Please solve the boxes that are empty. having trouble.

Please solve the boxes that are empty. having trouble.

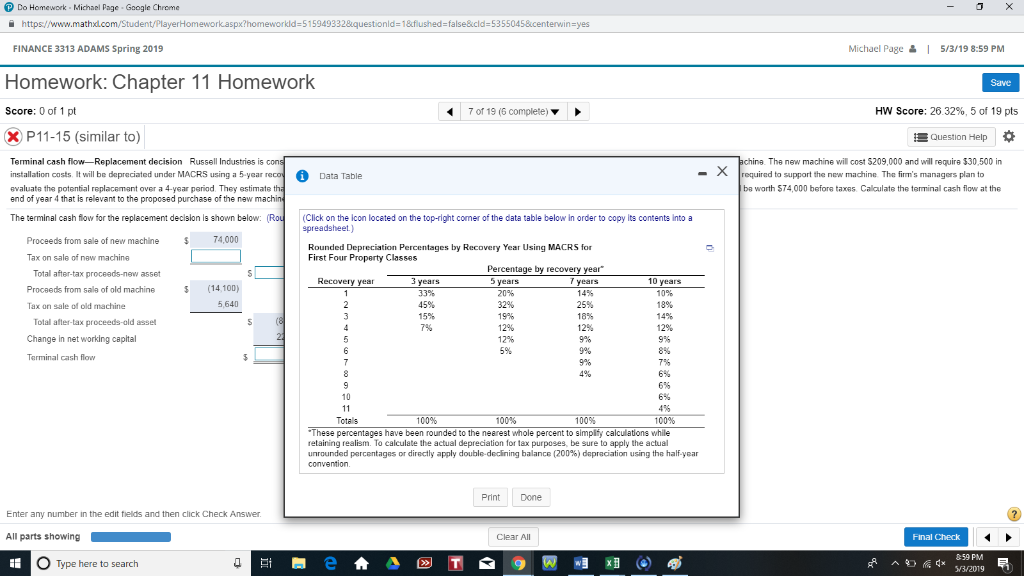

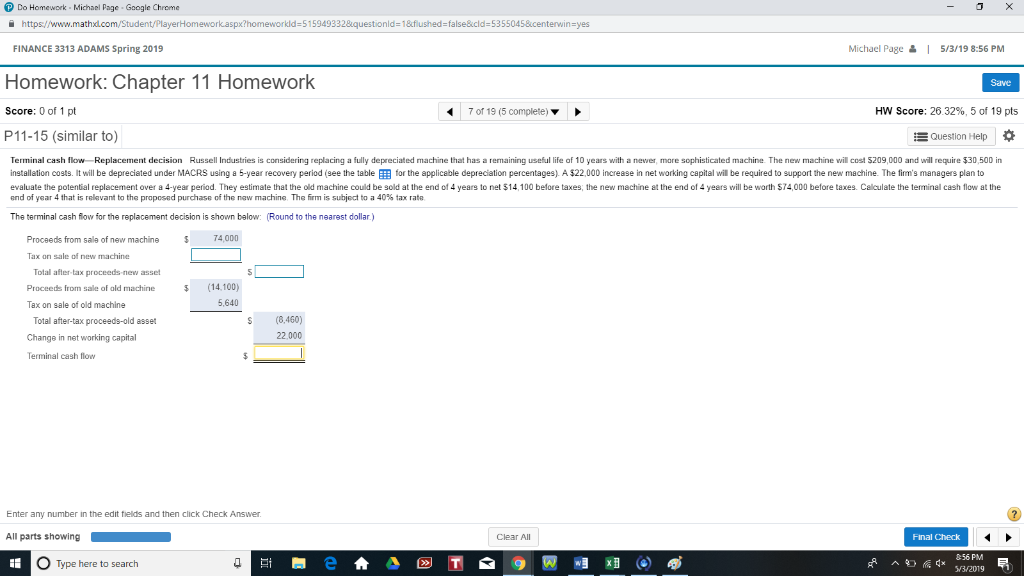

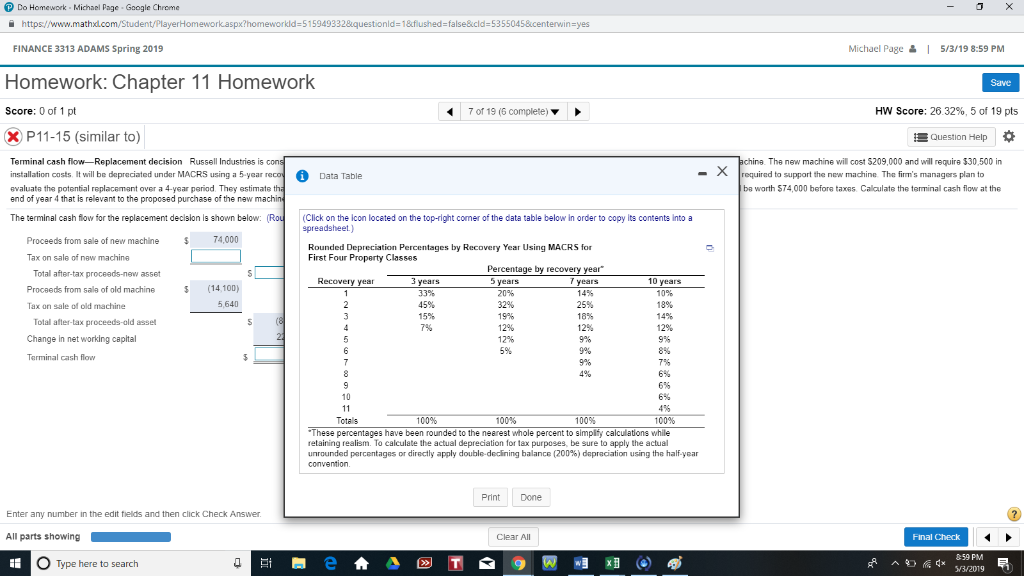

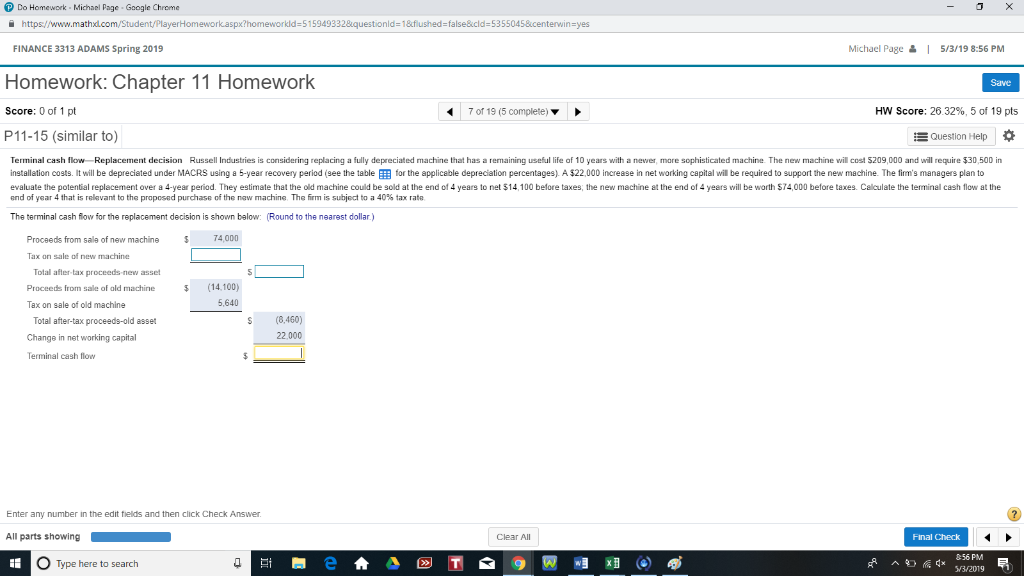

Do Homework Michael Page Google Chrome https://www.mathxl 5159493328questionld-1&flushed false&cld-5355045¢erwin yes Michael Page5/3/19 8:59 PM FINANCE 3313 ADAMS Spring 2019 Homework: Chapter 11 Homework Score: 0 of 1 pt HW Score: 26 32%, 5 of 19 pts 70119 (6 complete) P11-15 (similar to) Question Help Terminal cash flow-Replacement decision Russell Industries is con installation costs. It will be depreciated under MACRS using a 5-year reoData Table evaluate the potential replacement over a 4-year period They estimate end of year 4 that is relevant to the proposed purchase of the naw The new machine will cost $209,000 and will require $30,500 in equired to support the new machine The firm's managers plan to ba worth $74,000 before taxes Calaulate the terminal cash flow at the The terminal cash fiow for the replacement decision is shown below: (Click on the lcon located on the top-right comer of the data table below in order to copy its contents into a epreadsheet) Proceeds from sale of new machine 74,000 Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Tax on sale of new machine Total ater-tax proceeds-new asset Procaeds from sale of old machine Tax on 9ale of old machine 3 years 33% 45% 15% years 14 25% 18% 12% 10 years 10% 18% 14% 12% 9% 8% (14100) ,640 20% 32% 1996 12% 12% 5% Total after-tax proceeds-ald asse Change in net working capital Terminal cash flow 9% 9% 6% 6% 6% 10 100% 100% 100% 100% These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-decining balance (200%) depreciation using te half-year Print Done Enter any number in the edit fields and then click Check Ansiwer All parts