please solve all.

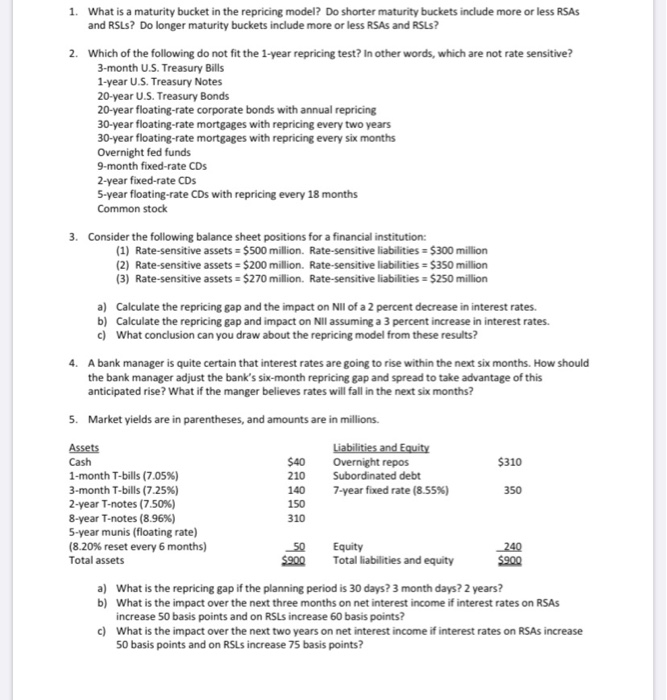

1. What is a maturity bucket in the repricing model? Do shorter maturity buckets include more or less RSAS and RSLS? Do longer maturity buckets include more or less RSAs and RSLS? 2. Which of the following do not fit the 1-year repricing test? In other words, which are not rate sensitive? 3-month U.S. Treasury Bills 1-year U.S. Treasury Notes 20-year U.S. Treasury Bonds 20-year floating-rate corporate bonds with annual repricing 30-year floating-rate mortgages with repricing every two years 30-year floating-rate mortgages with repricing every six months Overnight fed funds 9-month fixed-rate CDs 2-year fixed-rate CDs 5-year floating-rate CDs with repricing every 18 months Common stock 3. Consider the following balance sheet positions for a financial institution: (1) Rate-sensitive assets = $500 million. Rate-sensitive liabilities = $300 million (2) Rate-sensitive assets = $200 million. Rate-sensitive liabilities = $350 million (3) Rate-sensitive assets = $270 million. Rate-sensitive liabilities = $250 million a) Calculate the repricing gap and the impact on NII of a 2 percent decrease in interest rates. b) Calculate the repricing gap and impact on Nll assuming a 3 percent increase in interest rates. c) What conclusion can you draw about the repricing model from these results? 4. A bank manager is quite certain that interest rates are going to rise within the next six months. How should the bank manager adjust the bank's six-month repricing gap and spread to take advantage of this anticipated rise? What if the manger believes rates will fall in the next six months? 5. Market yields are in parentheses, and amounts are in millions Liabilities and Equity Overnight repos Subordinated debt 7-year fixed rate (8.55%) $40 210 140 150 310 Assets Cash 1-month T-bills (7.05%) 3-month T-bills (7.25%) 2-year T-notes (7.50%) 8-year T-notes (8.96%) 5-year munis (floating rate) (8.20% reset every 6 months) Total assets $310 350 50 $90,0 Equity Total liabilities and equity 240 a) What is the repricing gap if the planning period is 30 days? 3 month days? 2 years? b) What is the impact over the next three months on net interest income if interest rates on RSAS increase 50 basis points and on RSLs increase 60 basis points? c) What is the impact over the next two years on net interest income if interest rates on RSAs increase 50 basis points and on RSLs increase 75 basis points