Please solve this problem

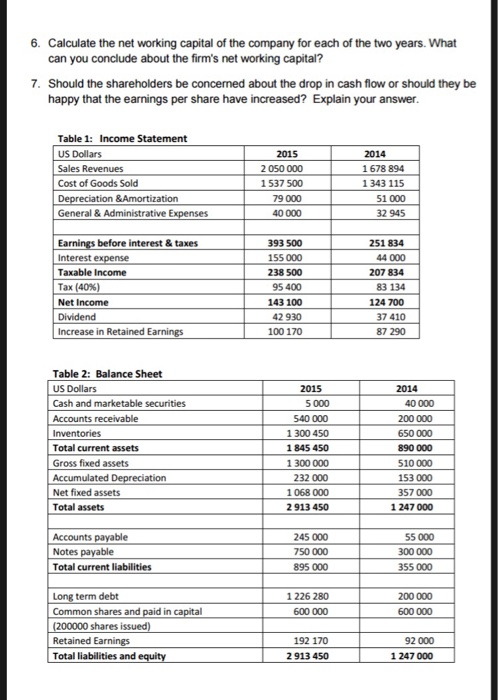

Assignment 2 You may work in groups of 3 people. Answer each of the 7 questions. Submit the written answers to the case at the beginning of class on Friday, 1 March 2019, 15:20 Case Study: Best Cable Company When Jay Smith started working as Assistant to the President 2 years ago, the company was doing quite well. It was actively expanding, and fiber optic business became one of the development directions. Prospects seemed very good. The state of the economy was stable, and the competition was not too strong. Due to the expectation of an increase in demand for fiber optic communications, the company opened 2 additional production facilities, and significantly increased the number of inventories Revenues of the company demonstrated stable growth. However, looking at the recent financial reports, Jay could see indications of declining profitability and cash generation. Jay knew that shareholders would be very concerned about the current state of affairs and most likely angry. He was confident that his boss, Joe Mathis, the CFO of the company would have to find suitable proposals on how to get out of the liquidity problems. The problem of liquidity was especially important right now, as the company was going to raise short-term capital in the near future. Jay's expectations were fully justified when Joe called him and asked him to prepare a report explaining the company's financial situation. Tables 1 and 2 present the Income Statement and the company's Balance Sheet for the last 2 years. Analyze the financial statements provided and answer the following questions: 1. Why has the stock price fallen despite the fact that the net income has increased? 2. How liquid would you say that this company is? Calculate the absolute liquidity of the firm. How does it compare with the previous year's liquidity position? 3. How does the market value of the stock compare with its book value? Is the book value accurately reflecting the true condition of the company? Calculate the book value of the company and book value per share in each year 4. The board of directors is not clear as to why the cash balance has dropped so much despite the increase in sales and the gross profit margin. What should Jay tell the board? 5. Calculate the free cash flow of the firm. What does it indicate? 6. Calculate the net working capital of the company for each of the two years. What can you conclude about the firm's net working capital? 7. Should the shareholders be concerned about the drop in cash flow or should they be happy that the earnings per share have increased? Explain your answer Table 1: Income Statement US Dollars Sales Revenues Cost of Goods Sold 2015 2014 2 050 000 1 537 500 79 000 40000 1 678 894 1343 115 51 000 32 945 & Amortization General & Administrative E before interest & taxes Interest Taxable Income Tax (40%) Net Income Dividend Increase in Retained Earnings 393 500 155 000 238 500 95 400 143 100 42 930 100 170 251 834 44 000 207 834 83 134 124 700 37 410 87 290 Table 2: Balance Sheet US Dollars Cash and marketable securities Accounts receivable 2015 2014 Total current assets Gross fixed assets Accumulated Net fixed assets Total assets 5 000 540 000 1 300 450 1 845 450 1 300 000 232 000 1 068 000 2 913 450 40 000 200 000 650 000 890 000 510 000 153 000 357 000 1 247 000 Accounts payable Notes payable Total current liabilities 245 000 750 000 895 000 55 000 300 000 55 000 1 226 280 term debt Common shares and 200000 600 000 600 000 shares i Retained Earnings Total liabilities and 192 170 2913 450 92 000 1 247 000