Answered step by step

Verified Expert Solution

Question

1 Approved Answer

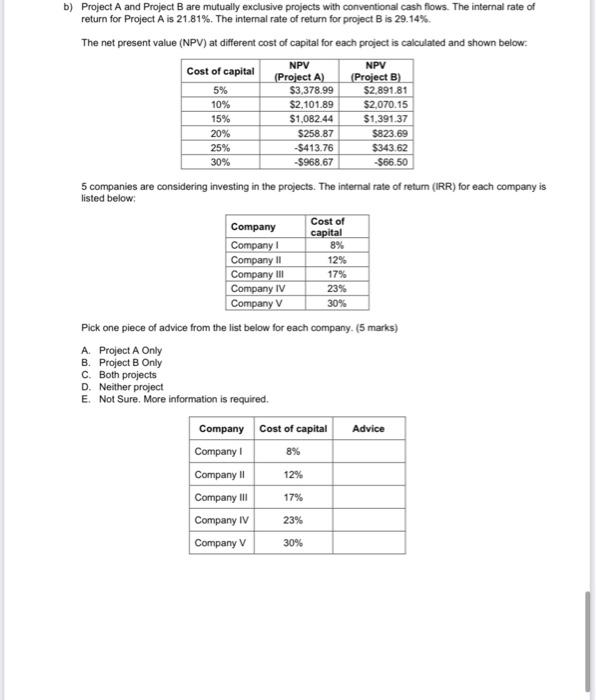

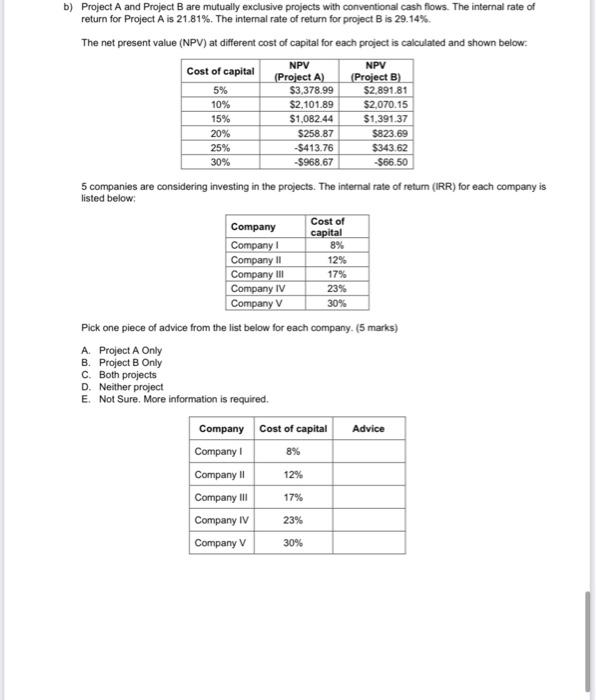

please solve that! thank you!! NPV b) Project A and Project B are mutually exclusive projects with conventional cash flows. The internal rate of return

please solve that! thank you!!

NPV b) Project A and Project B are mutually exclusive projects with conventional cash flows. The internal rate of return for Project A is 21.81%. The internal rate of return for project Bis 29.14% The net present value (NPV) at different cost of capital for each project is calculated and shown below: NPV Cost of capital Project A) Project B) 5% $3,378.99 $2.891.81 10% $2.101.89 $2,070.15 15% $1.082.44 $1,391.37 20% $258.87 $823.69 -$413.76 $343.62 30% -$968.67 $66.50 5 companies are considering investing in the projects. The internal rate of retum (IRR) for each company is listed below 25% 30% Company Cost of capital Company 8% Company II 12% Company III 17% Company IV 23% Company v Pick one piece of advice from the list below for each company. (5 marks) A. Project A Only B. Project B Only C. Both projects D. Neither project E. Not Sure. More information is required. Company Cost of capital Advice Company 8% Company II 12% Company II 17% Company IV 23% Company V 30%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started