Answered step by step

Verified Expert Solution

Question

1 Approved Answer

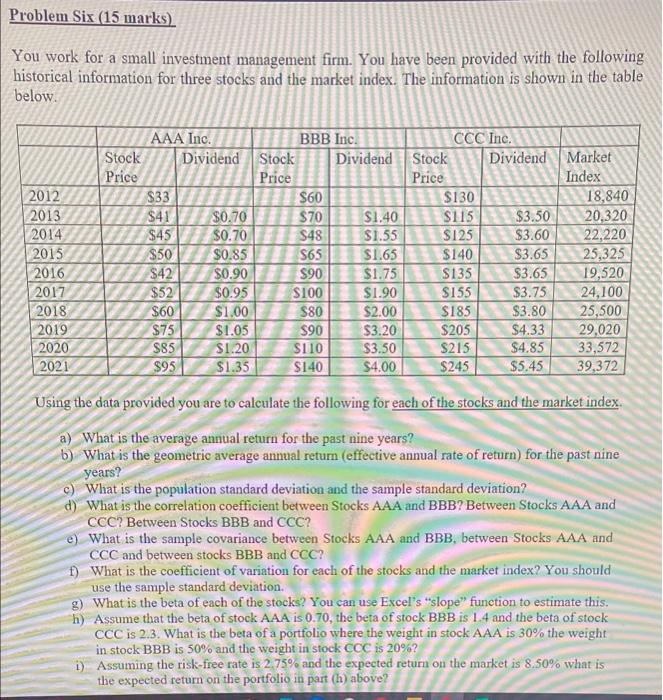

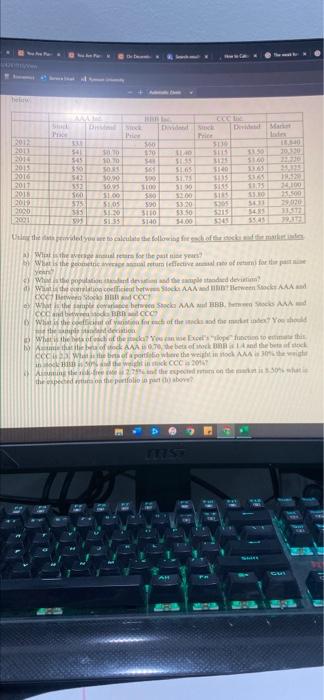

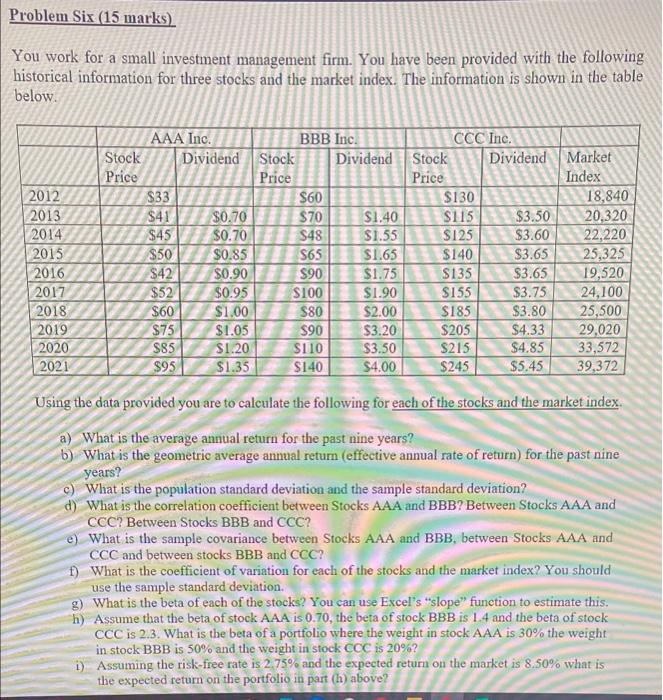

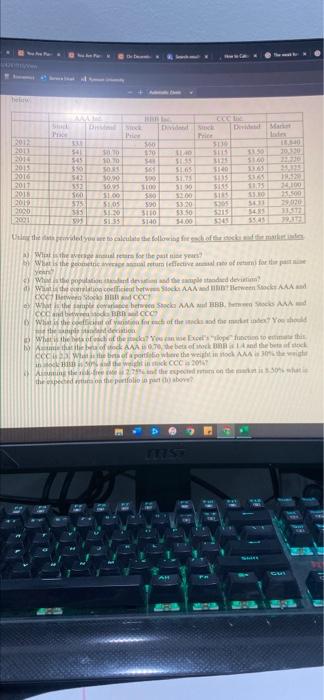

please show your work! Problem Six (15 marks) You work for a small investment management firm. You have been provided with the following historical information

please show your work!

Problem Six (15 marks) You work for a small investment management firm. You have been provided with the following historical information for three stocks and the market index. The information is shown in the table below. 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 AAA Inc. BBB Inc. Stock Dividend Stock Dividend Price Price S33 $60 $41 $0.70 $70 $1.40 $45 $0.70 S48 $1.55 $50 $0.85 S65 $1.65 $42 $0.90 $90 $1.75 $52 $0.95 S100 $1.90 $60 $1.00 S80 $2.00 $75 $1.05 $90 $3.20 $85 S1.20 S110 $3.50 $95 $1.35 $140 $4.00 CCC Inc. Stock Dividend Market Price Index $130 18,840 $115 $3.50 20,320 S125 $3.60 22,220 $140 $3.65 25,325 $135 $3.65 19,520 SI55 $3.75 24,100 $185 $3.80 25,500 $205 $4.33 29,020 S215 $4.85 33,572 $245 $5.45 39,372 Using the data provided you are to calculate the following for each of the stocks and the market index a) What is the average annual return for the past nine years? b) What is the geometric average annual return (effective annual rate of return) for the past nine years? C) What is the population standard deviation and the sample standard deviation? d) What is the correlation coefficient between Stocks AAA and BBB? Between Stocks AAA and CCC? Between Stocks BBB and CCC? e) What is the sample covariance between Stocks AAA and BBB, between Stocks AAA and CCC and between stocks BBB and CCC? f) What is the coefficient of variation for each of the stocks and the market index? You should use the sample standard deviation. g) What is the beta of each of the stocks? You can use Excel's "slope function to estimate this. h) Assume that the beta of stock AAA is 0.70, the beta of stock BBB is 1.4 and the beta of stock CCC is 2.3. What is the beta of a portfolio where the weight in stock AAA is 30% the weight in stock BBB is 50% and the weight in stock CCC is 20%? Assuming the risk-free rate is 2.75% and the expected return on the market is 8.50% what is the expected return on the portfolio in part (h) above? 201 2011 170 311 SI 100 5160 561 30 50 2015 2010 2017 2011 2012 2000 2001 510 $ SI SER STA SI ST 200 3320 SO 0.00 SO 31.00 5105 S 573 585 11.15 13 SU S 5521 14100 HO 200 3.00 590 3110 5140 51331 Utle to provide you were to call the following userskim Wat is the ser for the past Wat is the best effort yen What the pointed devi Walion coefficient between Socks AAA Cewek CCT ex With he Stacka AAA BAA code RCC Wh the of the dead there You the decision Wh Not othek Biophics to this til fod AAA 670, bet af en and the flock CCC Web of sport where the west A 10 Weight CCC 2017 And the spectate the othepuolio to be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started