Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve it in 10 mins I will thumb you up please fast Remaining Time: 1 hour, 34 minutes, 07 seconds. Question Completion Status: Question

please solve it in 10 mins I will thumb you up please fast

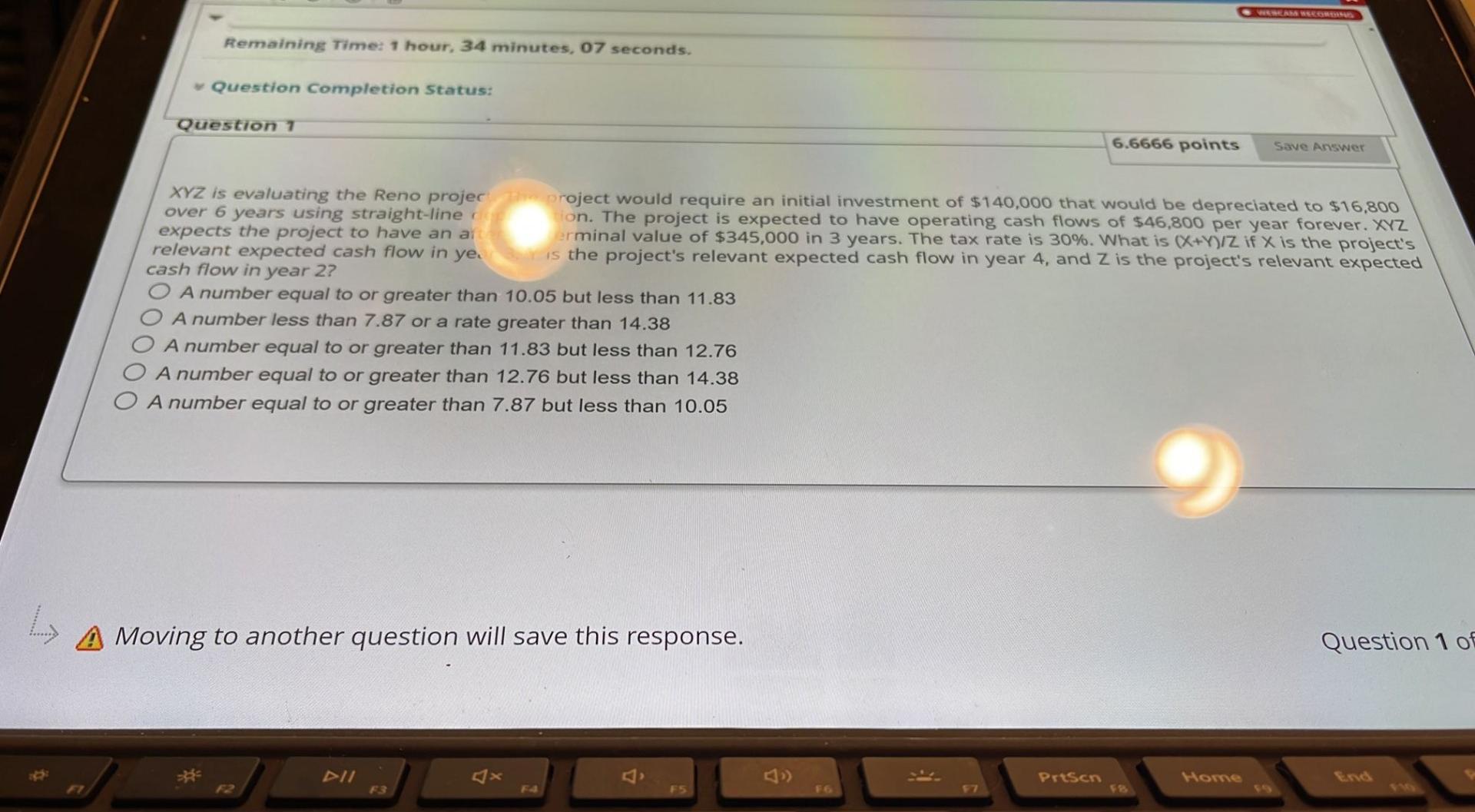

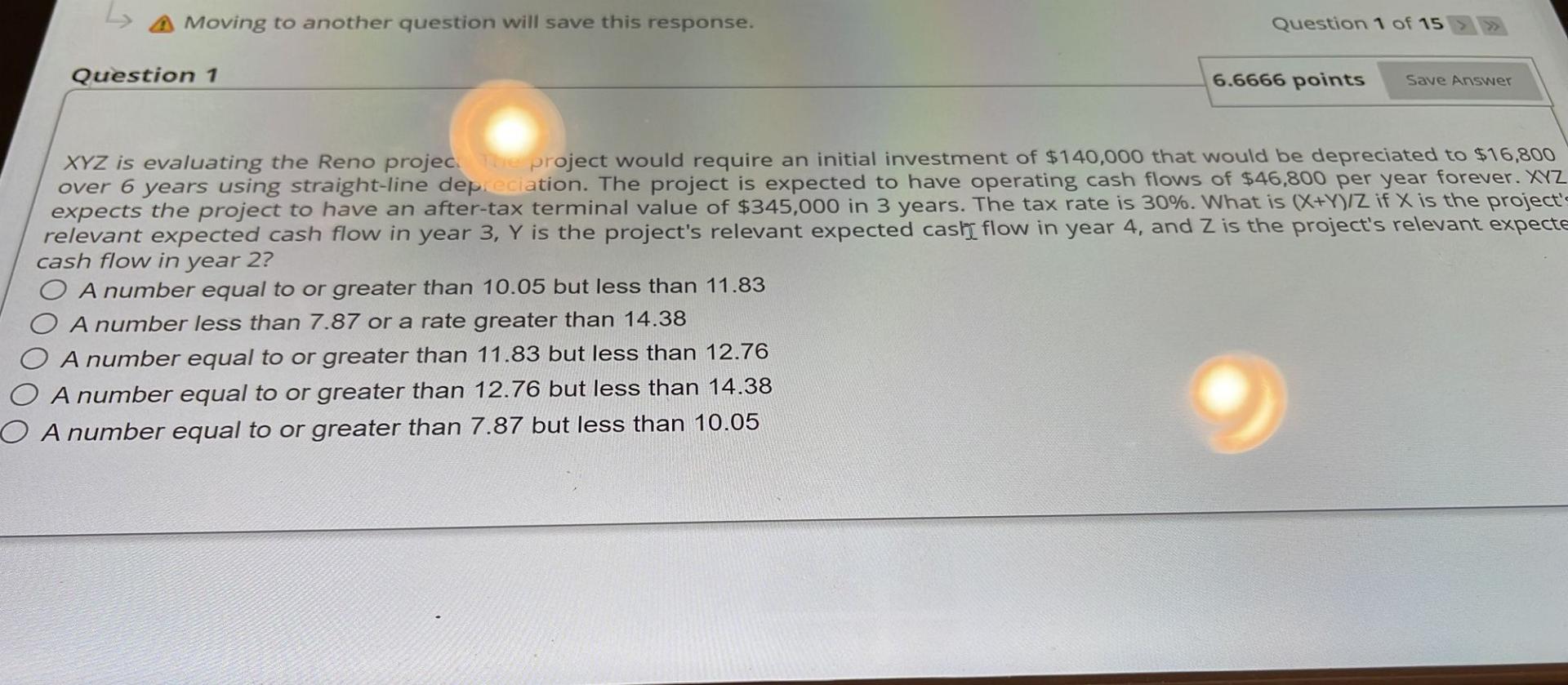

Remaining Time: 1 hour, 34 minutes, 07 seconds. Question Completion Status: Question 1 6.6666 points Save Answer XYZ is evaluating the Reno project The project would require an initial investment of $140,000 that would be depreciated to $16,800 over 6 years using straight-line de tion. The project is expected to have operating cash flows of $46,800 per year forever. XYZ expects the project to have an afterminal value of $345,000 in 3 years. The tax rate is 30%. What is (X+Y)/Z if X is the project's relevant expected cash flow in ye. is the project's relevant expected cash flow in year 4, and Z is the project's relevant expected cash flow in year 2? O A number equal to or greater than 10.05 but less than 11.83 A number less than 7.87 or a rate greater than 14.38 A number equal to or greater than 11.83 but less than 12.76 O A number equal to or greater than 12.76 but less than 14.38 O A number equal to or greater than 7.87 but less than 10.05 L A Moving to another question will save this response. Question 1 of PrtScn F3 F4 F5 00 WESCAM WECORDING Home Moving to another question will save this response. Question 1 of 15 Question 1 6.6666 points Save Answer XYZ is evaluating the Reno projec. The project would require an initial investment of $140,000 that would be depreciated to $16,800 over 6 years using straight-line depreciation. The project is expected to have operating cash flows of $46,800 per year forever. XYZ expects the project to have an after-tax terminal value of $345,000 in 3 years. The tax rate is 30%. What is (X+Y)/Z if X is the project's relevant expected cash flow in year 3, Y is the project's relevant expected cash flow in year 4, and Z is the project's relevant expecte cash flow in year 2? O A number equal to or greater than 10.05 but less than 11.83 A number less than 7.87 or a rate greater than 14.38 O A number equal to or greater than 11.83 but less