Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve it faster Notes relating to the above Statements: 1. The market value of the shares of the business at the end of the

Please solve it faster

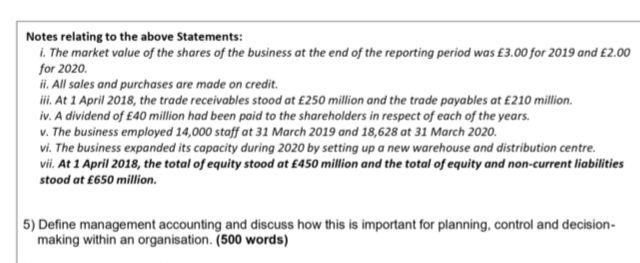

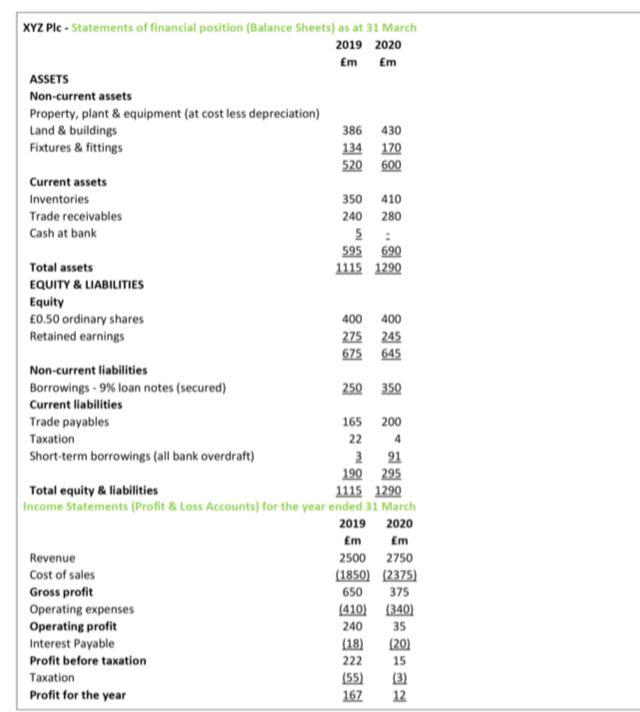

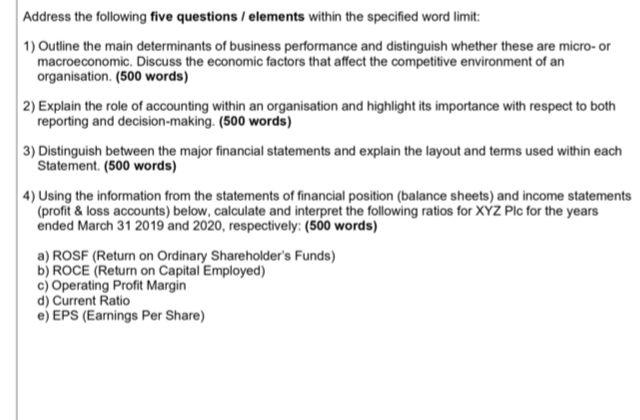

Notes relating to the above Statements: 1. The market value of the shares of the business at the end of the reporting period was 3.00 for 2019 and 2.00 for 2020 ii. All sales and purchases are made on credit ili. At 1 April 2018, the trade receivables stood at 250 million and the trade payables at 210 million. iv. A dividend of 40 million had been paid to the shareholders in respect of each of the years. V. The business employed 14,000 staff at 31 March 2019 and 18,628 at 31 March 2020. Vi. The business expanded its capacity during 2020 by setting up a new warehouse and distribution centre. vii. At 1 April 2018, the total of equity stood at 450 million and the total of equity and non-current liabilities stood at 650 million. 5) Define management accounting and discuss how this is important for planning, control and decision- making within an organisation. (500 words) XYZ PIC - Statements of financial position (Balance Sheets) as at 31 March 2019 2020 m m ASSETS Non-current assets Property, plant & equipment (at cost less depreciation) Land & buildings 386 430 Fixtures & fittings 134 170 520 600 Current assets Inventories 350 410 Trade receivables 240 280 Cash at bank 595 690 Total assets 1115 1290 EQUITY & LIABILITIES Equity 0.50 ordinary shares 400 400 Retained earnings 275 245 675 645 Non-current liabilities Borrowings - 9% loan notes (secured) 250 350 Current liabilities Trade payables 165 200 Taxation 224 Short-term borrowings (all bank overdraft) 3 91 190 295 Total equity & liabilities 1115 1290 Income Statements (Profit & Loss Accounts) for the year ended 31 March 2019 2020 Em Revenue 2500 2750 Cost of sales (1850) (2375) Gross profit 650 375 Operating expenses (410) (340) Operating profit 240 35 Interest Payable (18) (20) Profit before taxation 222 15 Taxation (55) (3) Profit for the year 167 12 Em Address the following five questions / elements within the specified word limit: 1) Outline the main determinants of business performance and distinguish whether these are micro-or macroeconomic Discuss the economic factors that affect the competitive environment of an organisation. (500 words) 2) Explain the role of accounting within an organisation and highlight its importance with respect to both reporting and decision-making. (500 words) 3) Distinguish between the major financial statements and explain the layout and terms used within each Statement. (500 words) 4) Using the information from the statements of financial position (balance sheets) and income statements (profit & loss accounts) below, calculate and interpret the following ratios for XYZ Plc for the years ended March 31 2019 and 2020, respectively: (500 words) a) ROSF (Return on Ordinary