Please solve all

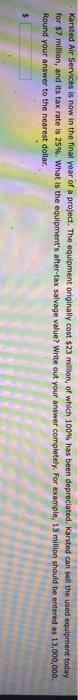

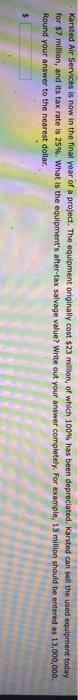

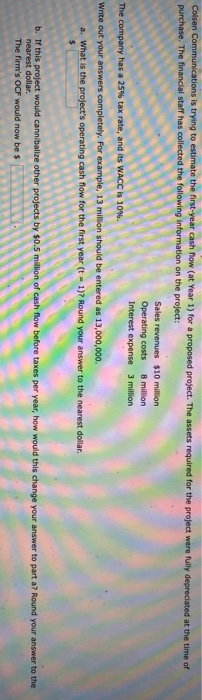

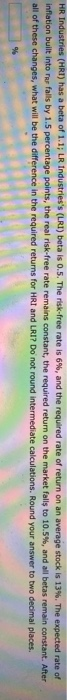

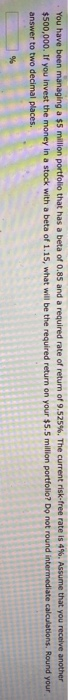

Karsted Air Services is now in the final year of a project. The equipment originally cost $23 million, of which 100% has been depreciated. Karsted can sell the used equipment today for $7 million, and its tax rate is 25%. What is the equipment's after-tax salvage value? Write out your answer completely. For example, 13 million should be entered as 13,000,000 Round your answer to the nearest dollar, $ Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales revenues $10 million Operating costs 8 million Interest expense 3 million The company has a 25% tax rate, and its WACC is 10%. Write out your answers completely. For example, 13 million should be entered as 13,000,000 a. What is the project's operating cash flow for the first year (t = 1)7 Round your answer to the nearest dollar. $ b. If this project would cannibalize other projects by $0.5 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar. The firm's OCF would now be $ HR Industries (HR) has a beta of 1.1; LR Industries's (LRI) beta is 0.5. The risk-free rate is 6%, and the required rate of return on an average stock is 13%. The expected rate of inflation built into Tu falls by 1.5 percentage points, the real risk-free rate remains constant, the required return on the market falls to 10.5%, and all betas remain constant. After all of these changes, what will be the difference in the required returns for HRI and LRI? Do not round intermediate calculations. Round your answer to two decimal places. % You have been managing a $5 million portfolio that has a beta of 0.85 and a required rate of return of 9.525%. The current risk-free rate is 4%. Assume that you receive another $500,000. If you invest the money in a stock with a beta of 1.15, what will be the required return on your $5.5 million portfolio? Do not round intermediate calculations. Round your answer to two decimal places