Answered step by step

Verified Expert Solution

Question

1 Approved Answer

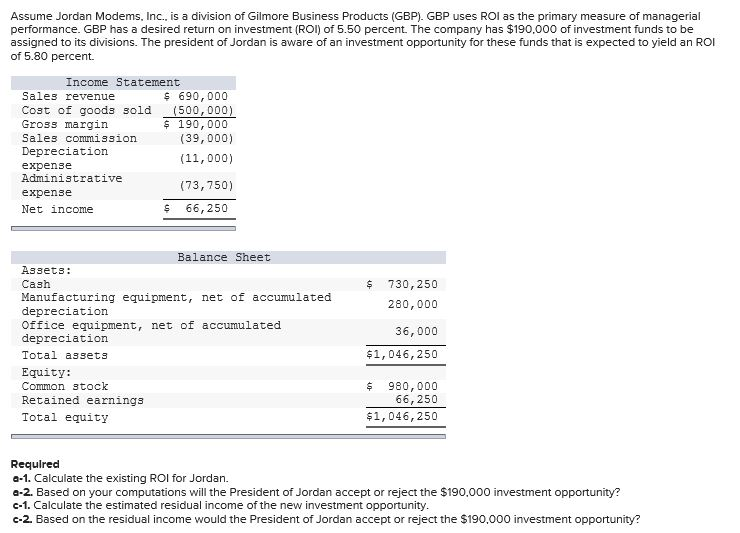

Please show your work. Assume Jordan Modems. Inc. is a division of Gilmore Business Products (GBP) GBP uses ROl as the primary measure of managerial

Please show your work.

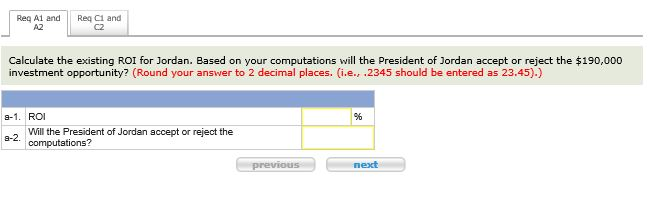

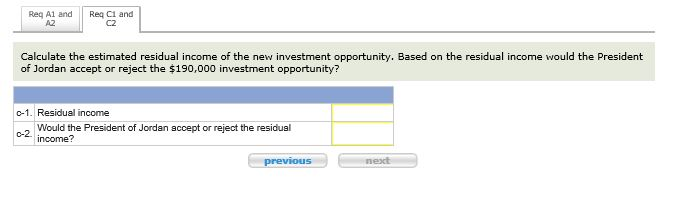

Assume Jordan Modems. Inc. is a division of Gilmore Business Products (GBP) GBP uses ROl as the primary measure of managerial performance. GBP has a desired return on investment (ROI) of 5.50 percent. The company has $190,000 of investment funds to be assigned to its divisions. The president of Jordan is aware of an investment opportunity for these funds that is expected to yield an ROI of 5.80 percent. Income Statement Sales revenue 690,000 Cost of goods sold 500,000 Gross margin 190,000 (39,000) Sales commissions Depreciation (11,000 expense Administrative (73,750) expense 66,250 Net income Balance Sheet Assets: Cas 730, 250 Manufacturing equipment net of accumulated 280,000 depreciation Office equipment, net of accumulated 36,000 depreciation Total assets $1,046,250 Equity: Common stock 980, 000 66,250 Retained earnings Total equity $1,046,250 Required a-1. Calculate the existing ROI for Jordan. a-2. Based on your computations will the President of Jordan accept or reject the $190.000 investment opportunity? c-1. Calculate the estimated residual income of the new investment opportunity. c-2. Based on the residual income would the President of Jordan accept or reject the $190,000 investment opportunityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started