Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve this with in 1 hour 2Fixed-Income Management (40 Points) Mark the appropriate box to indicate the correct answer. There is only one correct

please solve this with in 1 hour

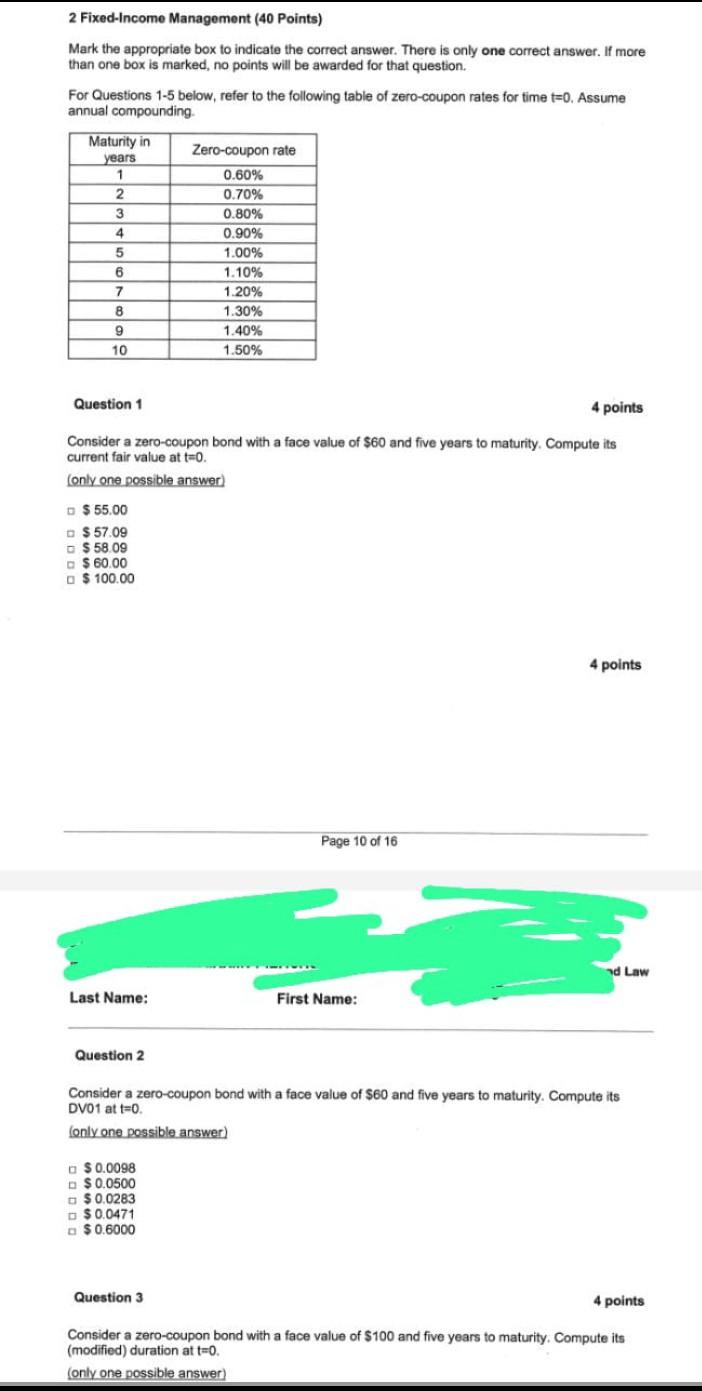

2Fixed-Income Management (40 Points) Mark the appropriate box to indicate the correct answer. There is only one correct answer. If more than one box is marked, no points will be awarded for that question. For Questions 1-5 below, refer to the following table of zero-coupon rates for time t=0. Assume annual compounding. Question 1 4 points Consider a zero-coupon bond with a face value of $60 and five years to maturity. Compute its current fair value at t=0. (only one possible answer) $55.00a$57.09a$58.09a$60.00a$100.00 4 points Page 10 of 16 Question 2 Consider a zero-coupon bond with a face value of $60 and five years to maturity. Compute its DV01 at t=0. (only one possible answer) $0.0098$0.0500a$0.0283a$0.0471a$0.6000 Question 3 4 points Consider a zero-coupon bond with a face value of $100 and five years to maturity. Compute its (modified) duration at t=0. (only one possible answer)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started