Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve correct and clear. I wont forget to give thumbs up or down thanks. UPDATE: 2. A painter came and painted the zoo for

Please solve correct and clear. I wont forget to give thumbs up or down thanks.

UPDATE:

2. A painter came and painted the zoo for $1100 on the 3rd of December, 2020. The zoo will pay the painter on the 15th of January, 2021. Show calculations where necessary.

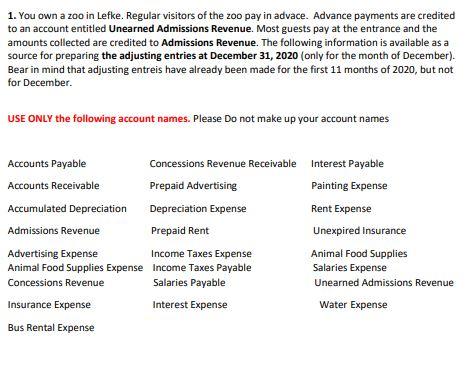

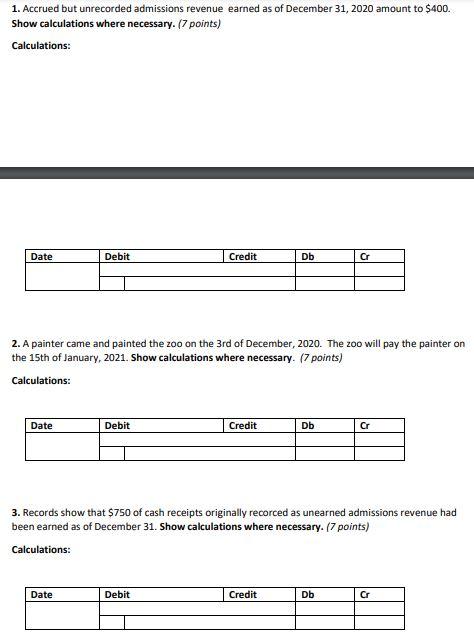

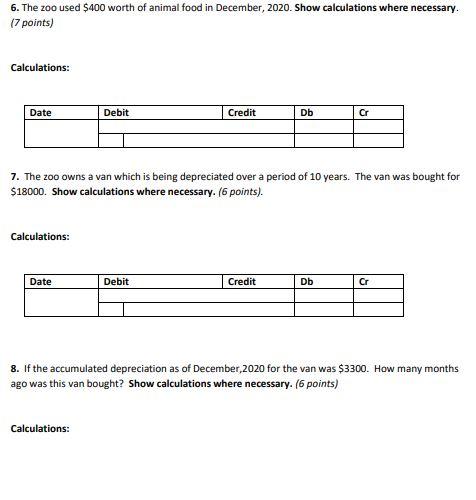

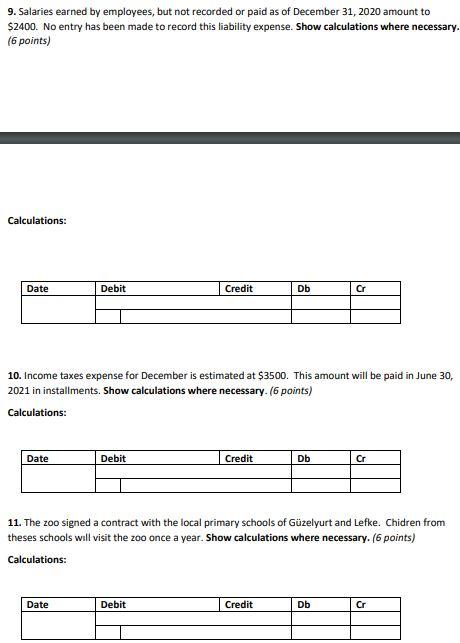

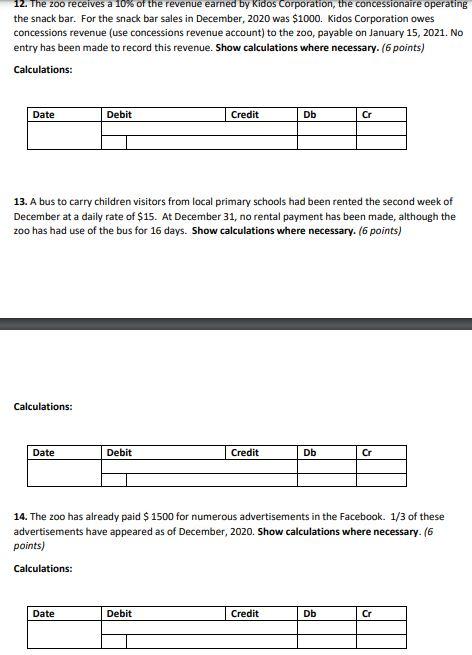

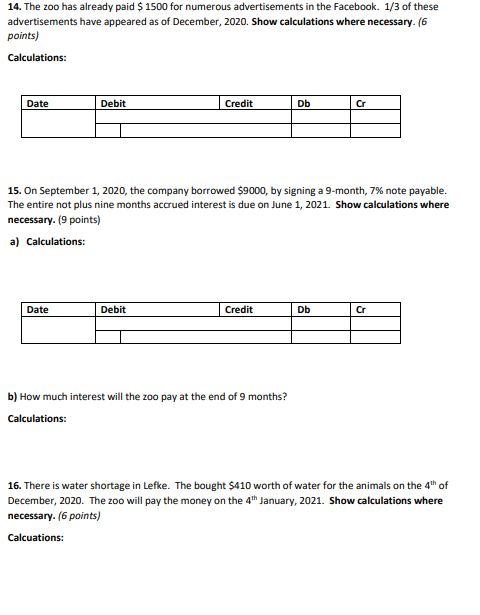

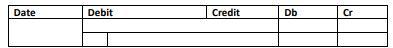

1. You own a zoo in Lefke. Regular visitors of the zoo pay in advace. Advance payments are credited to an account entitled Unearned Admissions Revenue. Most guests pay at the entrance and the amounts collected are credited to Admissions Revenue. The following information is available as a source for preparing the adjusting entries at December 31, 2020 (only for the month of December). Bear in mind that adjusting entreis have already been made for the first 11 months of 2020, but not for December USE ONLY the following account names. Please do not make up your account names Accounts Payable Concessions Revenue Receivable Interest Payable Accounts Receivable Prepaid Advertising Painting Expense Accumulated Depreciation Depreciation Expense Rent Expense Admissions Revenue Prepaid Rent Unexpired Insurance Advertising Expense Income Taxes Expense Animal Food Supplies Animal Food Supplies Expense Income Taxes Payable Salaries Expense Concessions Revenue Salaries Payable Unearned Admissions Revenue Insurance Expense Interest Expense Water Expense Bus Rental Expense 1. Accrued but unrecorded admissions revenue earned as of December 31, 2020 amount to $400. Show calculations where necessary. (7 points) Calculations: Date Debit Credit Db Cr 2. A painter came and painted the zoo on the 3rd of December, 2020. The zoo will pay the painter on the 15th of January, 2021. Show calculations where necessary. (7 points) Calculations: Date Debit Credit Db Cr 3. Records show that $750 of cash receipts originally recorced as unearned admissions revenue had been earned as of December 31. Show calculations where necessary. (7 points) Calculations: Date Debit Credit Db Cr 4. On December 1, 2020, the company paid rent 6 months rent through May 31, 2021 for $3000. Show calculations. (7 points) Calculations: Date Debit Credit Db Cr 5. The company purchased a 12-month insurance on August 1, 2020 for $2400. Show calculation where necessary. (7 points). Calculations: Date Debit Credit Db Cr 6. The zoo used $400 worth of animal food in December, 2020. Show calculations where necessary. (7 points) Calculations: Date Debit Credit Db Cr 