Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve fast i will thumb you up Suppose you buy 100 shares of stock initially selling at $50 per share, borrowing 25% of the

please solve fast

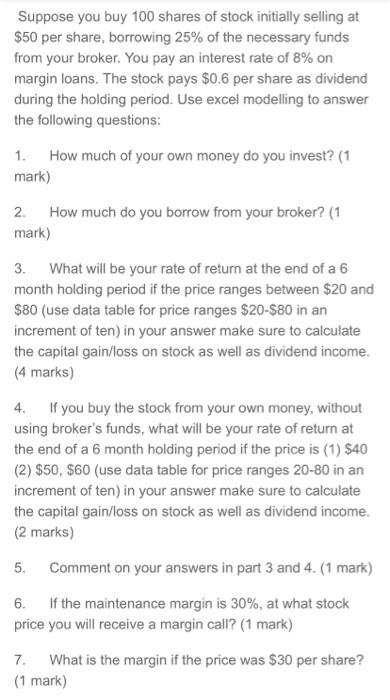

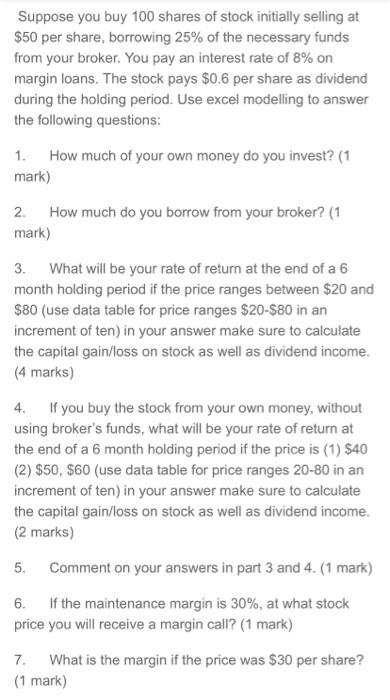

Suppose you buy 100 shares of stock initially selling at $50 per share, borrowing 25% of the necessary funds from your broker. You pay an interest rate of 8% on margin loans. The stock pays $0.6 per share as dividend during the holding period. Use excel modelling to answer the following questions: 1. How much of your own money do you invest? (1 mark) 2. How much do you borrow from your broker? (1 mark) 3. What will be your rate of return at the end of a 6 month holding period if the price ranges between $20 and $80 (use data table for price ranges $20-$80 in an increment of ten) in your answer make sure to calculate the capital gain/loss on stock as well as dividend income. (4 marks) 4. If you buy the stock from your own money, without using broker's funds, what will be your rate of return at the end of a 6 month holding period if the price is (1) $40 (2) $50, $60 (use data table for price ranges 20-80 in an increment of ten) in your answer make sure to calculate the capital gain/loss on stock as well as dividend income. (2 marks) 5. Comment on your answers in part 3 and 4. (1 mark) 6. If the maintenance margin is 30%, at what stock price you will receive a margin call? (1 mark) 7. What is the margin if the price was $30 per share? (1 mark) i will thumb you up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started