Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve this (first question should have 2 parts to it's answer) Cooperton Mining just announced it will cut its dividend from $4.18 to $2.31

Please solve this (first question should have 2 parts to it's answer)

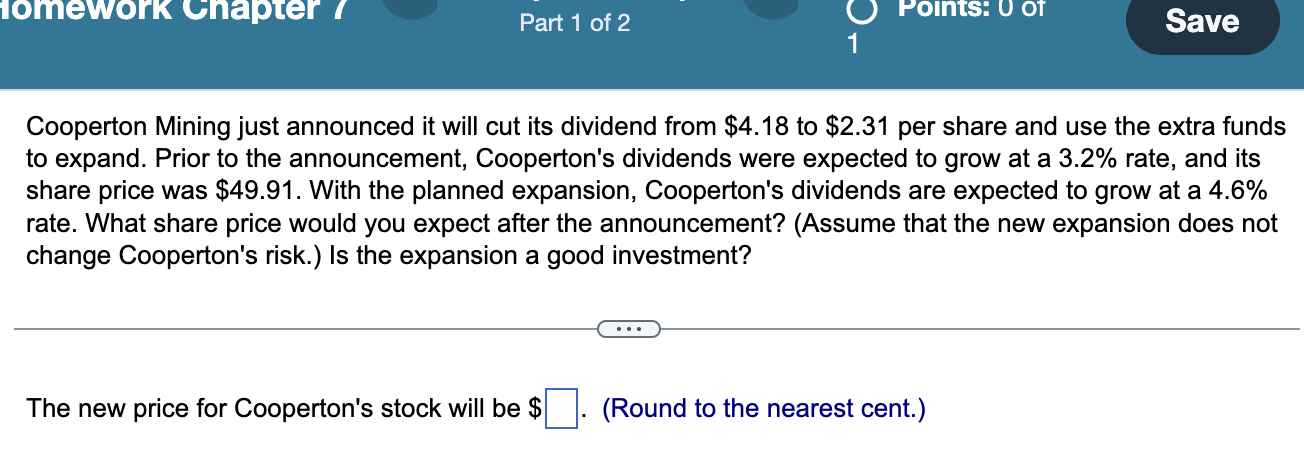

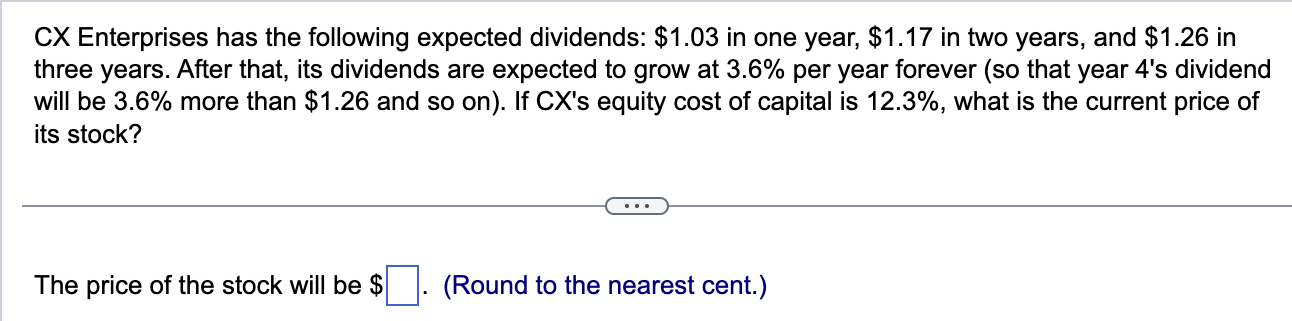

Cooperton Mining just announced it will cut its dividend from $4.18 to $2.31 per share and use the extra funds to expand. Prior to the announcement, Cooperton's dividends were expected to grow at a 3.2% rate, and its share price was $49.91. With the planned expansion, Cooperton's dividends are expected to grow at a 4.6% rate. What share price would you expect after the announcement? (Assume that the new expansion does not change Cooperton's risk.) Is the expansion a good investment? The new price for Cooperton's stock will be $ (Round to the nearest cent.) CX Enterprises has the following expected dividends: $1.03 in one year, $1.17 in two years, and $1.26 in three years. After that, its dividends are expected to grow at 3.6% per year forever (so that year 4 's dividend will be 3.6% more than $1.26 and so on). If CX's equity cost of capital is 12.3%, what is the current price of its stock? The price of the stock will be $. (Round to the nearest cent.)

Cooperton Mining just announced it will cut its dividend from $4.18 to $2.31 per share and use the extra funds to expand. Prior to the announcement, Cooperton's dividends were expected to grow at a 3.2% rate, and its share price was $49.91. With the planned expansion, Cooperton's dividends are expected to grow at a 4.6% rate. What share price would you expect after the announcement? (Assume that the new expansion does not change Cooperton's risk.) Is the expansion a good investment? The new price for Cooperton's stock will be $ (Round to the nearest cent.) CX Enterprises has the following expected dividends: $1.03 in one year, $1.17 in two years, and $1.26 in three years. After that, its dividends are expected to grow at 3.6% per year forever (so that year 4 's dividend will be 3.6% more than $1.26 and so on). If CX's equity cost of capital is 12.3%, what is the current price of its stock? The price of the stock will be $. (Round to the nearest cent.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started