showing Clear Al Final Check 59 PM Type here to search Do Homework Michael Page Google Chrome https://www.mathxl 5159493328questionld-1&flushed false&cld-5355045¢erwin yes Michael Page5/3/19 8:56 PM FINANCE 3313 ADAMS Spring 2019 Homework: Chapter 11 Homework Score: 0 of 1 pt P11-15 (similar to) Save HW Score: 26 32%, 5 of 19 pts 7 of 19 (5 complete) E Question Help Terminal cash flow Replacement decision Russell Industries is considering replacing a fully depreciated machine that has a remaining useful life of 10 years with a newer, more sophisticated machine The new machine will cost $209,000 and will require $30,500 in installation costs. It will be depreciated under MACRS using a 5-year recovery period (see the table EEE for the applicable depreciation percentages) A $22,000 increase in net working capital will be required to support the new machine. The firm's managers plan to evaluate the potential replacement over a 4-year periad. They estimate that the old machine could be sold at the end of 4 years to net $14,100 belore taxes, the new machine at the end of 4 years will be worth $74,000 before taxes. Calculate the terminal cash flow at the end of year 4 that is relevant to the proposed purchase of the new machine The firm is subject to a 40% tax rate The terminal cash flow for the replacement decision is shown below: (Round to the nearest dollar.) Proceeds from salle of new machine $74,000 Tax on sale of new machine Total after-tax proceeds-new asset Proceeds from sale of ald machine Tax on sale of old machine 14.100) 5,640 S (8,460) 22,000 Total after-tax proceeds-old asset Change in net working capital Terminal cash flow Enter any number in the edit fields and then click Check Ansiwer All parts showing Clear Al Final Check 56 PM O Type here to search

Please solve the boxes that are empty. having trouble.

Please solve the boxes that are empty. having trouble.