Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve this question within 1 hour I have to submit it today by 10:00 PM. Golden Wedding Dress Company designs custom wedding dresses for

Please solve this question within 1 hour I have to submit it today by 10:00 PM.

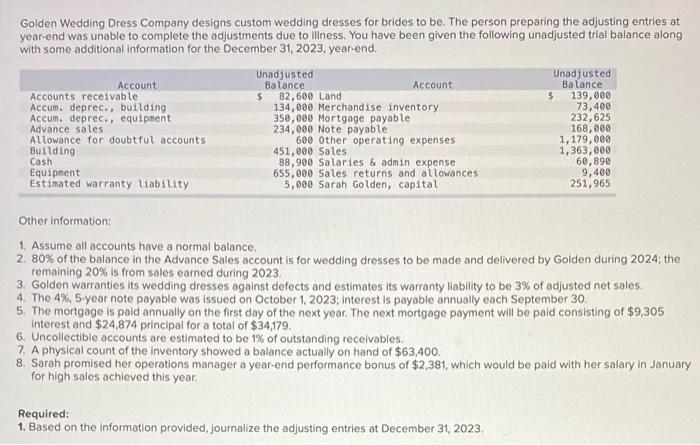

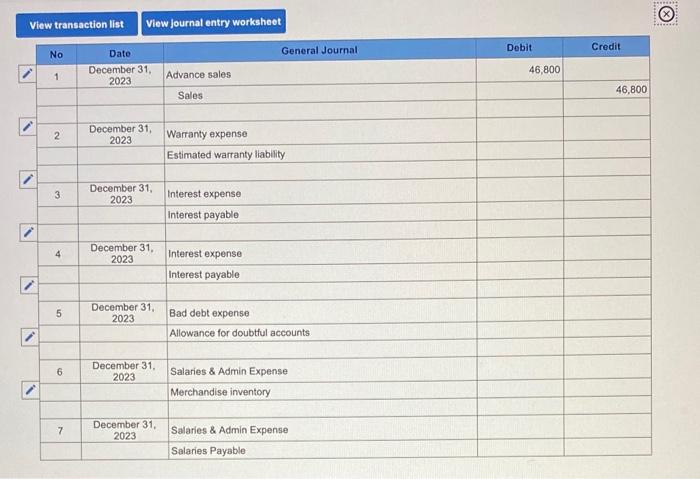

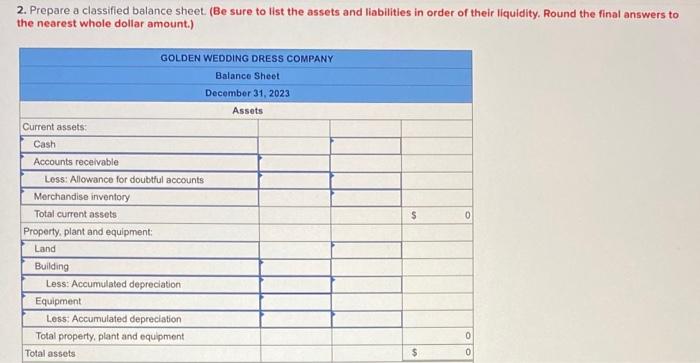

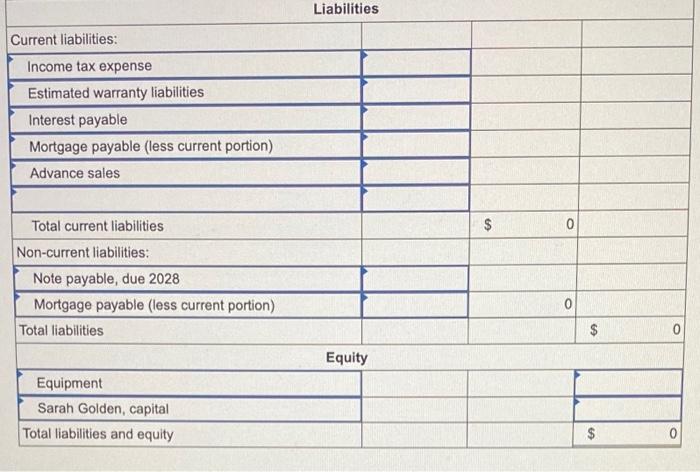

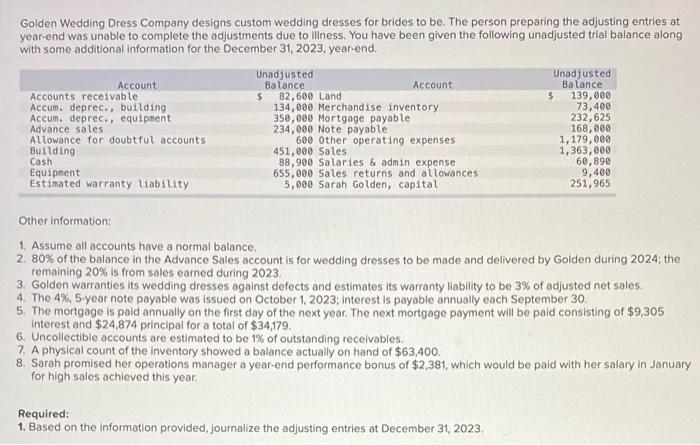

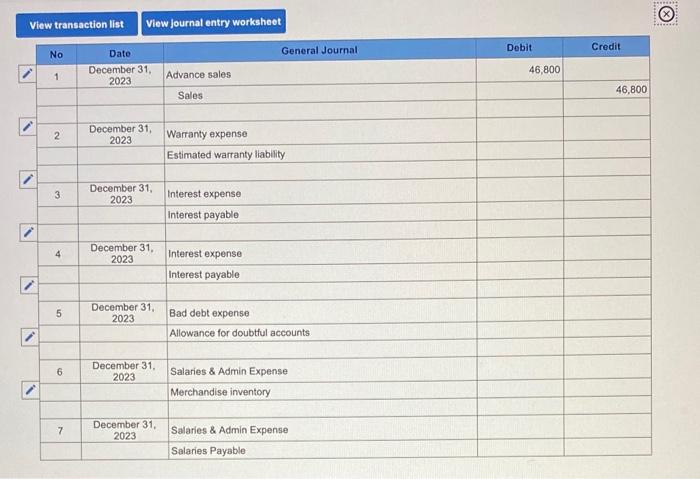

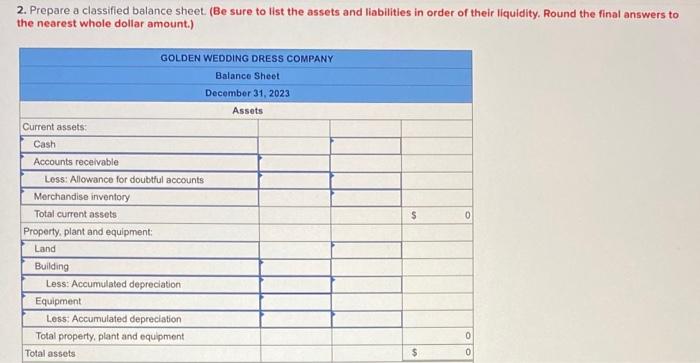

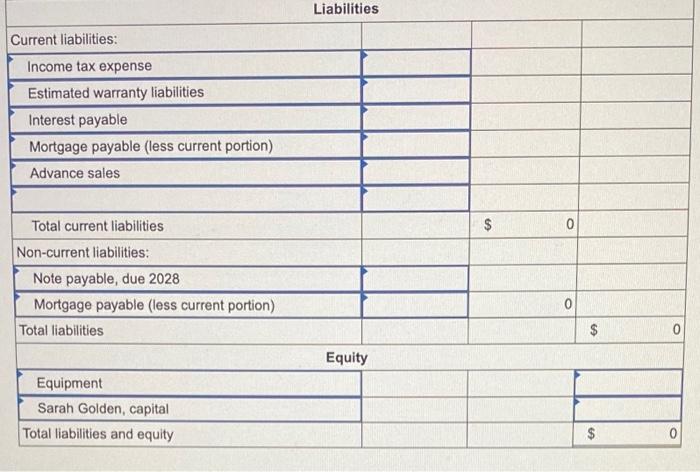

Golden Wedding Dress Company designs custom wedding dresses for brides to be. The person preparing the adjusting entries at year-end was unable to complete the adjustments due to Iliness. You have been given the following unadjusted trial balance along with some additional information for the December 31, 2023, year-end. Other information: 1. Assume all accounts have a normal balance, 2. 80% of the balance in the Advance Sales account is for wedding dresses to be made and delivered by Golden during 2024 ; the remaining 20% is from sales earned during 2023. 3. Golden warranties its wedding dresses against defects and estimates its warranty liability to be 3% of adjusted net sales. 4. The 4%,5-year note payable was issued on October 1,2023 ; interest is payable annually each September 30 . 