Answered step by step

Verified Expert Solution

Question

1 Approved Answer

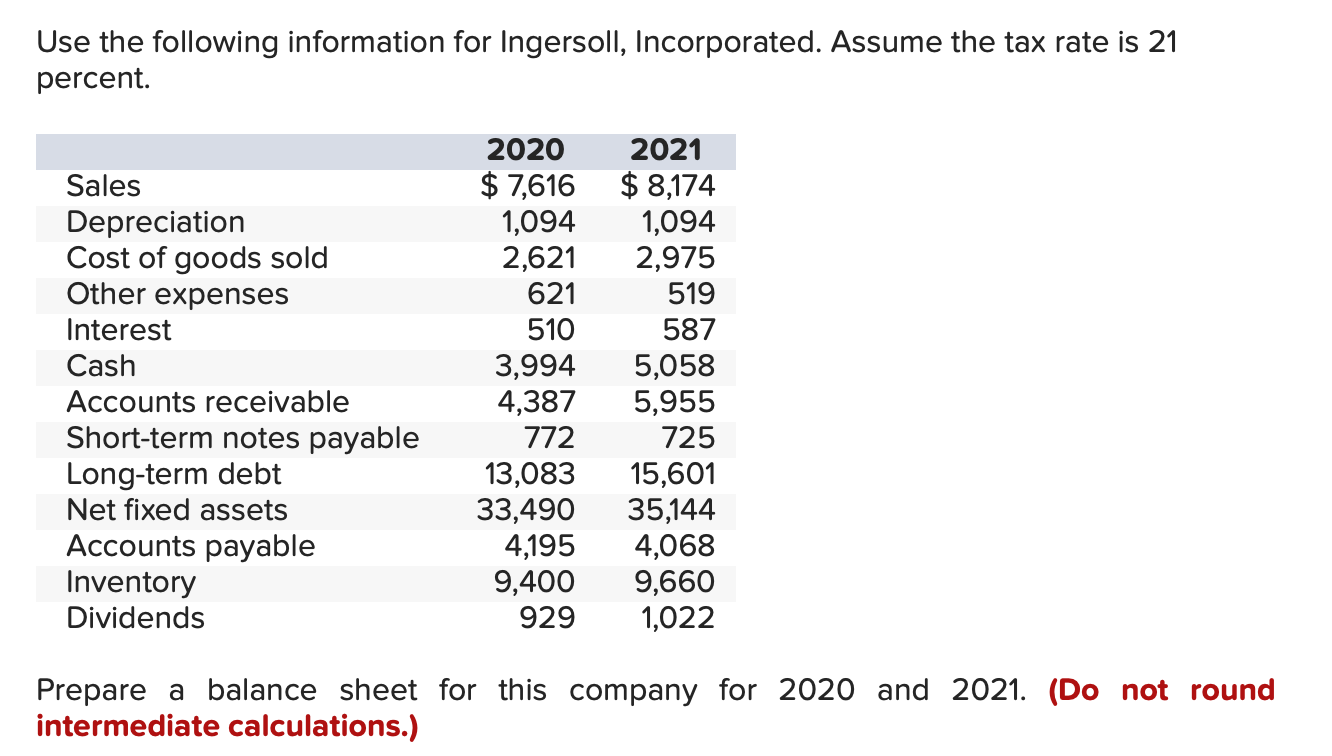

Please solve. Use the following information for Ingersoll, Incorporated. Assume the tax rate is 21 percent. Prepare a balance sheet for this company for 2020

Please solve.

