Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve all 4! What will happen to any items in the assets and liabilities and capital and surplus if the investment on Bonds declines

please solve all 4!

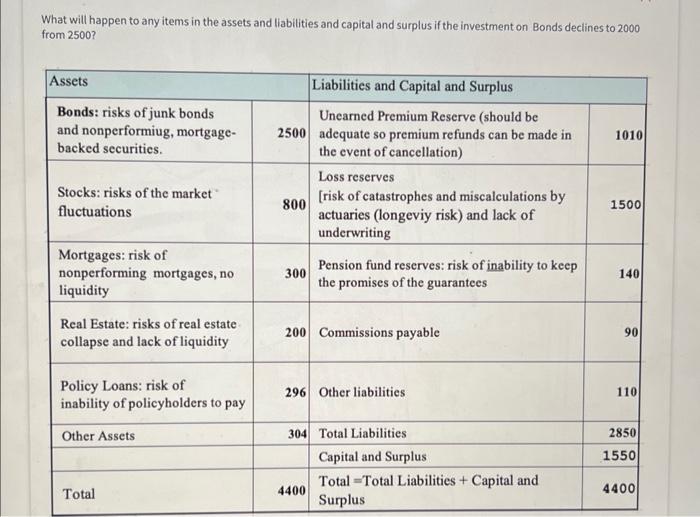

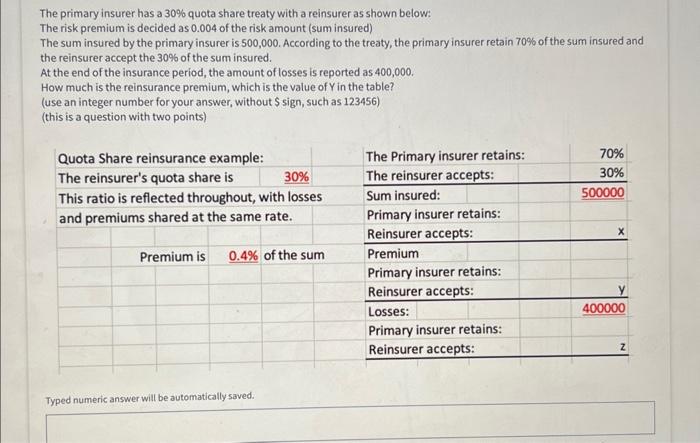

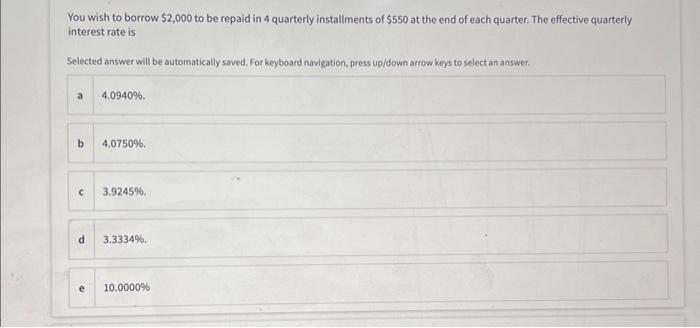

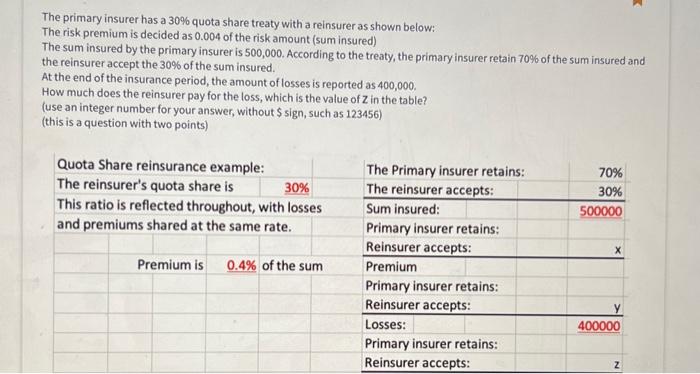

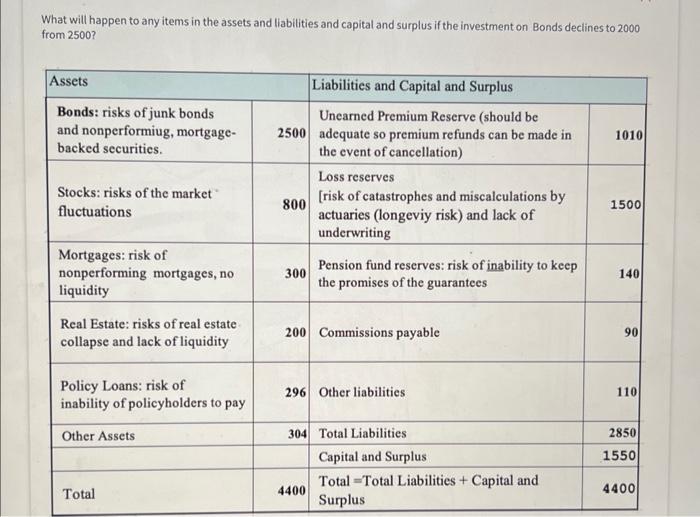

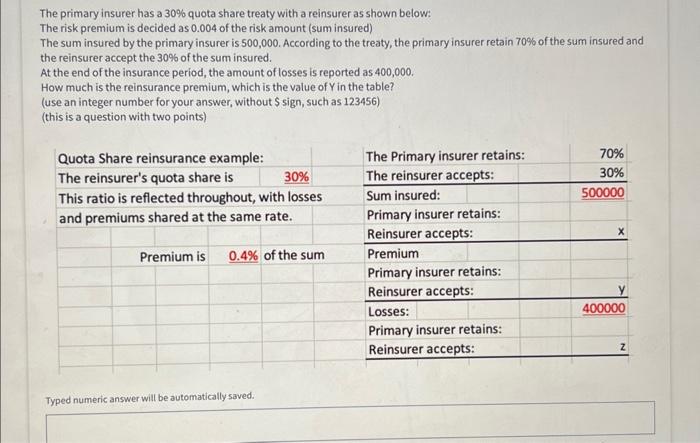

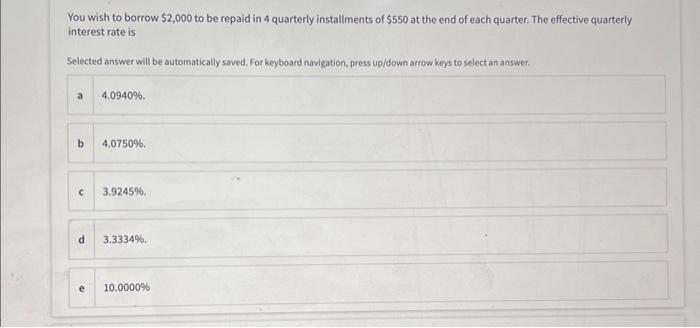

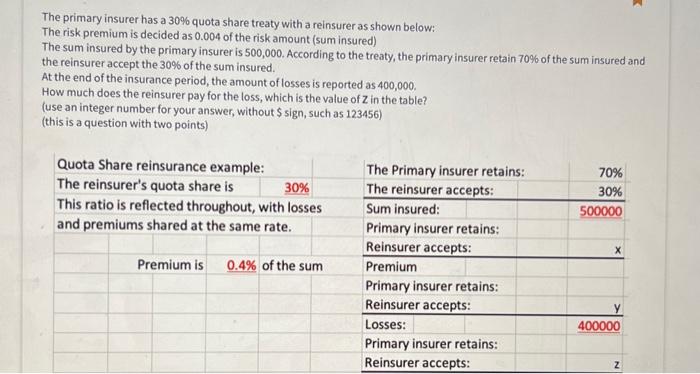

What will happen to any items in the assets and liabilities and capital and surplus if the investment on Bonds declines to 2000 from 2500? The primary insurer has a 30% quota share treaty with a reinsurer as shown below: The risk premium is decided as 0.004 of the risk amount (sum insured) The sum insured by the primary insurer is 500,000 . According to the treaty, the primary insurer retain 70% of the sum insured and the reinsurer accept the 30% of the sum insured. At the end of the insurance period, the amount of losses is reported as 400,000 . How much is the reinsurance premium, which is the value of Y in the table? (use an integer number for your answer, without \$ sign, such as 123456) (this is a question with two points) Typed numeric answer will be automatically saved. You wish to borrow $2,000 to be repaid in 4 quarterly installments of $550 at the end of each quarter. The effective quarterly interest rate is Selected answer will be automatically saved. For keyboard navigation, press up/down arrow keys to select an answer. a 4.0940% b 4,0750%6. c 3.9245% d 3.3334%. e 10.0000% The primary insurer has a 30% quota share treaty with a reinsurer as shown below: The risk premium is decided as 0.004 of the risk amount (sum insured) The sum insured by the primary insurer is 500,000 . According to the treaty, the primary insurer retain 70% of the sum insured and the reinsurer accept the 30% of the sum insured. At the end of the insurance period, the