5. The mongage is paid annually on the first day of the next year. The next mortgage payment will be paid consisting of $9.305 interest and $24,874 principal for a total of $34,179. 6. Uncollectible accounts are estimated to be 1% of outstanding receivables. 7. A physical count of the inventory showed a balance actually on hand of $63,400. 8. Sarah promised her operations manager a year-end performance bonus of $2,381, which would be paid with her salary in January for high sales achieved this year. Required: 1. Based on the information provided, journalize the adjusting entries at December 31,2023. View transaction list View journal entry worksheet 2. Prepare a classifled balance sheet. (Be sure to list the assets and liabilities in order of their liquidity. Round the final answers to the nearest whole dollar amount.) Liabilities \begin{tabular}{|l|l|l|l|} \hline Current liabilities: & & & \\ \hline Income tax expense & & & \\ \hline Estimated warranty liabilities & & & \\ \hline Interest payable & & & \\ \hline Mortgage payable (less current portion) & & & \\ \hline Advance sales & & & \\ \hline & & & \\ \hline Total current liabilities & & & \\ \hline Non-current liabilities: & & & \\ \hline Note payable, due 2028 & & & \\ \hline Mortgage payable (less current portion) & & & \\ \hline Total liabilities & & & \\ \hline & & & \\ \hline Equipment & & & \\ \hline Sarah Golden, capital & & & \\ \hline Total liabilities and equity & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started