Please solve:

12-a calculating WACC

21a-b cost of capital

15-1 firm value

15-5 capital structure and non marketed claims

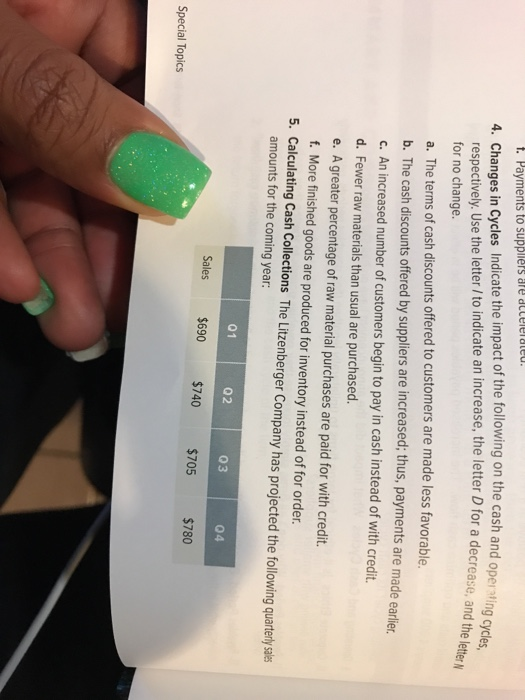

18-4 change in cycles

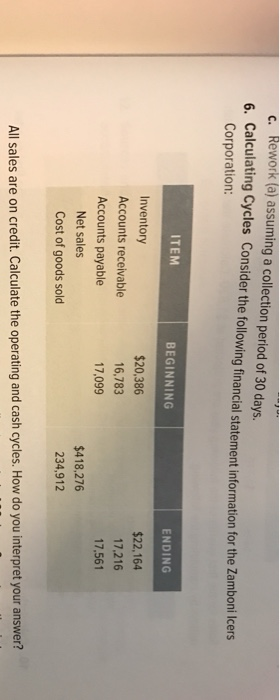

18-6 calculating cycles

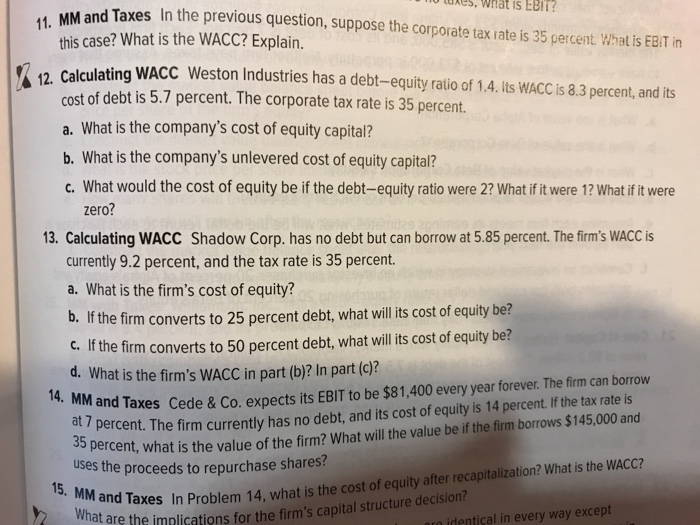

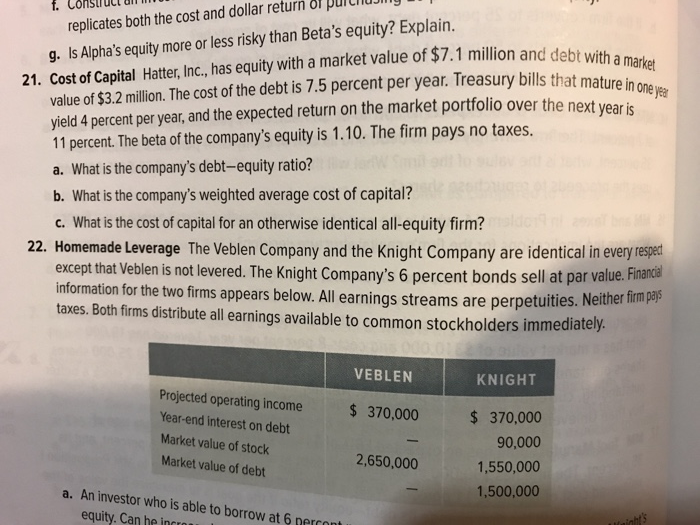

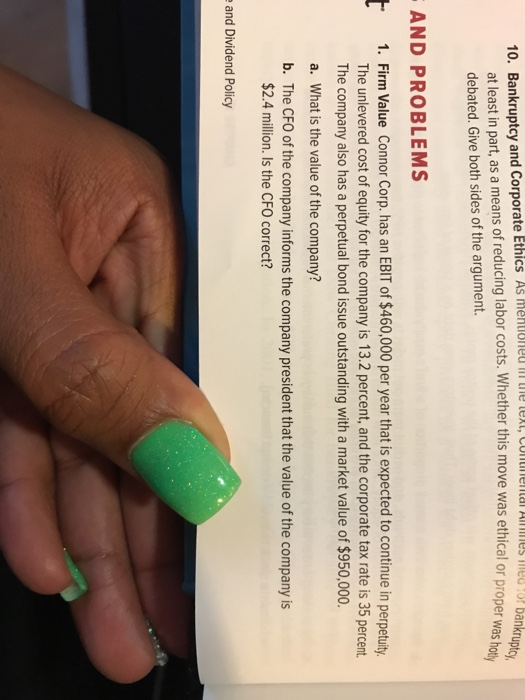

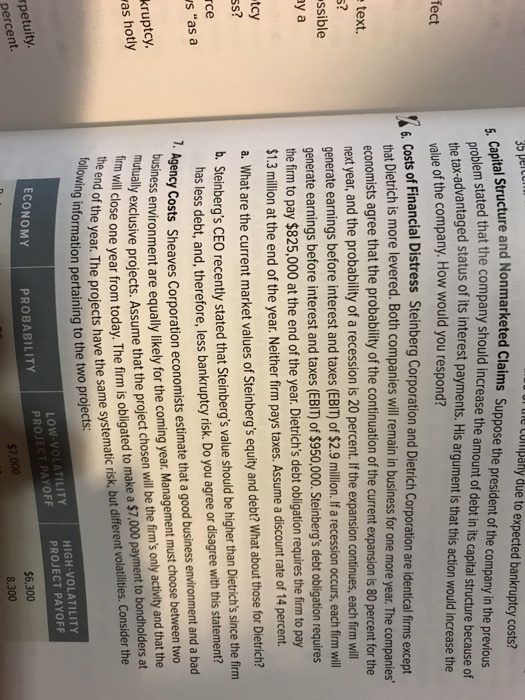

tuAes, What is EBIT? t MM and Taxes In the previous question, suppose the corporate tax rate is 35 percent What is EBIT in this case? What is the WACC? Explain. 17 1Calculating WACC Weston Industries has a debt-equity raio of 1.4. ts WACC is 8.3 percent, and its cost of debt is 5.7 percent. The corporate tax rate is 35 percert. a. What is the company's cost of equity capital? b. What is the company's unlevered cost of equity capital? c. What would the cost of equity be if the debt-equity ratio were 2? What if it were 1? What if it were zero? 13. Calculating WACC Shadow Corp. has no debt but can borrow at 5.85 percent. The firm's WACC is currently 9.2 percent, and the tax rate is 35 percent. a. What is the firm's cost of equity? b. If the firm converts to 25 percent debt, what will its cost of equity be? c. If the firm converts to 50 percent debt, what will ts cost of equity be? d. What is the firm's WACC in part (b)? In part(c)? MM and Taxes Cede & Co expects its EBIT to be $81,400 every year forever. The firm can borrow ac percent. The firm currently has no debt, and its cost of equity is 14 percent.If the tax rate is uses the proceeds to repurchase shares? MM t, what is the value of the firm? What will the value be if the firm borrows $145,000 and 15, Wha axes In Problem 14, what is the cost of equity after recapitalization? What is the WACC? implications for the firm's capital structure decision? identical in every way except all purtiuin replicates both the cost and dollar return g. Is Alpha's equity more or less risky than Beta's equity? Explain. f. Construcl of debt with a market 21. Cost of Capital Hate, Inc., has equity with a market value of $7.1 million an value of $3.2 million. The cost of the debt is 7.5 percent per year. Treasury bills that mat yield 4 percent per year, and the expected return on the market portfolio over the next 11 percent. The beta of the company's equity is 1.10. The firm pays no taxes. year is a. What is the company's debt-equity ratio? b. What