Shareholder's Funds) b) ROCE (Return on Capital Employed) c) Operating Profit Margin d) Current Ratio e) EPS (Earnings Per Share) Notes relating to the above Statements: 1. The market value of the shares of the business at the end of the reporting period was 3.00 for 2019 and 2.00 for 2020 ii. All sales and purchases are made on credit ili. At 1 April 2018, the trade receivables stood at 250 million and the trade payables at 210 million. iv. A dividend of 40 million had been paid to the shareholders in respect of each of the years. V. The business employed 14,000 staff at 31 March 2019 and 18,628 at 31 March 2020. Vi. The business expanded its capacity during 2020 by setting up a new warehouse and distribution centre. vii. At 1 April 2018, the total of equity stood at 450 million and the total of equity and non-current liabilities stood at 650 million. 5) Define management accounting and discuss how this is important for planning, control and decision- making within an organisation. (500 words) XYZ PIC - Statements of financial position (Balance Sheets) as at 31 March 2019 2020 m m ASSETS Non-current assets Property, plant & equipment (at cost less depreciation) Land & buildings 386 430 Fixtures & fittings 134 170 520 600 Current assets Inventories 350 410 Trade receivables 240 280 Cash at bank 595 690 Total assets 1115 1290 EQUITY & LIABILITIES Equity 0.50 ordinary shares 400 400 Retained earnings 275 245 675 645 Non-current liabilities Borrowings - 9% loan notes (secured) 250 350 Current liabilities Trade payables 165 200 Taxation 224 Short-term borrowings (all bank overdraft) 3 91 190 295 Total equity & liabilities 1115 1290 Income Statements (Profit & Loss Accounts) for the year ended 31 March 2019 2020 Em Revenue 2500 2750 Cost of sales (1850) (2375) Gross profit 650 375 Operating expenses (410) (340) Operating profit 240 35 Interest Payable (18) (20) Profit before taxation 222 15 Taxation (55) (3) Profit for the year 167 12 Em Address the following five questions / elements within the specified word limit: 1) Outline the main determinants of business performance and distinguish whether these are micro-or macroeconomic Discuss the economic factors that affect the competitive environment of an organisation. (500 words) 2) Explain the role of accounting within an organisation and highlight its importance with respect to both reporting and decision-making. (500 words) 3) Distinguish between the major financial statements and explain the layout and terms used within each Statement. (500 words) 4) Using the information from the statements of financial position (balance sheets) and income statements (profit & loss accounts) below, calculate and interpret the following ratios for XYZ Plc for the years ended March 31 2019 and 2020, respectively: (500 words) a) ROSF (Return on Ordinary Shareholder's Funds) b) ROCE (Return on Capital Employed) c) Operating Profit Margin d) Current Ratio e) EPS (Earnings Per Share)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started