Answered step by step

Verified Expert Solution

Question

1 Approved Answer

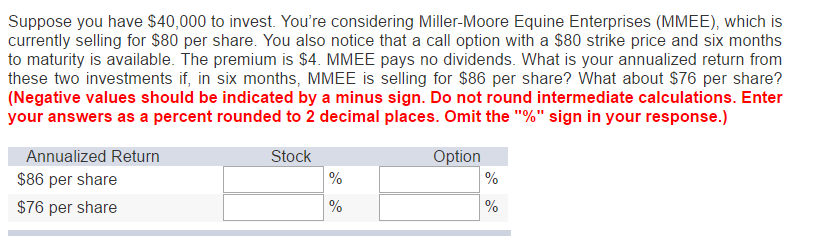

Please show your work. Suppose you have exist40,000 to invest. You're considering Miller-Moore Equine Enterprises (MMEE), which is currently selling for exist80 per share. You

Please show your work.

Suppose you have exist40,000 to invest. You're considering Miller-Moore Equine Enterprises (MMEE), which is currently selling for exist80 per share. You also notice that a call option with a S80 strike price and six months to maturity is available. The premium is exist4. MMEE pays no dividends. What is your annualized return from these two investments if, in six months: MMEE is selling for exist86 per share? What about exist76 per share? (Negative values should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Omit the "%" sign in your response.) Annualized Return Stock Option exist86 per share % % exist76 per share % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started