please solve it with showing the steps.

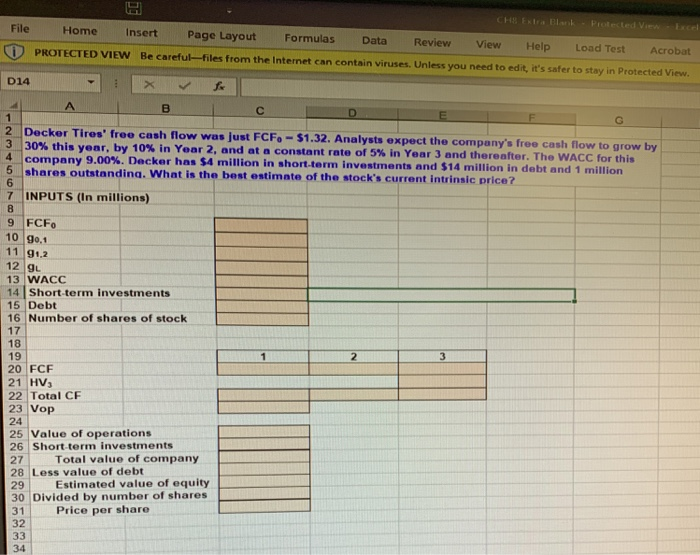

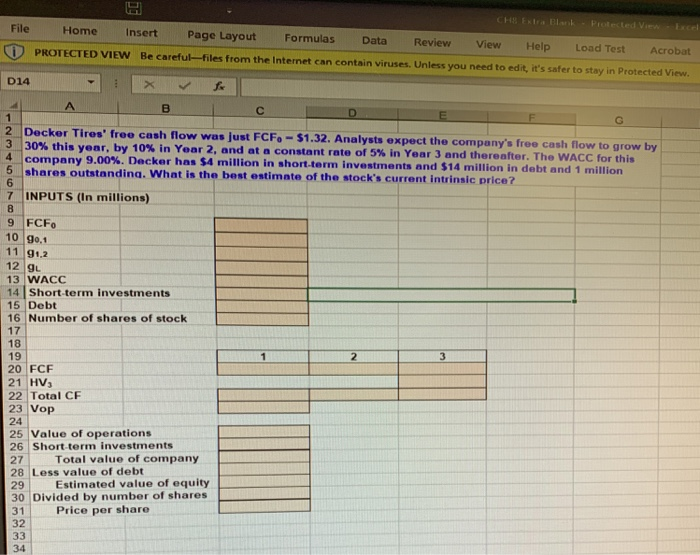

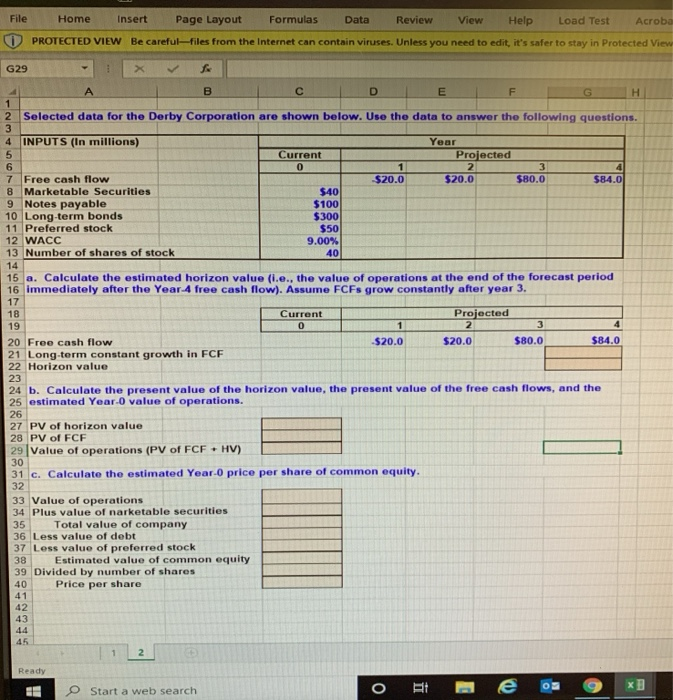

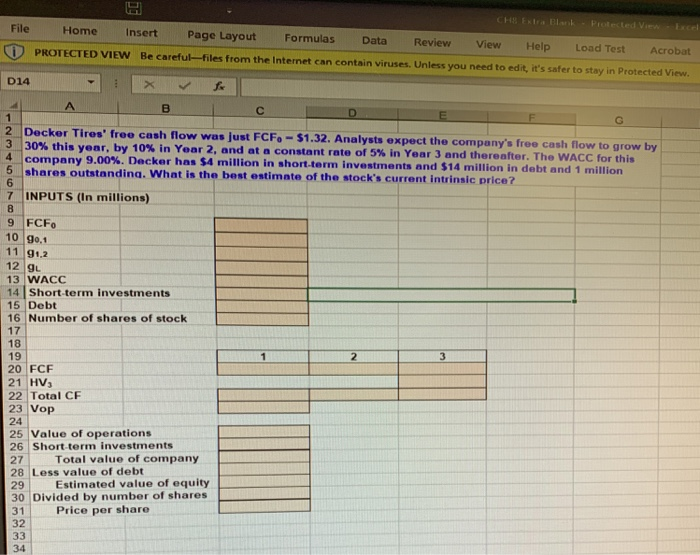

File Home Insert Page Layout Formulas Data Review View Help Load Test Acrobat O PROTECTED VIEW Be carefulfiles from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. D14X R 2 Decker Tires' freo cash flow was just FCF-51.32. Analysts expect the company's free cash flow to grow by 30% this year, by 10% in Year 2, and at a constant rate of 5% in Year 3 and thereafter. The WACC for this company 9.00%. Dacker has $4 million in short-term investments and $14 million in debt and 1 million shares outstanding. What is the best estimate of the stock's current intrinsic price? 5 7 INPUTS (In millions) 9 FCF. 10 90.1 11 91.2 12 SL 13 WACC 14 Short-term investments 15 Debt 16 Number of shares of stock 3 19 20 FCF 21 HV, 22 Total CF 23 Vop 24 25 Value of operations 26 Short-term investments Total value of company 28 Less value of debt Estimated value of equity 30 Divided by number of shares Price per share 29 File Home Insert Page Layout Formulas Data Review View Help Load Test Acroba O PROTECTED VIEW Be careful--files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View