is the company's weighted average cost of capital? c. What is the cost of capital for an otherwise identical all-equity firm? 22. Homemade Leverage The Veblen Company and the Knight Company are identical in every resper except that Veblen is not levered. The Knight Company's 6 percent bonds sell at par value. Financa information for the two firms appears below. All earnings streams are perpetuities. Neit taxes. Both firms distribute all earnings available to common stockholders immediately ther firmpas VEBLEN 370,000 KNIGHT Projected operating income Year-end interest on debt Market value of stock Market value of debt $ 370,000 90,000 1,550,000 1,500,000 2,650,000 a. An investor who is able to borrow at 6 ner equity. Can he incro 10. Bankruptcy and Corporate Ethics As melhllrieu lil tie t cing labor costs. Whether this move was ethical or proper was ho at least in part, as a means of redu debated. Give both sides of the argument. AND PROBLEMS 1. Firm Value Connor Corp. has an EBIT of $460,000 per year that is expected to continue in perpetuity The unlevered cost of equity for the company is 13.2 percent, and the corporate tax rate is 35 percent The company also has a perpetual bond issue outstanding with a market value of $950,000. a. What is the value of the company? b. The CFO of the company informs the company president that the value of the company is $2.4 million. Is the CFO correct? and Dividend Policy 35 perc Structure and Nonmarketed Claims Suppose the president of the company in the previous ul ue tollpany due to expected bankruptcy costs? tal the tax-a value of the company. How would you respond? ted that the company should increase the amount of debtin its capital structure because of taged status of its interest payments. His argument is that this action would increase the fect 7 s. Costs of Financial Distress Steinberg Corporation and Dietrich Corporation areidentical fims except that Dietrich is more levered. Both companies will emain in business for one more year The companies economists agree that the probability of the continuation of the current expansion is 80 percent for the next year, and the probability of a recession is 20 percent. If the expansion continues, each firm will generate earnings before interest and taxes (EBIT) of $2.9 million. If a recession occurs, each firm wil generate earnings before interest and taxes (EBIT) of $950,000. Steinberg's debt obligation