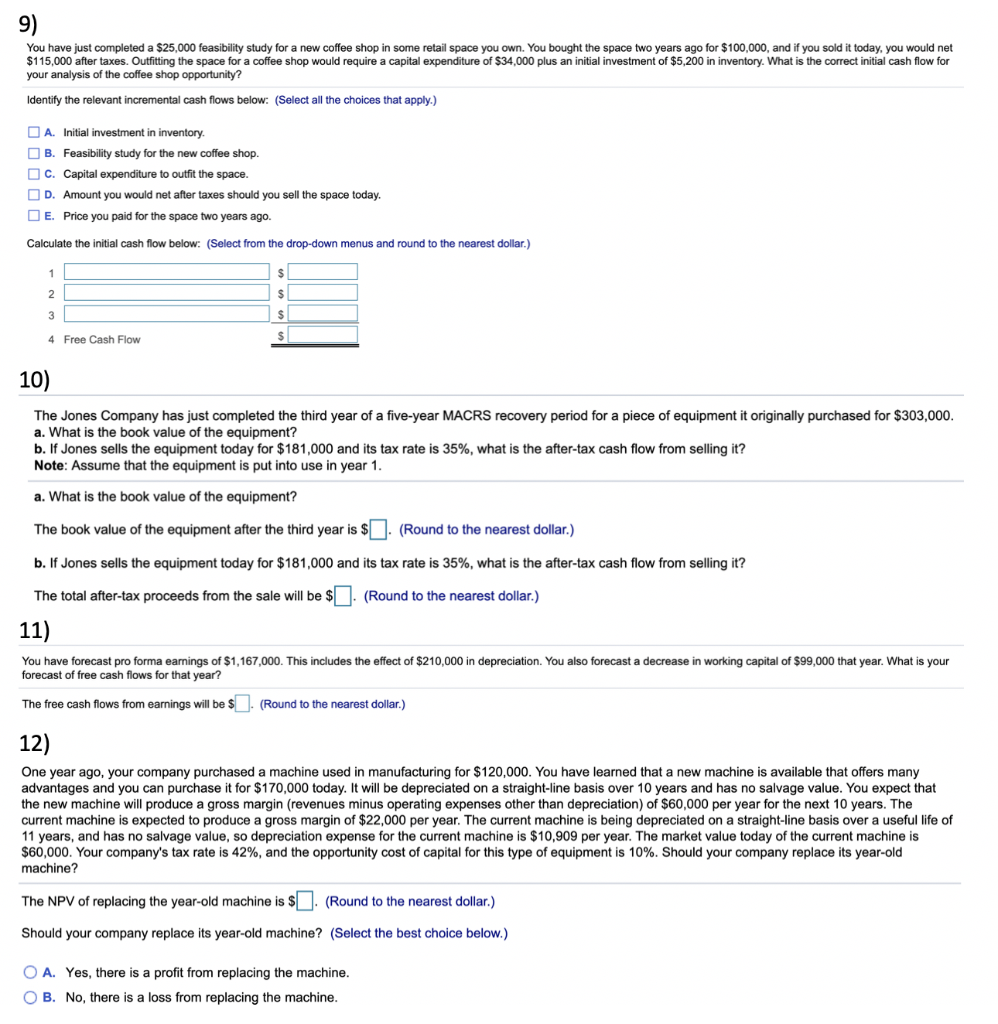

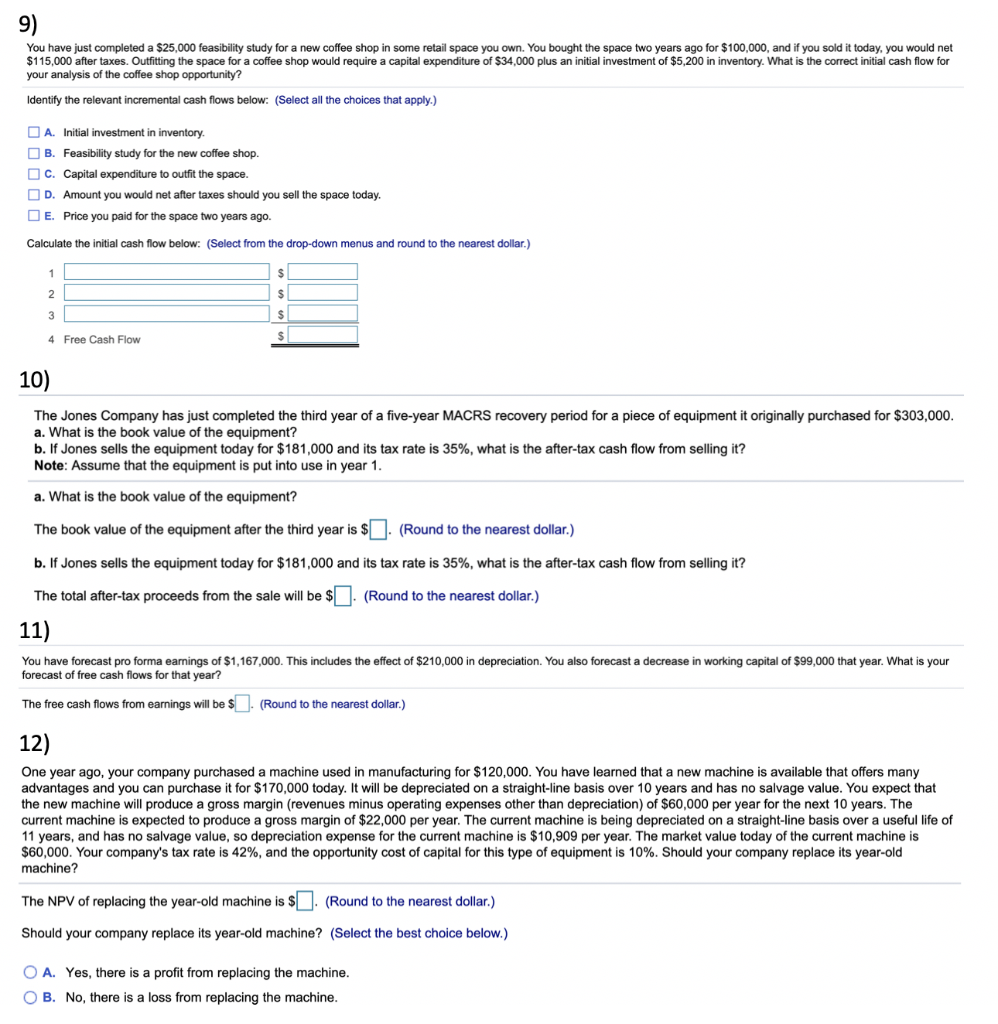

Please solve all parts of 9,10,11, and 12

You have just completed a $25,000 feasibility study for a new coffee shop in some retail space you own. You bought the space two years ago for $100,000, and if you sold it today, you would net $115,000 after taxes. Outfitting the space for a coffee shop would require a capital expenditure of $34,000 plus an initial investment of $5,200 in inventory. What is the correct initial cash flow for your analysis of the coffee shop opportunity? Identify the relevant incremental cash flows below: (Select all the choices that apply.) A. Initial investment in inventory. B. Feasibility study for the new coffee shop. C. Capital expenditure to outfit the space. D. Amount you would net after taxes should you sell the space today. E. Price you paid for the space two years ago Calculate the initial cash flow below: (Select from the drop-down menus and round to the nearest dollar.) 4 Free Cash Flow 10) The Jones Company has just completed the third year of a five-year MACRS recovery period for a piece of equipment it originally purchased for $303,000. a. What is the book value of the equipment? b. If Jones sells the equipment today for $181,000 and its tax rate is 35%, what is the after-tax cash flow from selling it? Note: Assume that the equipment is put into use in year 1. a. What is the book value of the equipment? The book value of the equipment after the third year is $ . (Round to the nearest dollar.) b. If Jones sells the equipment today for $181,000 and its tax rate is 35%, what is the after-tax cash flow from selling it? The total after-tax proceeds from the sale will be $ . (Round to the nearest dollar.) 11) You have forecast pro forma earnings of $1,167,000. This includes the effect of $210,000 in depreciation. You also forecast a decrease in working capital of $99,000 that year. What is your forecast of free cash flows for that year? The free cash flows from earnings will be $ . (Round to the nearest dollar.) 12) One year ago, your company purchased a machine used in manufacturing for $120,000. You have learned that a new machine is available that offers many advantages and you can purchase it for $170,000 today. It will be depreciated on a straight-line basis over 10 years and has no salvage value. You expect that the new machine will produce a gross margin (revenues minus operating expenses other than depreciation) of $60,000 per year for the next 10 years. The current machine is expected to produce a gross margin of $22,000 per year. The current machine is being depreciated on a straight-line basis over a useful life of 11 years, and has no salvage value, so depreciation expense for the current machine is $10,909 per year. The market value today of the current machine is $60,000. Your company's tax rate is 42%, and the opportunity cost of capital for this type of equipment is 10%. Should your company replace its year-old machine? The NPV of replacing the year-old machine is $ . (Round to the nearest dollar.) Should your company replace its year-old machine? (Select the best choice below.) O A. Yes, there is a profit from replacing the machine. OB. No, there is a loss from replacing the machine