Answered step by step

Verified Expert Solution

Question

1 Approved Answer

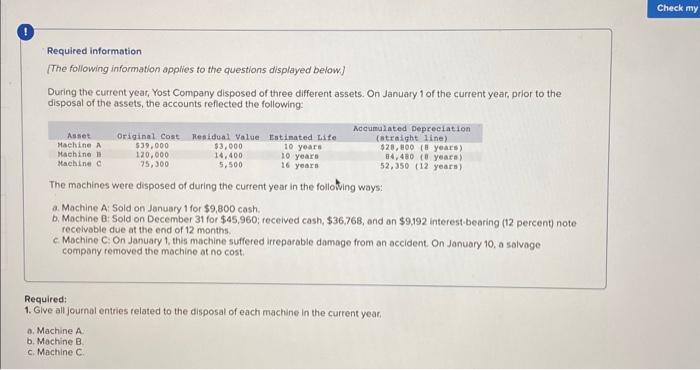

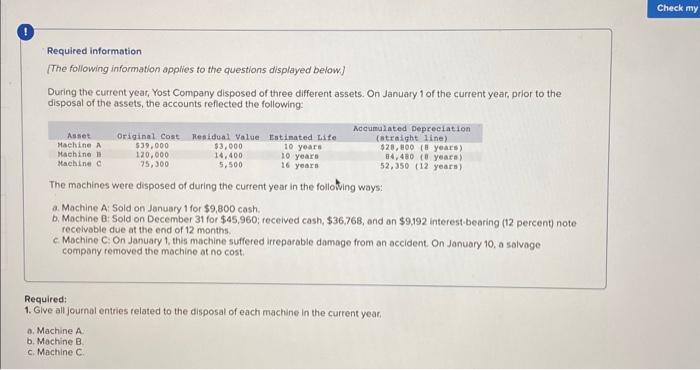

please solve :) Required information [The following information applies to the questions displayed beiow] During the current year, Yost Company disposed of three different assets.

please solve :)