amount of losses is reported as 400,000 . How much does the reinsurer pay for the loss, which is the value of Z in the table? (use an integer number for your answer, without \$ sign, such as 123456) (this is a question with two points) What will happen to any items in the assets and liabilities and capital and surplus if the investment on Bonds declines to 2000 from 2500? The primary insurer has a 30% quota share treaty with a reinsurer as shown below: The risk premium is decided as 0.004 of the risk amount (sum insured) The sum insured by the primary insurer is 500,000 . According to the treaty, the primary insurer retain 70% of the sum insured and the reinsurer accept the 30% of the sum insured. At the end of the insurance period, the amount of losses is reported as 400,000 . How much is the reinsurance premium, which is the value of Y in the table? (use an integer number for your answer, without \$ sign, such as 123456) (this is a question with two points) Typed numeric answer will be automatically saved. You wish to borrow $2,000 to be repaid in 4 quarterly installments of $550 at the end of each quarter. The effective quarterly interest rate is Selected answer will be automatically saved. For keyboard navigation, press up/down arrow keys to select an answer. a 4.0940% b 4,0750%6. c 3.9245% d 3.3334%. e 10.0000% The primary insurer has a 30% quota share treaty with a reinsurer as shown below: The risk premium is decided as 0.004 of the risk amount (sum insured) The sum insured by the primary insurer is 500,000 . According to the treaty, the primary insurer retain 70% of the sum insured and the reinsurer accept the 30% of the sum insured. At the end of the insurance period, the amount of losses is reported as 400,000 . How much does the reinsurer pay for the loss, which is the value of Z in the table? (use an integer number for your answer, without \$ sign, such as 123456) (this is a question with two points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started