than 12.76 O A number equal to or greater than 12.76 but less than 14.38 O A number equal to or greater than 7.87 but less than 10.05 Remaining Time: 1 hour, 34 minutes, 07 seconds. Question Completion Status: Question 1 6.6666 points Save Answer XYZ is evaluating the Reno project The project would require an initial investment of $140,000 that would be depreciated to $16,800 over 6 years using straight-line de tion. The project is expected to have operating cash flows of $46,800 per year forever. XYZ expects the project to have an afterminal value of $345,000 in 3 years. The tax rate is 30%. What is (X+Y)/Z if X is the project's relevant expected cash flow in ye. is the project's relevant expected cash flow in year 4, and Z is the project's relevant expected cash flow in year 2? O A number equal to or greater than 10.05 but less than 11.83 A number less than 7.87 or a rate greater than 14.38 A number equal to or greater than 11.83 but less than 12.76 O A number equal to or greater than 12.76 but less than 14.38 O A number equal to or greater than 7.87 but less than 10.05 L A Moving to another question will save this response. Question 1 of PrtScn F3 F4 F5 00 WESCAM WECORDING Home Moving to another question will save this response. Question 1 of 15 Question 1 6.6666 points Save Answer XYZ is evaluating the Reno projec. The project would require an initial investment of $140,000 that would be depreciated to $16,800 over 6 years using straight-line depreciation. The project is expected to have operating cash flows of $46,800 per year forever. XYZ expects the project to have an after-tax terminal value of $345,000 in 3 years. The tax rate is 30%. What is (X+Y)/Z if X is the project's relevant expected cash flow in year 3, Y is the project's relevant expected cash flow in year 4, and Z is the project's relevant expecte cash flow in year 2? O A number equal to or greater than 10.05 but less than 11.83 A number less than 7.87 or a rate greater than 14.38 O A number equal to or greater than 11.83 but less than 12.76 O A number equal to or greater than 12.76 but less than 14.38 O A number equal to or greater than 7.87 but less than 10.05

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started