7. The zoo owns a van which is being depreciated over a period of 10 years. The van was bought for $18000. Show calculations where necessary. (6 points). Calculations: Date Debit Credit Db Cr 8. If the accumulated depreciation as of December,2020 for the van was $3300. How many months ago was this van bought? Show calculations where necessary. (6 points) Calculations: 9. Salaries earned by employees, but not recorded or paid as of December 31, 2020 amount to $2400. No entry has been made to record this liability expense. Show calculations where necessary. (6 points) Calculations: Date Debit Credit Db Cr 10. Income taxes expense for December is estimated at $3500. This amount will be paid in June 30, 2021 in installments. Show calculations where necessary. (6 points) Calculations: Date Debit Credit Db Cr 11. The zoo signed a contract with the local primary schools of Gzelyurt and Lefke. Chidren from theses schools will visit the zoo once a year. Show calculations where necessary. (6 points) Calculations: Date Debit Credit Db 15 12. The zoo receives a 10% of the revenue earned by Kidos Corporation, the concessionaire operating the snack bar. For the snack bar sales in December, 2020 was $1000. Kidos Corporation owes concessions revenue (use concessions revenue account) to the zoo, payable on January 15, 2021. No entry has been made to record this revenue. Show calculations where necessary. (6 points) Calculations: Date Debit Credit Db Cr 13. A bus to carry children visitors from local primary schools had been rented the second week of December at a daily rate of $15. At December 31, no rental payment has been made, although the zoo has had use of the bus for 16 days. Show calculations where necessary. (6 points) Calculations: Date Debit Credit Db Cr 14. The zoo has already paid $ 1500 for numerous advertisements in the Facebook. 1/3 of these advertisements have appeared as of December, 2020. Show calculations where necessary. (6 points) Calculations: Date Debit Credit Db Cr 14. The zoo has already paid $ 1500 for numerous advertisements in the Facebook. 1/3 of these advertisements have appeared as of December, 2020. Show calculations where necessary. (6 points) Calculations: Date Debit Credit Db Cr 15. On September 1, 2020, the company borrowed $9000, by signing a 9-month, 7% note payable. The entire not plus nine months accrued interest is due on June 1, 2021. Show calculations where necessary. (9 points) a) Calculations: Date Debit Credit Db Cr b) How much interest will the zoo pay at the end of 9 months? Calculations: 16. There is water shortage in Lefke. The bought $410 worth of water for the animals on the 4th of December, 2020. The zoo will pay the money on the 4th January, 2021. Show calculations where necessary. (6 points) Calcuations: Date Debit Credit DbStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started