Please solve

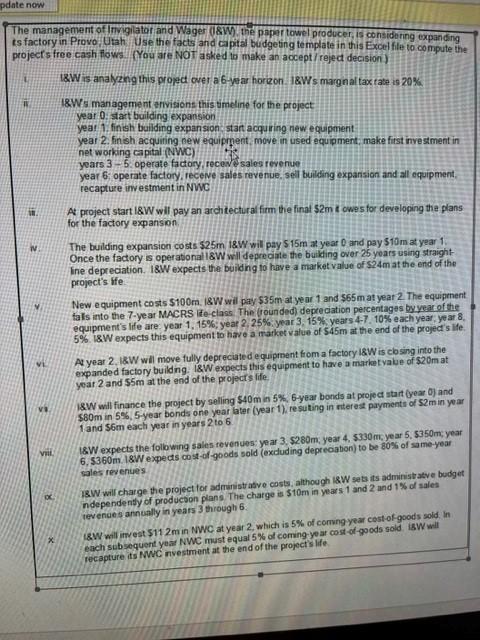

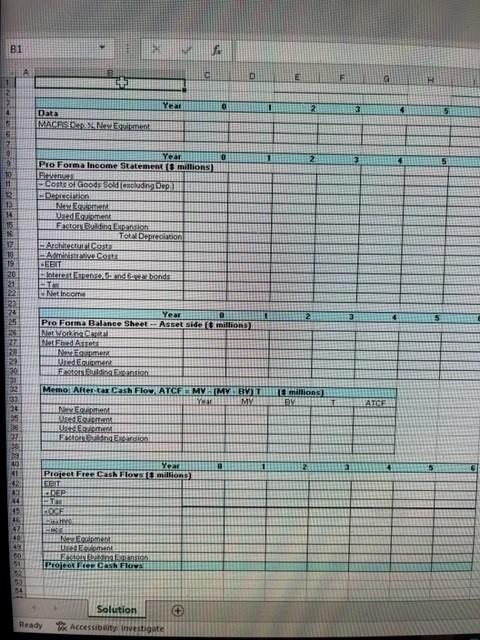

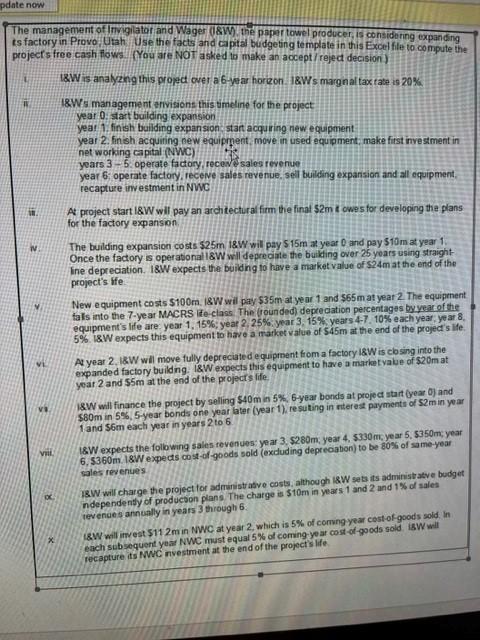

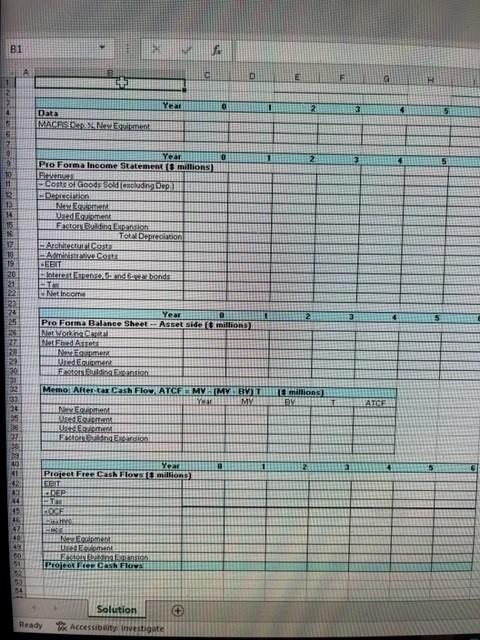

The management of Invigilator and Wager (isW). toe poper towel prodocer, is considering expanding s factory in Provo Utah Use the facts and capital budgeting template in this Excelfile to compute the rojects free cash flows Nou are NoT asked to make an accept/reject decision). 18W5 management arivisions this timeline for the project year 0 : start buifding expansion yeat 1. finish builing expansion: start acquring new equipment year 2. finish acquiting new equiprqent, move in used equipment; make fist investment in net working capital (NWC) yoars 35. operate factory, recodes sales revenue year 6. operate factory, recene sales revenue. sel bulding exparision and all equipment, recapture investment in NWC ift. At project start 18W will pay an atchtectural firm the finat 52m t owe sfor developing the plans for the factory expansion. N. The building expansion costs $25m 18W will pay 515m at year 0 and pay 510m at year 1 . Once the factory is operational 18W wil deprecinte the bulking over 25 yoars using straightIne depreciation. I8W expects the buiding to have a maket value of 524m at the end of the project's ife. New equipment costs 5100m. 18W will pay 535m at year 1 and $65m at year 2 . The equipment fals into the 7-year MACRS Ife-class. The (rounded) depceciation percentagas byyear of the equipment's Ife are: year 1,15\%; year 2,25\%; year 3, 15\%; years 4.7. 10% each year, year 8, 5%. 18W expects this equipment to have a matket value of 545m at the end of the project 5 life. v1. Ac year 2. I8W wil move fully depreciated equipment from a factory 18W is closing into the expanded factory buildng. 18W expects this equipnent to have a marketvalue of 320m at yeat 2 and 55m at the end of the projects iffe. v. I8W will finance the project by selling $40m in 5%,6-yeat bonds at project atart (year. 0 and $80m in 5%,5-year bonds one year later (year 1 ), resuting in miter es payments of 52m in year 1 and $6m each year in years 2 to 6 . vii. 18 W expects the folbwing sales revenues year 3.5280m, year 4,5330m, year 5,5350m, year 6,5360m. 18W expects cost-of-goods sold (exduding deprecaation) to be 80%6 of same-year vales revenues o. 13W will charge the project tor admanistrasve costs, although 18W sets its administatve budget ndependenty of producson plans. The charge is $10m in year 1 and 2 and 1% of ales revenues annually in years 3 through 6 . I8W will itwest 5112m in NWC at year 2 , which is 5% of corring year cost-of goods soid. In each subsequent year NWC must equal 5% of comng-year cost-of-qoods sold. isW will recapture its NWCC nvestment at the end of the project Ife \begin{tabular}{r|} 52 \\ 52 \\ 54 \\ \hline \end{tabular} Solution Frady Vx Accessibety inuestigate The management of Invigilator and Wager (isW). toe poper towel prodocer, is considering expanding s factory in Provo Utah Use the facts and capital budgeting template in this Excelfile to compute the rojects free cash flows Nou are NoT asked to make an accept/reject decision). 