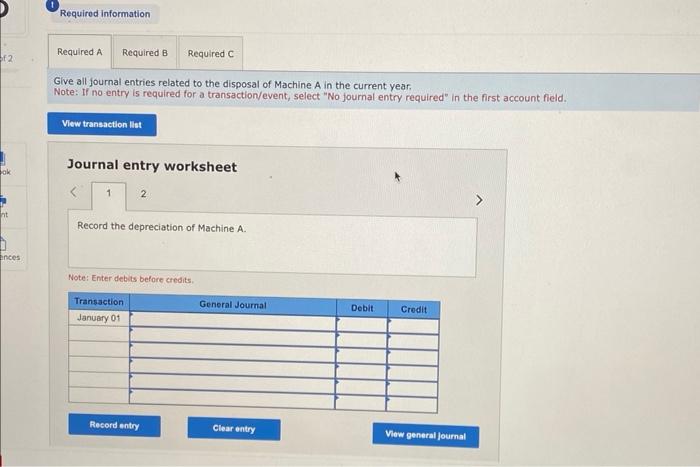

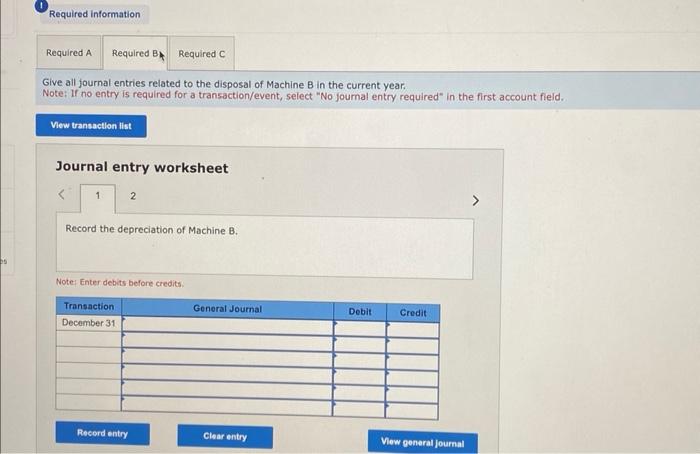

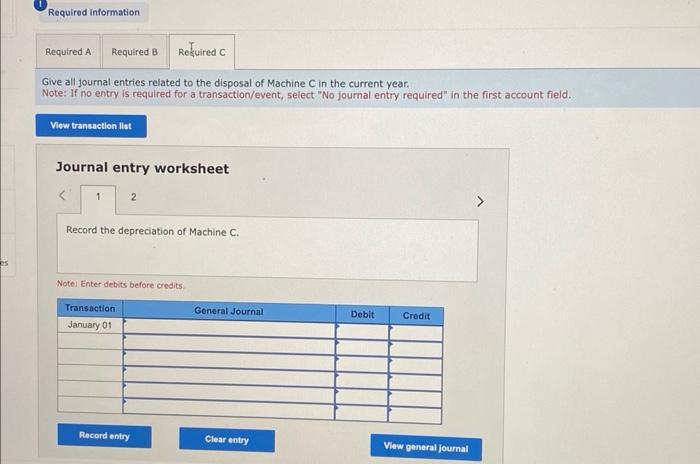

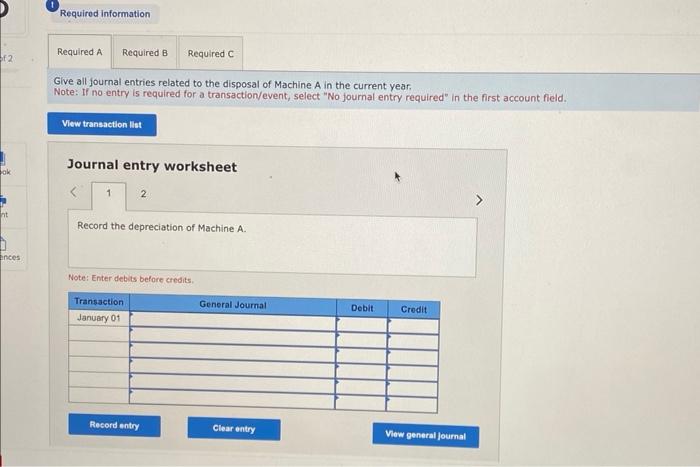

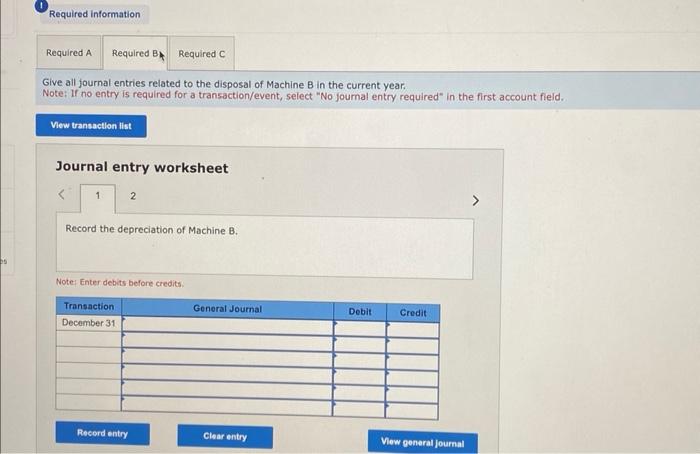

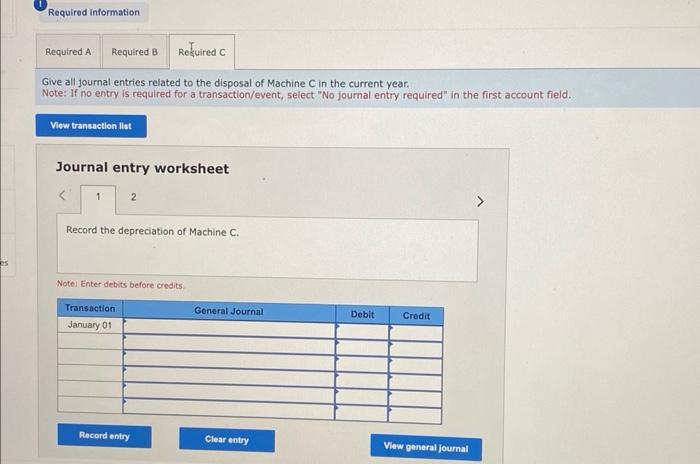

Required information [The following information applies to the questions displayed beiow] During the current year, Yost Company disposed of three different assets. On January 1 of the current year, prior to the disposal of the assets, the accounts reflected the following: The machines were disposed of during the current year in the folloting ways: a. Machine A: Sold on January 1 for $9,800 cash. b. Mochine 8: Sold on December 31 for $45,960; received cash, $36,768, and an $9,192 interest-bearing (12 percent) note receivoble due at the end of 12 months. c. Mochine C: On January 1, this machine suffered irreparable damage from an accident On January 10, a salvoge company removed the machine at no cost. Required: 1. Glve all journal entries related to the disposal of each machine in the current year, o. Machine A. b. Machine B c. Machine C. Give all journal entries related to the disposal of Machine A in the current year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 2 Give all journal entries related to the disposal of Machine B in the current year. Note: If no entry is required for a transaction/event, select "No joumal entry required" in the first account field. Journal entry worksheet Give all journal entries related to the disposal of Machine C in the current year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started