Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show your work and be clear on answers Scenario You have graduated from college and just started working for Nok Airlines, a medium sized

please show your work and be clear on answers

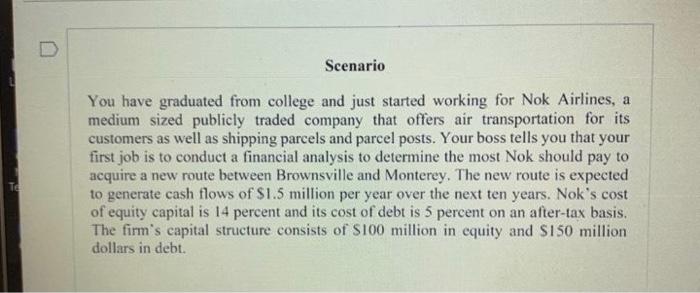

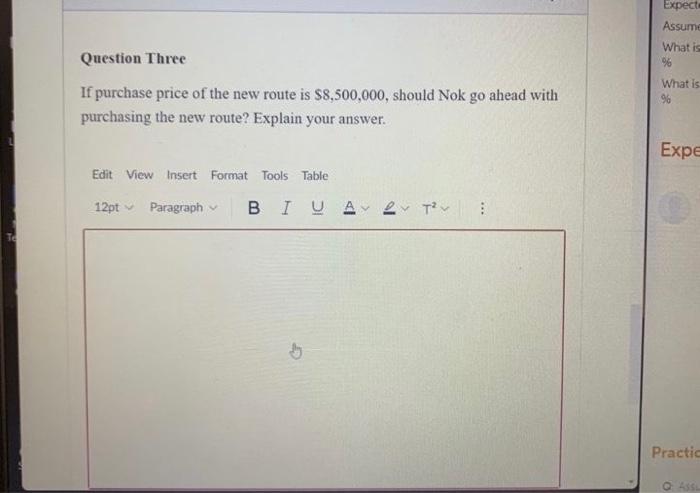

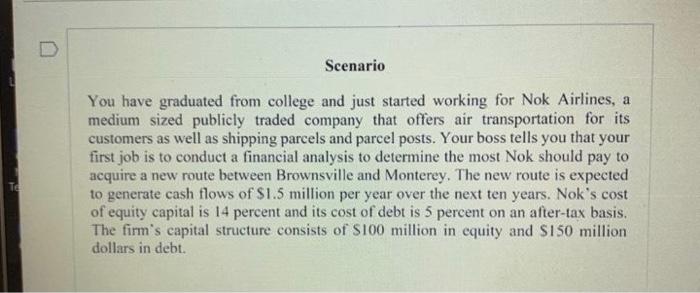

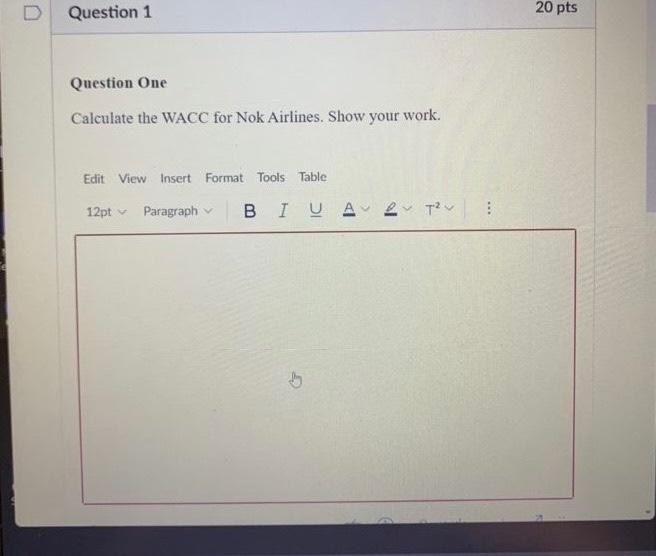

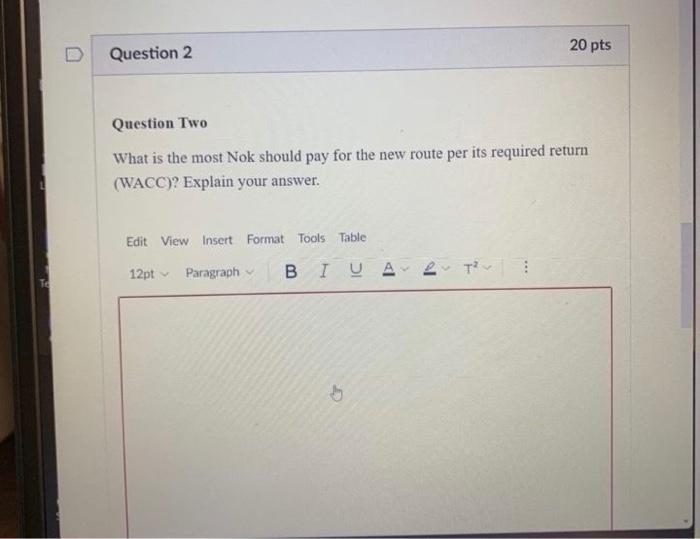

Scenario You have graduated from college and just started working for Nok Airlines, a medium sized publicly traded company that offers air transportation for its customers as well as shipping parcels and parcel posts. Your boss tells you that your first job is to conduct a financial analysis to determine the most Nok should pay to acquire a new route between Brownsville and Monterey. The new route is expected to generate cash flows of $1.5 million per year over the next ten years. Nok's cost of equity capital is 14 percent and its cost of debt is 5 percent on an after-tax basis. The firm's cap structure consists of $100 million in equity and $150 million dollars in debt. Question 1 Question One Calculate the WACC for Nok Airlines. Show your work. Edit View Insert Format Tools Table 12pt Paragraph 2 T BIUA H 4 20 pts To D 20 pts Question 2 Question Two What is the most Nok should pay for the new route per its required return (WACC)? Explain your answer. Edit View Insert Format Tools Table 12pt Paragraph T B I U A 6 www Question Three If purchase price of the new route is $8,500,000, should Nok go ahead with purchasing the new route? Explain your answer. Edit View Insert Format Tools Table 12pt Paragraph BIUA T E b Expecta Assume What is % What is % Expe Practic Q Assu

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started