Answered step by step

Verified Expert Solution

Question

1 Approved Answer

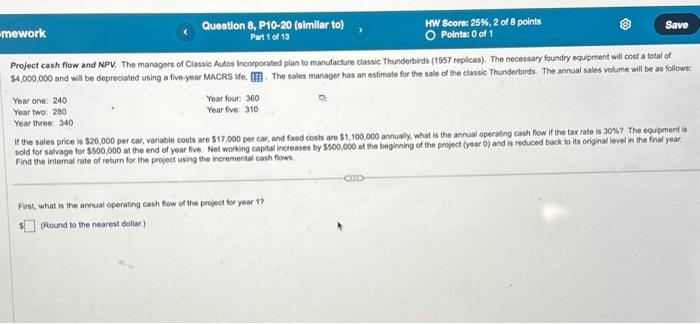

please solve all 13 parts it would help so much $4,000,000 and wil be deprecialed using a five-year MACRS Ute. The sales manapert Year one:

please solve all 13 parts it would help so much

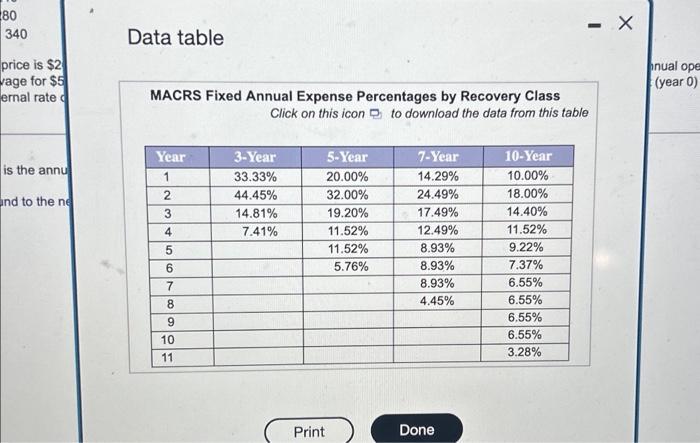

$4,000,000 and wil be deprecialed using a five-year MACRS Ute. The sales manapert Year one: 240 Year four: 360 Year two: 280 Year five: 310 Year throe: 340 If the sales price is $26,000 per car, variable costs are $17,000 per car, and frod costs are $1,100,000 annualy, ahat is the annual opersting cauh fow if the tax rate is 30% ? The equpment is sold for salvage for $500,000 at the end of year five. Net working caplal increases by $500,000 at the begining of the project (year 0 ) and is reduced back to its original level in the fral year. Find the intemal rate of return for the project using the ineremental cash foms. First, what is the arnual operating cash fow of the peopet for year 17 1 (Round to the nearest dollar) Data table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started