Please solve by hand without excel

Please solve by hand without excel

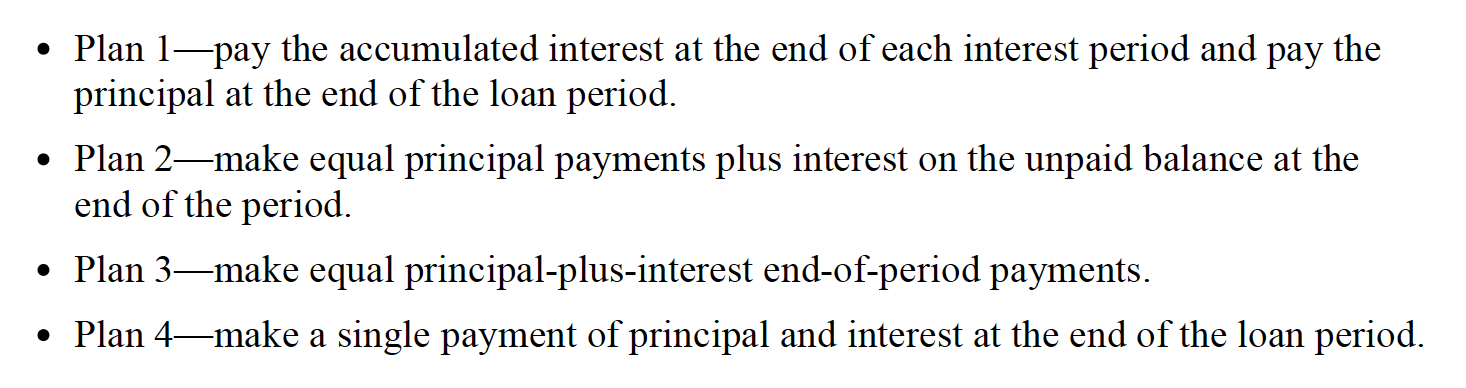

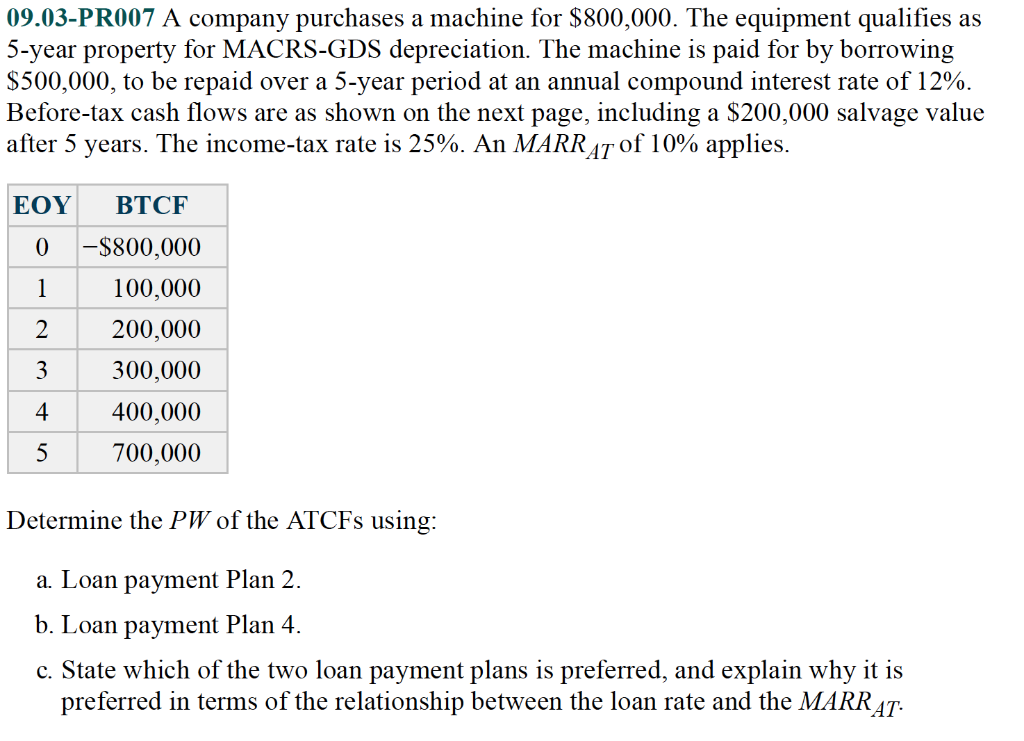

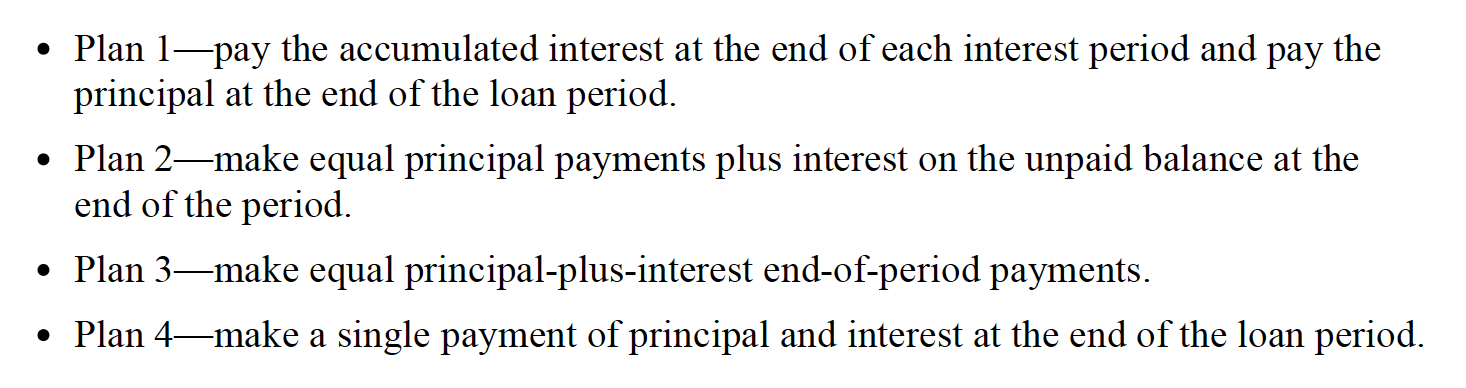

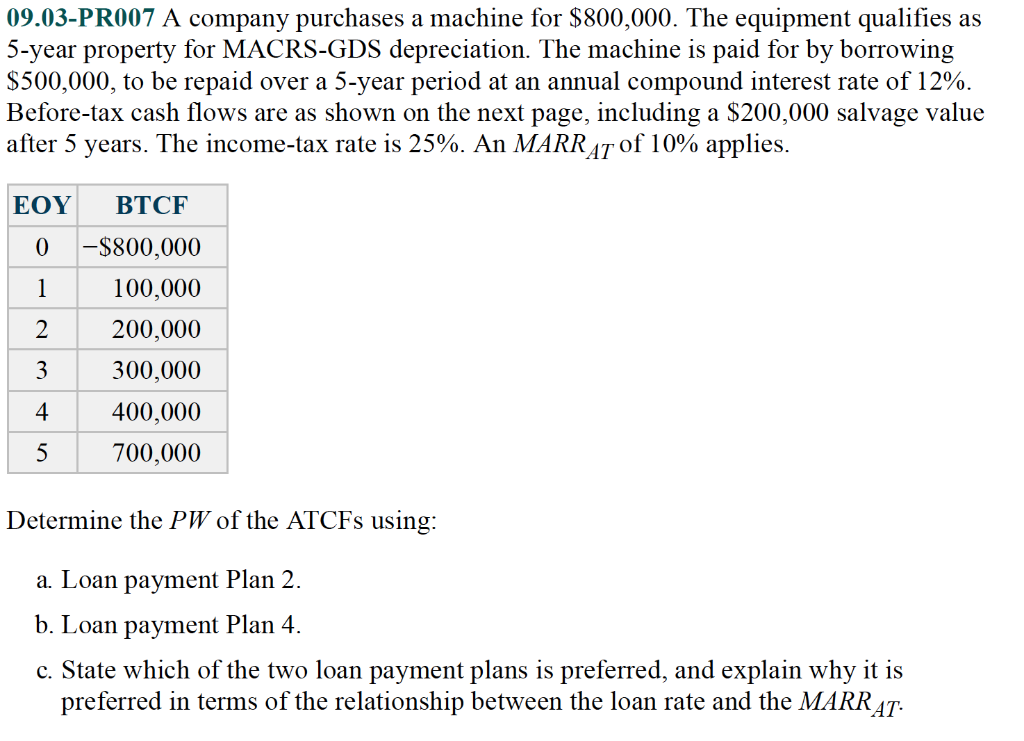

Plan 1-pay the accumulated interest at the end of each interest period and pay the principal at the end of the loan period. Plan 2make equal principal payments plus interest on the unpaid balance at the end of the period. Plan 3make equal principal-plus-interest end-of-period payments. Plan 4make a single payment of principal and interest at the end of the loan period. 09.03-PR007 A company purchases a machine for $800,000. The equipment qualifies as 5-year property for MACRS-GDS depreciation. The machine is paid for by borrowing $500,000, to be repaid over a 5-year period at an annual compound interest rate of 12%. Before-tax cash flows are as shown on the next page, including a $200,000 salvage value after 5 years. The income-tax rate is 25%. An MARRAT of 10% applies. EOY BTCF 0 1 2 -$800,000 100,000 200,000 300,000 400,000 700,000 3 4 5 Determine the PW of the ATCFs using: a. Loan payment Plan 2. b. Loan payment Plan 4. c. State which of the two loan payment plans is preferred, and explain why it is preferred in terms of the relationship between the loan rate and the MARRAT: Plan 1-pay the accumulated interest at the end of each interest period and pay the principal at the end of the loan period. Plan 2make equal principal payments plus interest on the unpaid balance at the end of the period. Plan 3make equal principal-plus-interest end-of-period payments. Plan 4make a single payment of principal and interest at the end of the loan period. 09.03-PR007 A company purchases a machine for $800,000. The equipment qualifies as 5-year property for MACRS-GDS depreciation. The machine is paid for by borrowing $500,000, to be repaid over a 5-year period at an annual compound interest rate of 12%. Before-tax cash flows are as shown on the next page, including a $200,000 salvage value after 5 years. The income-tax rate is 25%. An MARRAT of 10% applies. EOY BTCF 0 1 2 -$800,000 100,000 200,000 300,000 400,000 700,000 3 4 5 Determine the PW of the ATCFs using: a. Loan payment Plan 2. b. Loan payment Plan 4. c. State which of the two loan payment plans is preferred, and explain why it is preferred in terms of the relationship between the loan rate and the MARRAT

Please solve by hand without excel

Please solve by hand without excel