Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve all questions 6. During self-construction of an asset by Gambino Company, the following were among the costs incurred. What amount of overhead should

please solve all questions

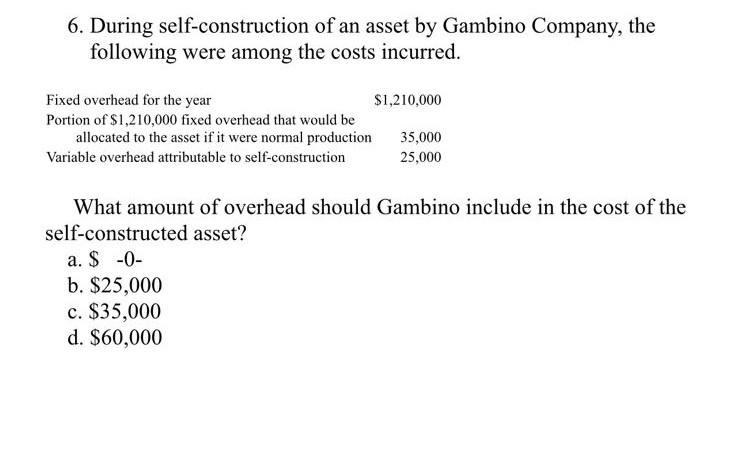

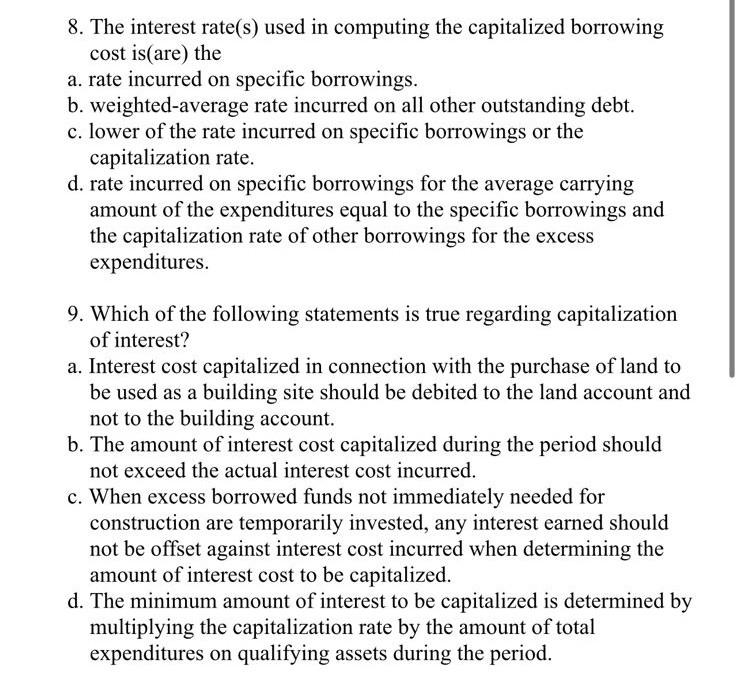

6. During self-construction of an asset by Gambino Company, the following were among the costs incurred. What amount of overhead should Gambino include in the cost of the self-constructed asset? a. $0 b. $25,000 c. $35,000 d. $60,000 8. The interest rate(s) used in computing the capitalized borrowing cost is(are) the a. rate incurred on specific borrowings. b. weighted-average rate incurred on all other outstanding debt. c. lower of the rate incurred on specific borrowings or the capitalization rate. d. rate incurred on specific borrowings for the average carrying amount of the expenditures equal to the specific borrowings and the capitalization rate of other borrowings for the excess expenditures. 9. Which of the following statements is true regarding capitalization of interest? a. Interest cost capitalized in connection with the purchase of land to be used as a building site should be debited to the land account and not to the building account. b. The amount of interest cost capitalized during the period should not exceed the actual interest cost incurred. c. When excess borrowed funds not immediately needed for construction are temporarily invested, any interest earned should not be offset against interest cost incurred when determining the amount of interest cost to be capitalized. d. The minimum amount of interest to be capitalized is determined by multiplying the capitalization rate by the amount of total expenditures on qualifying assets during the periodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started