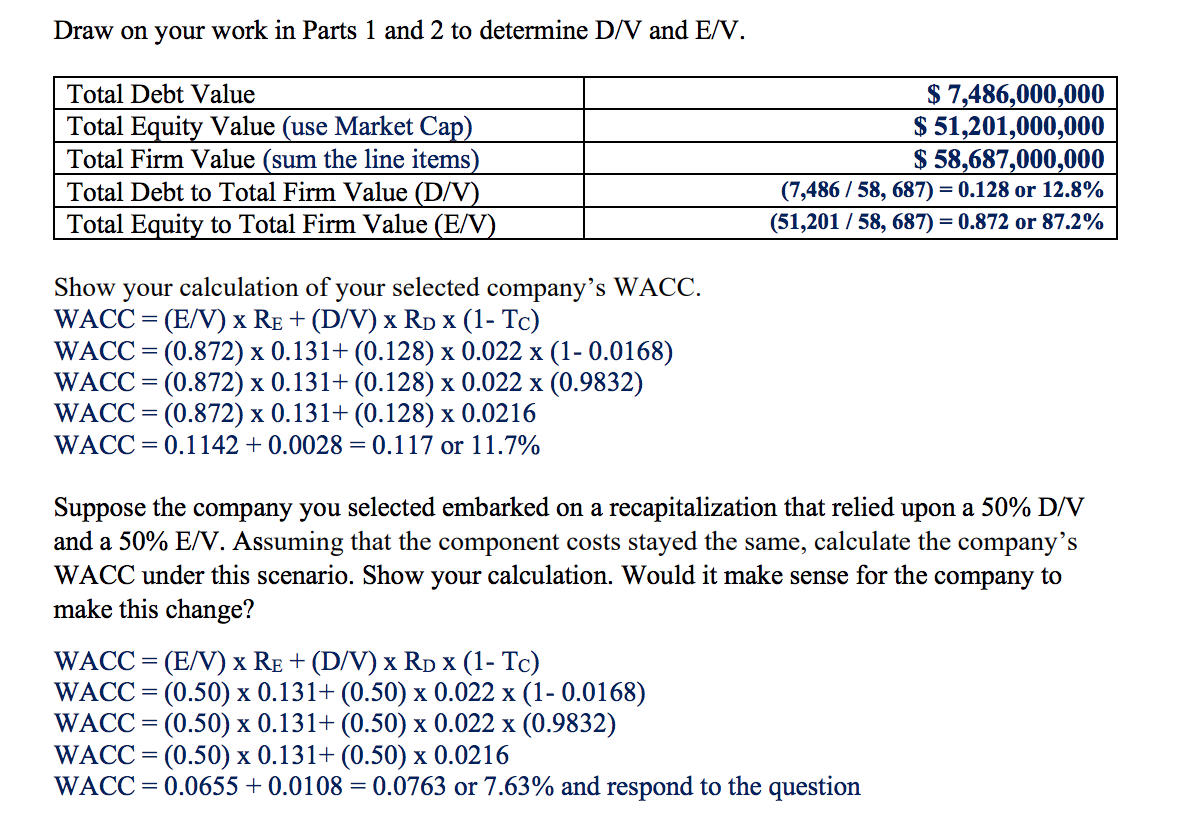

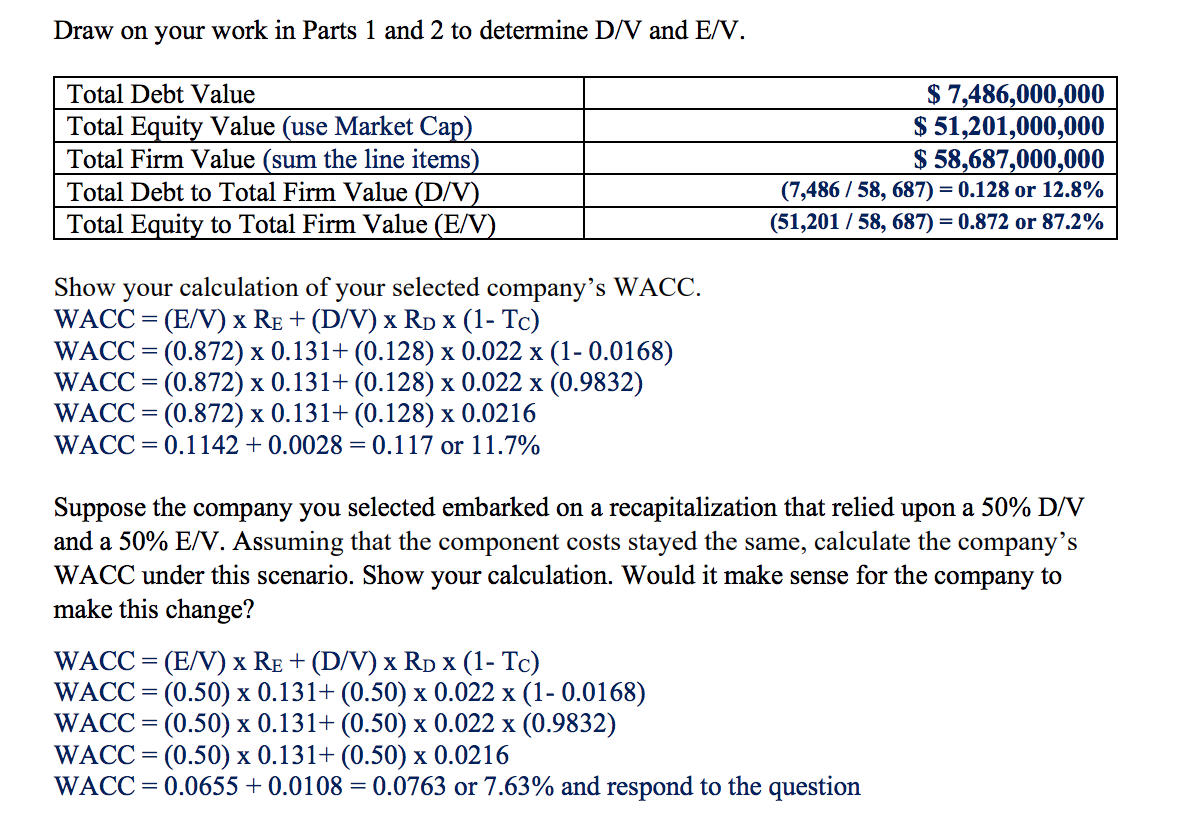

Draw on your work in Parts 1 and 2 to determine D/V and E/V. Total Debt Value Total Equity Value (use Market Cap) Total Firm Value (sum the line items) Total Debt to Total Firm Value (D/V) Total Equity to Total Firm Value (E/V) $ 7,486,000,000 $ 51,201,000,000 $ 58,687,000,000 (7,486 / 58, 687) = 0.128 or 12.8% (51,201 / 58, 687) = 0.872 or 87.2% Show your calculation of your selected company's WACC. WACC = (E/V) x Re + (D/V) x RD X (1- Tc) WACC = (0.872) x 0.131+ (0.128) x 0.022 x (1-0.0168) WACC = (0.872) x 0.131+ (0.128) x 0.022 x (0.9832) WACC = (0.872) x 0.131+ (0.128) x 0.0216 WACC = 0.1142 + 0.0028 = 0.117 or 11.7% Suppose the company you selected embarked on a recapitalization that relied upon a 50% D/V and a 50% E/V. Assuming that the component costs stayed the same, calculate the company's WACC under this scenario. Show your calculation. Would it make sense for the company to make this change? WACC = (E/V) x Re+ (D/V) x RD X (1- Tc) WACC = (0.50) x 0.131+ (0.50) x 0.022 x (1-0.0168) WACC = (0.50) x 0.131+ (0.50) x 0.022 x (0.9832) WACC = (0.50) x 0.131+ (0.50) x 0.0216 WACC = 0.0655 +0.0108 = 0.0763 or 7.63% and respond to the question Draw on your work in Parts 1 and 2 to determine D/V and E/V. Total Debt Value Total Equity Value (use Market Cap) Total Firm Value (sum the line items) Total Debt to Total Firm Value (D/V) Total Equity to Total Firm Value (E/V) $ 7,486,000,000 $ 51,201,000,000 $ 58,687,000,000 (7,486 / 58, 687) = 0.128 or 12.8% (51,201 / 58, 687) = 0.872 or 87.2% Show your calculation of your selected company's WACC. WACC = (E/V) x Re + (D/V) x RD X (1- Tc) WACC = (0.872) x 0.131+ (0.128) x 0.022 x (1-0.0168) WACC = (0.872) x 0.131+ (0.128) x 0.022 x (0.9832) WACC = (0.872) x 0.131+ (0.128) x 0.0216 WACC = 0.1142 + 0.0028 = 0.117 or 11.7% Suppose the company you selected embarked on a recapitalization that relied upon a 50% D/V and a 50% E/V. Assuming that the component costs stayed the same, calculate the company's WACC under this scenario. Show your calculation. Would it make sense for the company to make this change? WACC = (E/V) x Re+ (D/V) x RD X (1- Tc) WACC = (0.50) x 0.131+ (0.50) x 0.022 x (1-0.0168) WACC = (0.50) x 0.131+ (0.50) x 0.022 x (0.9832) WACC = (0.50) x 0.131+ (0.50) x 0.0216 WACC = 0.0655 +0.0108 = 0.0763 or 7.63% and respond to the