requires the firm to pay $825,000 at the end of the year.Dietrich's debt obligation requires the firm to pay $1.3 million at the end of the year. Neither firm pays taxes. Assume a discount rate of 14 percent. a. What are the current market values of Steinberg's equity and debt? What about those for Dietrich? text. ssible b. Steinberg's CEO recently stated that Steinberg's value should be higher than Dietrich's since the firm ce s "as a has less debt, and, therefore, less bankruptcy risk. Do you agree or disagree with this statement? cy Costs Sheaves Corporation economists estimate that a good business environment and a bad mness rent are equally likely for the coming year. Management must choose between two exclusive projects. Assume that the project chosen will be the fim's only activity and thathe close one year from today. The firm is obligated to make a $7.000 payment to bondholders at e year. The projects have the same systematic risk, but different volatilities. Consider th kruptcy s hotly ally exclusive pr ng information pertaining to the two projects: HIGH-VOLATILITY PROJECT PAYOFF $6,300 8,300 uity ECONOMY PROBABILITY t. Payments to supplers are dcelerted. 4. Changes in Cycles Indicate the impact of the following on the cash and oper ating Gyclh s, the letter N respectively. Use the letter / to indicate an increase, the letter D for a decrease, and for no change. a. The terms of cash discounts offered to customers are made less favorable. b. The cash discounts offered by c. An increased number of customers begin to pay in cash instead of with credit d. Fewer raw materials than usual are purchased. e. A greater percentage of raw material purchases are paid for with credit. f. More finished goods are produced for inventory instead of for order. suppliers are increased; thus, payments are made earlier. 5. Calculating Cash Collections The Litzenberger Company has projected the following quarterly sales amounts for the coming year: 01 02 03 04 Sales $690 $740 $705 $780 Special Topics Rework (a) assuming a collection period of 30 days. c. Calculating Cycles Consider the following financial statement information for the Zamboni Icers Corporation: 6. ITEM BEGINNING ENDING Inventory Accounts receivable Accounts payable $20,386 6,783 17,099 $22.164 17.216 17,561 418,276 234,912 Net sales Cost of goods sold All sales are on credit. Calculate the operating and cash cycles. How do you interpret your