Please solve Calculation

Problem 2: The Brigham Company purchased a machine on October 1, 2017, for $90,000. At the time of acquisition, the machine was estimated to have a useful life of five years and an estimated salvage of $6000. Brigham has recorded depreciation using the straight-line method. On April 1, 2019, the machine was sold for $60000. The companys fiscal year end is Dec 31. It calculates depreciation on a monthly basis, and no depreciation was recorded for 2019 yet.

Record the journal entries for 2020 related to the disposal of the machine.

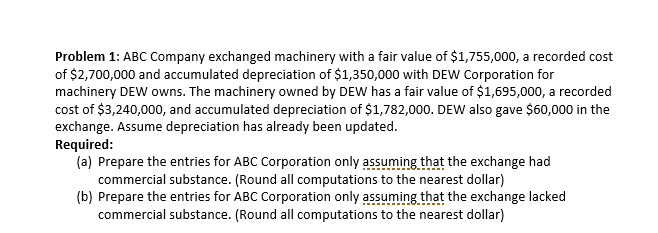

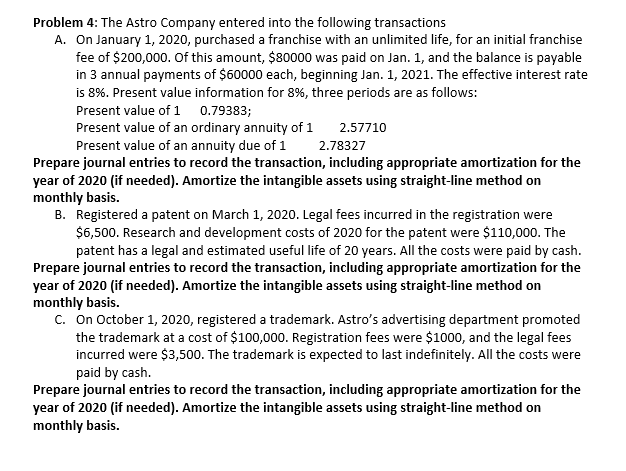

Problem 1: ABC Company exchanged machinery with a fair value of $1,755,000, a recorded cost of $2,700,000 and accumulated depreciation of $1,350,000 with DEW Corporation for machinery DEW Owns. The machinery owned by DEW has a fair value of $1,695,000, a recorded cost of $3,240,000, and accumulated depreciation of $1,782,000. DEW also gave $60,000 in the exchange. Assume depreciation has already been updated. Required: (a) Prepare the entries for ABC Corporation only assuming that the exchange had commercial substance. (Round all computations to the nearest dollar) (b) Prepare the entries for ABC Corporation only assuming that the exchange lacked commercial substance. (Round all computations to the nearest dollar) Problem 4: The Astro Company entered into the following transactions A. On January 1, 2020, purchased a franchise with an unlimited life, for an initial franchise fee of $200,000. Of this amount, $80000 was paid on Jan. 1, and the balance is payable in 3 annual payments of $60000 each, beginning Jan. 1, 2021. The effective interest rate is 8%. Present value information for 8%, three periods are as follows: Present value of 1 0.79383; Present value of an ordinary annuity of 1 2.57710 Present value of an annuity due of 1 2.78327 Prepare journal entries to record the transaction, including appropriate amortization for the year of 2020 (if needed). Amortize the intangible assets using straight-line method on monthly basis. B. Registered a patent on March 1, 2020. Legal fees incurred in the registration were $6,500. Research and development costs of 2020 for the patent were $110,000. The patent has a legal and estimated useful life of 20 years. All the costs were paid by cash. Prepare journal entries to record the transaction, including appropriate amortization for the year of 2020 (if needed). Amortize the intangible assets using straight-line method on monthly basis. C. On October 1, 2020, registered a trademark. Astro's advertising department promoted the trademark at a cost of $100,000. Registration fees were $1000, and the legal fees incurred were $3,500. The trademark is expected to last indefinitely. All the costs were paid by cash. Prepare journal entries to record the transaction, including appropriate amortization for the year of 2020 (if needed). Amortize the intangible assets using straight-line method on monthly basis