Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve it in 10 mins I will thumb you up please I have 10 mins only O II. Question 28 Mauin 4 points (4

please solve it in 10 mins I will thumb you up please I have 10 mins only

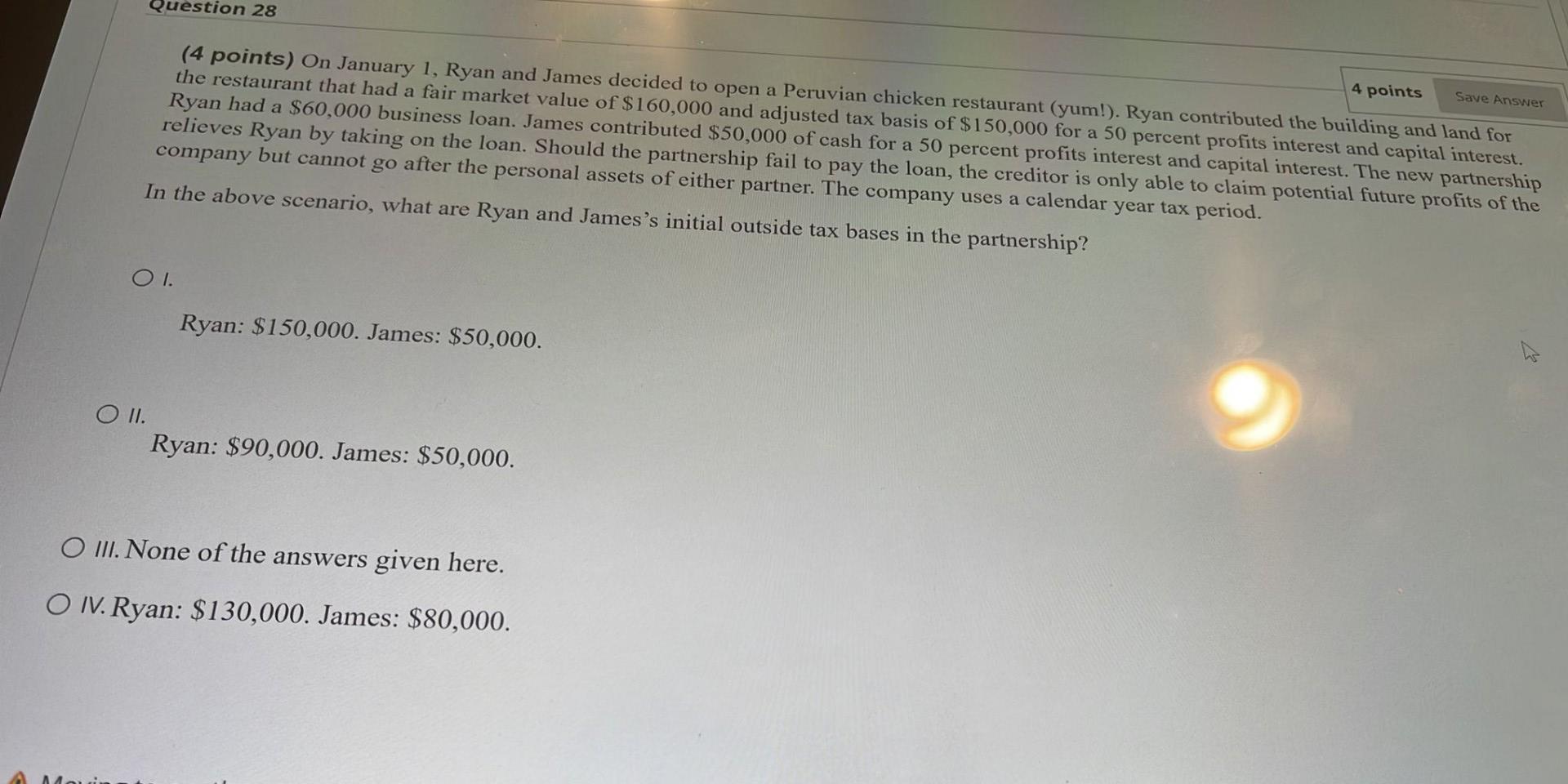

O II. Question 28 Mauin 4 points (4 points) On January 1, Ryan and James decided to open a Peruvian chicken restaurant (yum!). Ryan contributed the building and land for the restaurant that had a fair market value of $160,000 and adjusted tax basis of $150,000 for a 50 percent profits interest and capital interest. Ryan had a $60,000 business loan. James contributed $50,000 of cash for a 50 percent profits interest and capital interest. The new partnership relieves Ryan by taking on the loan. Should the partnership fail to pay the loan, the creditor is only able to claim potential future profits of the company but cannot go after the personal assets of either partner. The company uses a calendar year tax period. In the above scenario, what are Ryan and James's initial outside tax bases in the partnership? OI. Ryan: $150,000. James: $50,000. Ryan: $90,000. James: $50,000. O III. None of the answers given here. O IV. Ryan: $130,000. James: $80,000. SaveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started