G29 c o E I F Selected data for the Derby Corporation are shown below. Use the data to answer the following questions. WN 4 INPUTS (In millions) Current Year Projected 2 $20.0 1 $20.0 3 $80.0 S84.0 7 Free cash flow 8 Marketable Securities 9 Notes payable 10 Long-term bonds 11 Preferred stock 12 WACC 13 Number of shares of stock $40 $100 $300 $50 9.00% 40 15 a. Calculate the estimated horizon value (i.e., the value of operations at the end of the forecast period 16 immediately after the Year 4 free cash flow). Assume FCFs grow constantly after year 3. 17 18 19 Current 0 1 $20.0 Projected 2 $20.0 3 $80.0 4 $84.0 20 Free cash flow 21 Long-term constant growth in FCF 22 Horizon value 23 24 b. Calculate the present value of the horizon value, the present value of the free cash flows, and the 25 estimated Year-O value of operations. 26 27 PV of horizon value 28 PV of FCF 29 Value of operations (PV of FCF + HV) 31 c. Calculate the estimated Year.O price per share of common equity. 33 Value of operations 34 Plus value of narketable securities 35 Total value of company 36 Less value of debt 37 Less value of preferred stock 38 Estimated value of common equity 39 Divided by number of shares 40 Price per share 43 45 Ready Start a web search