please solve this problem

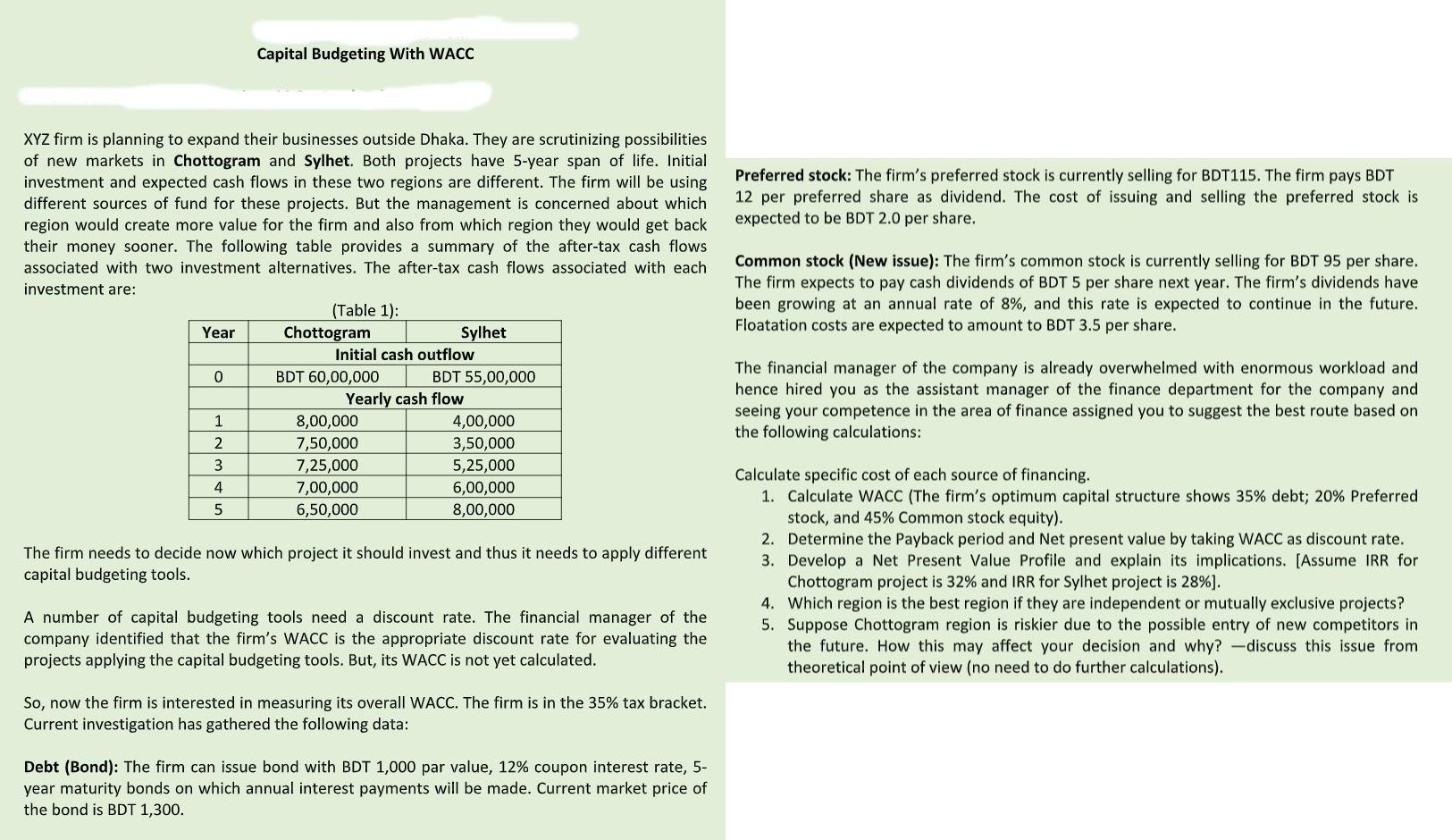

Capital Budgeting With WACC Preferred stock: The firm's preferred stock is currently selling for BDT115. The firm pays BDT 12 per preferred share as dividend. The cost of issuing and selling the preferred stock is expected to be BDT 2.0 per share. XYZ firm is planning to expand their businesses outside Dhaka. They are scrutinizing possibilities of new markets in Chottogram and Sylhet. Both projects have 5-year span of life. Initial investment and expected cash flows in these two regions are different. The firm will be using different sources of fund for these projects. But the management is concerned about which region would create more value for the firm and also from which region they would get back their money sooner. The following table provides a summary of the after-tax cash flows associated with two investment alternatives. The after-tax cash flows associated with each investment are: (Table 1): Year Chottogram Sylhet Initial cash outflow 0 BDT 60,00,000 BDT 55,00,000 Yearly cash flow 1 8,00,000 4,00,000 2 7,50,000 3,50,000 3 7,25,000 5,25,000 4 7,00,000 6,00,000 5 6,50,000 8,00,000 Common stock (New issue): The firm's common stock is currently selling for BDT 95 per share. The firm expects to pay cash dividends of BDT 5 per share next year. The firm's dividends have been growing at an annual rate of 8%, and this rate is expected to continue in the future. Floatation costs are expected to amount to BDT 3.5 per share. The financial manager of the company is already overwhelmed with enormous workload and hence hired you as the assistant manager of the finance department for the company and seeing your competence in the area of finance assigned you to suggest the best route based on the following calculations: The firm needs to decide now which project it should invest and thus it needs to apply different capital budgeting tools. Calculate specific cost of each source of financing. 1. Calculate WACC (The firm's optimum capital structure shows 35% debt; 20% Preferred stock, and 45% Common stock equity). 2. Determine the Payback period and Net present value by taking WACC as discount rate. 3. Develop a Net Present Value Profile and explain its implications. (Assume IRR for Chottogram project is 32% and IRR for Sylhet project is 28%). 4. Which region is the best region if they are independent or mutually exclusive projects? 5. Suppose Chottogram region is riskier due to the possible entry of new competitors in the future. How this may affect your decision and why? - discuss this issue from theoretical point of view (no need to do further calculations). A number of capital budgeting tools need a discount rate. The financial manager of the company identified that the firm's WACC is the appropriate discount rate for evaluating the projects applying the capital budgeting tools. But, its WACC is not yet calculated. So, now the firm is interested in measuring its overall WACC. The firm is in the 35% tax bracket. Current investigation has gathered the following data: Debt (Bond): The firm can issue bond with BDT 1,000 par value, 12% coupon interest rate, 5- year maturity bonds on which annual interest payments will be made. Current market price of the bond is BDT 1,300