Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve question 2 Thanks in advance! Sparty Corporation has been operating for two years. The December 31, 2018 account balances are: Cash Accounts Receivable

Please solve question 2

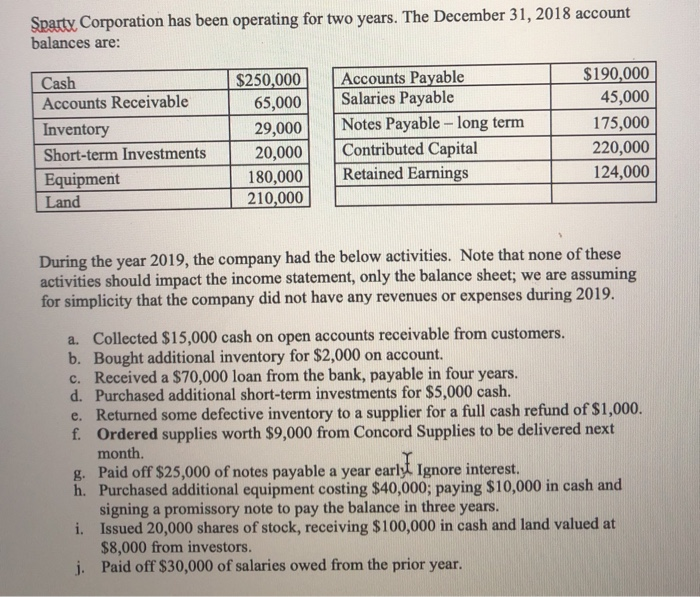

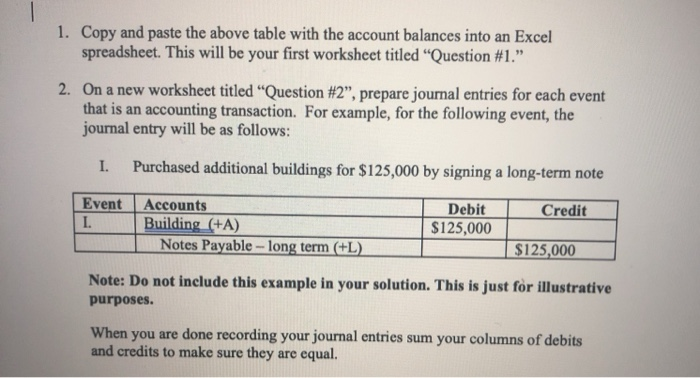

Sparty Corporation has been operating for two years. The December 31, 2018 account balances are: Cash Accounts Receivable Inventory Short-term Investments Equipment Land $250,000 65,000 29,000 20,000 180,000 210,000 Accounts Payable Salaries Payable Notes Payable - long term Contributed Capital Retained Earnings $190,000 45,000 175,000 220,000 124,000 During the year 2019, the company had the below activities. Note that none of these activities should impact the income statement, only the balance sheet; we are assuming for simplicity that the company did not have any revenues or expenses during 2019. a. Collected $15,000 cash on open accounts receivable from customers. b. Bought additional inventory for $2,000 on account. C. Received a $70,000 loan from the bank, payable in four years. d. Purchased additional short-term investments for $5,000 cash. e. Returned some defective inventory to a supplier for a full cash refund of $1,000. f. Ordered supplies worth $9,000 from Concord Supplies to be delivered next month. 8. Paid off $25,000 of notes payable a year earlyt Ignore interest. h. Purchased additional equipment costing $40,000; paying $10,000 in cash and signing a promissory note to pay the balance in three years. i. Issued 20,000 shares of stock, receiving $100,000 in cash and land valued at $8,000 from investors. j. Paid off $30,000 of salaries owed from the prior year. 1. Copy and paste the above table with the account balances into an Excel spreadsheet. This will be your first worksheet titled "Question #1." 2. On a new worksheet titled "Question #2, prepare journal entries for each event that is an accounting transaction. For example, for the following event, the journal entry will be as follows: I. Purchased additional buildings for $125,000 by signing a long-term note Event Credit Accounts Building (+A) Notes Payable - long term (L) Debit $125,000 $125,000 Note: Do not include this example in your solution. This is just for illustrative purposes. When you are done recording your journal entries sum your columns of debits and credits to make sure they are equal

Thanks in advance!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started