Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve it in 20 mins I will thumb you up Question 32 15 pts B-Fabrics Ltd, a US multinational company, is assessing the possibility

please solve it in 20 mins I will thumb you up

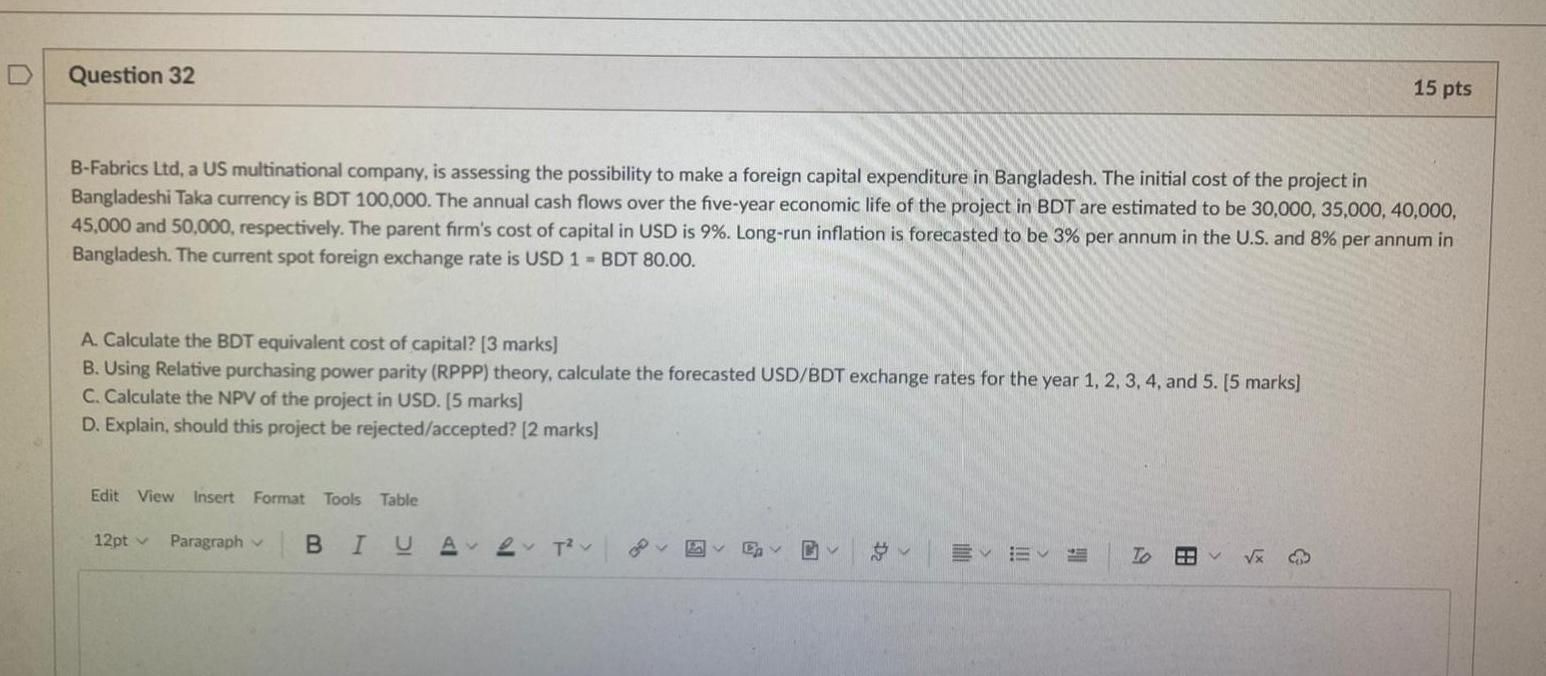

Question 32 15 pts B-Fabrics Ltd, a US multinational company, is assessing the possibility to make a foreign capital expenditure in Bangladesh. The initial cost of the project in Bangladeshi Taka currency is BDT 100,000. The annual cash flows over the five-year economic life of the project in BDT are estimated to be 30,000, 35,000, 40,000, 45,000 and 50,000, respectively. The parent firm's cost of capital in USD is 9%. Long-run inflation is forecasted to be 3% per annum in the U.S. and 8% per annum in Bangladesh. The current spot foreign exchange rate is USD 1 - BDT 80.00. A. Calculate the BDT equivalent cost of capital? [3 marks) B. Using Relative purchasing power parity (RPPP) theory, calculate the forecasted USD/BDT exchange rates for the year 1, 2, 3, 4, and 5. [5 marks) C. Calculate the NPV of the project in USD. (5 marks] D. Explain, should this project be rejected/accepted? [2 marks] Edit View Insert Format Tools Table 12pt Paragraph B I U ALT? CA B TOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started