18W5 management arivisions this timeline for the project year 0 : start buifding expansion yeat 1. finish builing expansion: start acquring new equipment year 2. finish acquiting new equiprqent, move in used equipment; make fist investment in net working capital (NWC) yoars 35. operate factory, recodes sales revenue year 6. operate factory, recene sales revenue. sel bulding exparision and all equipment, recapture investment in NWC ift. At project start 18W will pay an atchtectural firm the finat 52m t owe sfor developing the plans for the factory expansion. N. The building expansion costs $25m 18W will pay 515m at year 0 and pay 510m at year 1 . Once the factory is operational 18W wil deprecinte the bulking over 25 yoars using straightIne depreciation. I8W expects the buiding to have a maket value of 524m at the end of the project's ife. New equipment costs 5100m. 18W will pay 535m at year 1 and $65m at year 2 . The equipment fals into the 7-year MACRS Ife-class. The (rounded) depceciation percentagas byyear of the equipment's Ife are: year 1,15\%; year 2,25\%; year 3, 15\%; years 4.7. 10% each year, year 8, 5%. 18W expects this equipment to have a matket value of 545m at the end of the project 5 life. v1. Ac year 2. I8W wil move fully depreciated equipment from a factory 18W is closing into the expanded factory buildng. 18W expects this equipnent to have a marketvalue of 320m at yeat 2 and 55m at the end of the projects iffe. v. I8W will finance the project by selling $40m in 5%,6-yeat bonds at project atart (year. 0 and $80m in 5%,5-year bonds one year later (year 1 ), resuting in miter es payments of 52m in year 1 and $6m each year in years 2 to 6 . vii. 18 W expects the folbwing sales revenues year 3.5280m, year 4,5330m, year 5,5350m, year 6,5360m. 18W expects cost-of-goods sold (exduding deprecaation) to be 80%6 of same-year vales revenues o. 13W will charge the project tor admanistrasve costs, although 18W sets its administatve budget ndependenty of producson plans. The charge is $10m in year 1 and 2 and 1% of ales revenues annually in years 3 through 6 . I8W will itwest 5112m in NWC at year 2 , which is 5% of corring year cost-of goods soid. In each subsequent year NWC must equal 5% of comng-year cost-of-qoods sold. isW will recapture its NWCC nvestment at the end of the project Ife \begin{tabular}{r|} 52 \\ 52 \\ 54 \\ \hline \end{tabular} Solution Frady Vx Accessibety inuestigate