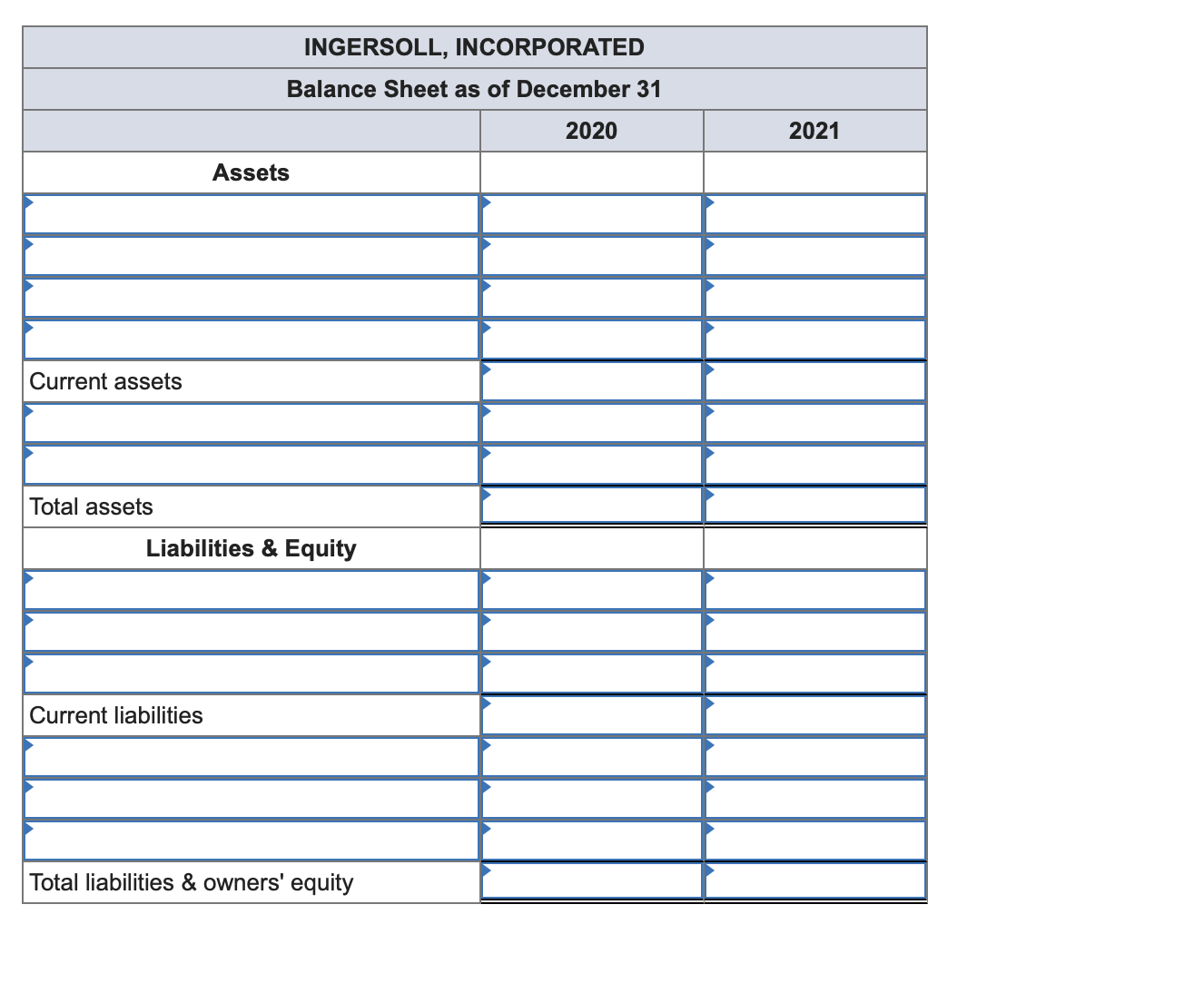

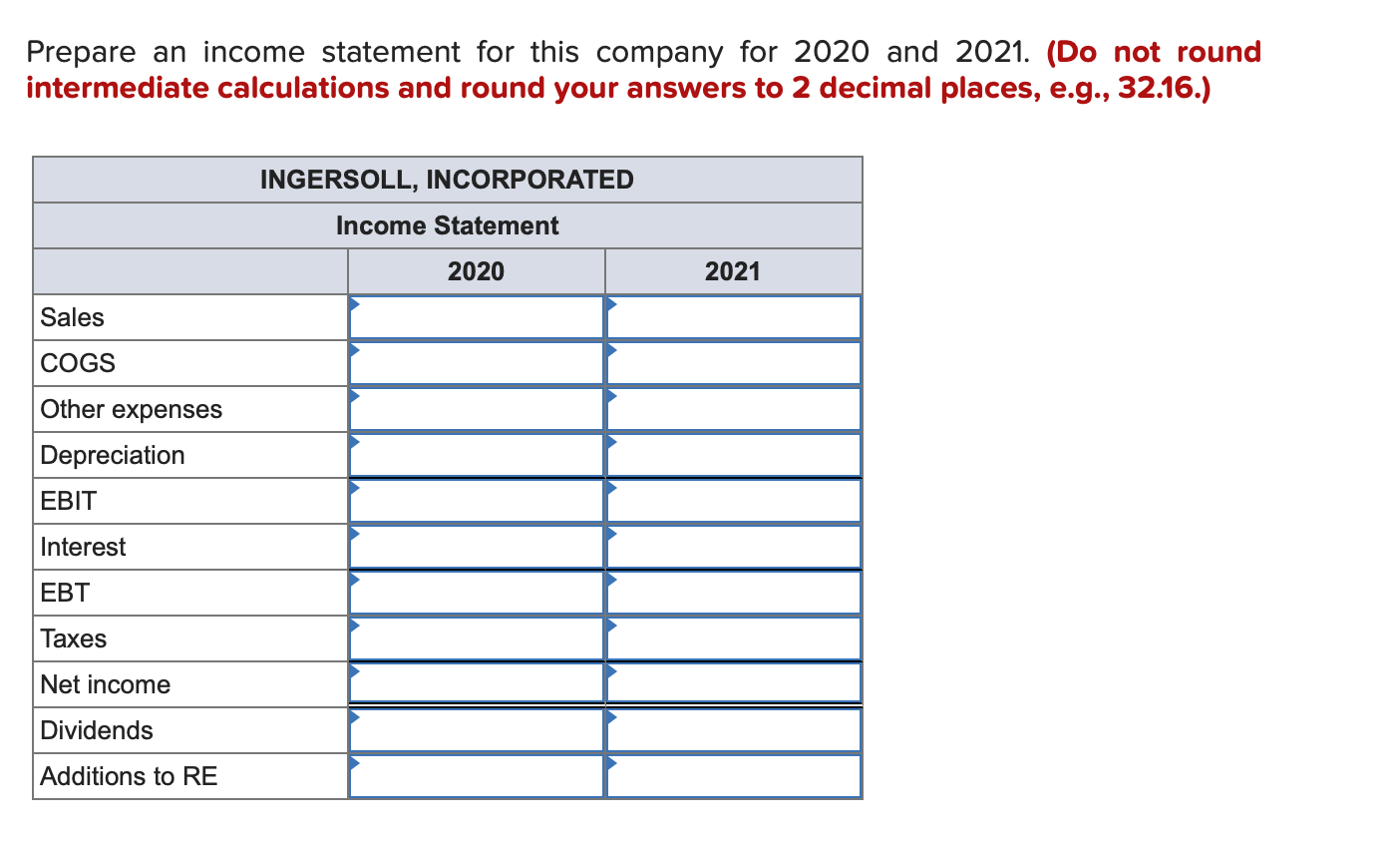

Use the following information for Ingersoll, Incorporated. Assume the tax rate is 21 percent. Prepare a balance sheet for this company for 2020 and 2021. (Do not round intermediate calculations.) \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ INGERSOLL, INCORPORATED } \\ \hline \multicolumn{3}{|c|}{ Balance Sheet as of December 31} \\ \hline & 2020 & 2021 \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline & & \\ \hline \\ \hline \\ \hline & & \\ \hline \multicolumn{3}{|l|}{ Current assets } \\ \hline \\ \hline \multirow{2}{*}{\multicolumn{3}{|c|}{ Total assets }} \\ \hline & & \\ \hline \multicolumn{3}{|l|}{ Liabilities \& Equity } \\ \hline \\ \hline \\ \hline \multirow{2}{*}{\multicolumn{3}{|c|}{ Current liabilities }} \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Total liabilities \& owners' equity & & \\ \hline \end{tabular} Prepare an income statement for this company for 2020 and 2021. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)

Use the following information for Ingersoll, Incorporated. Assume the tax rate is 21 percent. Prepare a balance sheet for this company for 2020 and 2021. (Do not round intermediate calculations.) \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ INGERSOLL, INCORPORATED } \\ \hline \multicolumn{3}{|c|}{ Balance Sheet as of December 31} \\ \hline & 2020 & 2021 \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline & & \\ \hline \\ \hline \\ \hline & & \\ \hline \multicolumn{3}{|l|}{ Current assets } \\ \hline \\ \hline \multirow{2}{*}{\multicolumn{3}{|c|}{ Total assets }} \\ \hline & & \\ \hline \multicolumn{3}{|l|}{ Liabilities \& Equity } \\ \hline \\ \hline \\ \hline \multirow{2}{*}{\multicolumn{3}{|c|}{ Current liabilities }} \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Total liabilities \& owners' equity & & \\ \hline \end{tabular} Prepare an income statement for this company for 2020 and 2021. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started