accounts payable balances be at March 31, 2024? \begin{tabular}{|c|c|c|c|c|} \hline & \multicolumn{2}{|c|}{ GIZMO KIANUFACTUR|NG LIMITED } & & \\ \hline & \multicolumn{2}{|c|}{ SALES BUDGET } & & \\ \hline & January & February & March & Total \\ \hline \multirow{2}{*}{\multicolumn{5}{|c|}{ Sales in units }} \\ \hline & & & & \\ \hline \multirow{2}{*}{\multicolumn{5}{|c|}{ Selling price per unit }} \\ \hline & & & & \\ \hline \multicolumn{5}{|l|}{ Total budgeted sales } \\ \hline & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline & \multicolumn{2}{|c|}{ PKODUCTION BLDGET } & \multirow[b]{2}{*}{ March } & \multirow[b]{2}{*}{ Total } \\ \hline & January & February & & \\ \hline \multirow{2}{*}{\multicolumn{5}{|c|}{ Budgeted sales in units }} \\ \hline & & & & \\ \hline & & & & \\ \hline \multicolumn{5}{|l|}{ Desired ending inventory } \\ \hline & & & & \\ \hline \multicolumn{5}{|l|}{ Total needs } \\ \hline & & & & \\ \hline \multicolumn{5}{|l|}{ Beginning inventory } \\ \hline & & & & \\ \hline \multicolumn{5}{|l|}{ Required production (unit) } \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline & \multicolumn{2}{|c|}{ PRODUCTON BULGET } & \multicolumn{2}{|c|}{1} \\ \hline & January & | Fotrumy & March & | Total \\ \hline Budgeted sales in units & & & & \\ \hline Desired ending inventory & & & & \\ \hline Total needs & & & & \\ \hline Beginning inventory & & & & \\ \hline Required production (unit & & & & \\ \hline & 1 & & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline & \multicolumn{3}{|c|}{ D/RECT MATERIALS PLRCHASES BLDGTT } & \multirow{2}{*}{1} \\ \hline & January & Fetnury & March & \\ \hline & & & & L \\ \hline & & & & L \\ \hline & & & & L \\ \hline & & & & | \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & L \\ \hline & & E & & \\ \hline & & & & L \\ \hline & 1 & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \\ \hline & January & Fotrumy & March & Total \\ \hline Accounts pyyable & & L & & \\ \hline July purchases & & & & \\ \hline August purchases & & & & \\ \hline Sptember purchases & & & & \\ \hline Total eash distur sements & & & & \\ \hline & & & & \\ \hline \end{tabular} there was some inconsistency from thr previous tutor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started