please solve using excel and show work

please solve using excel and show work

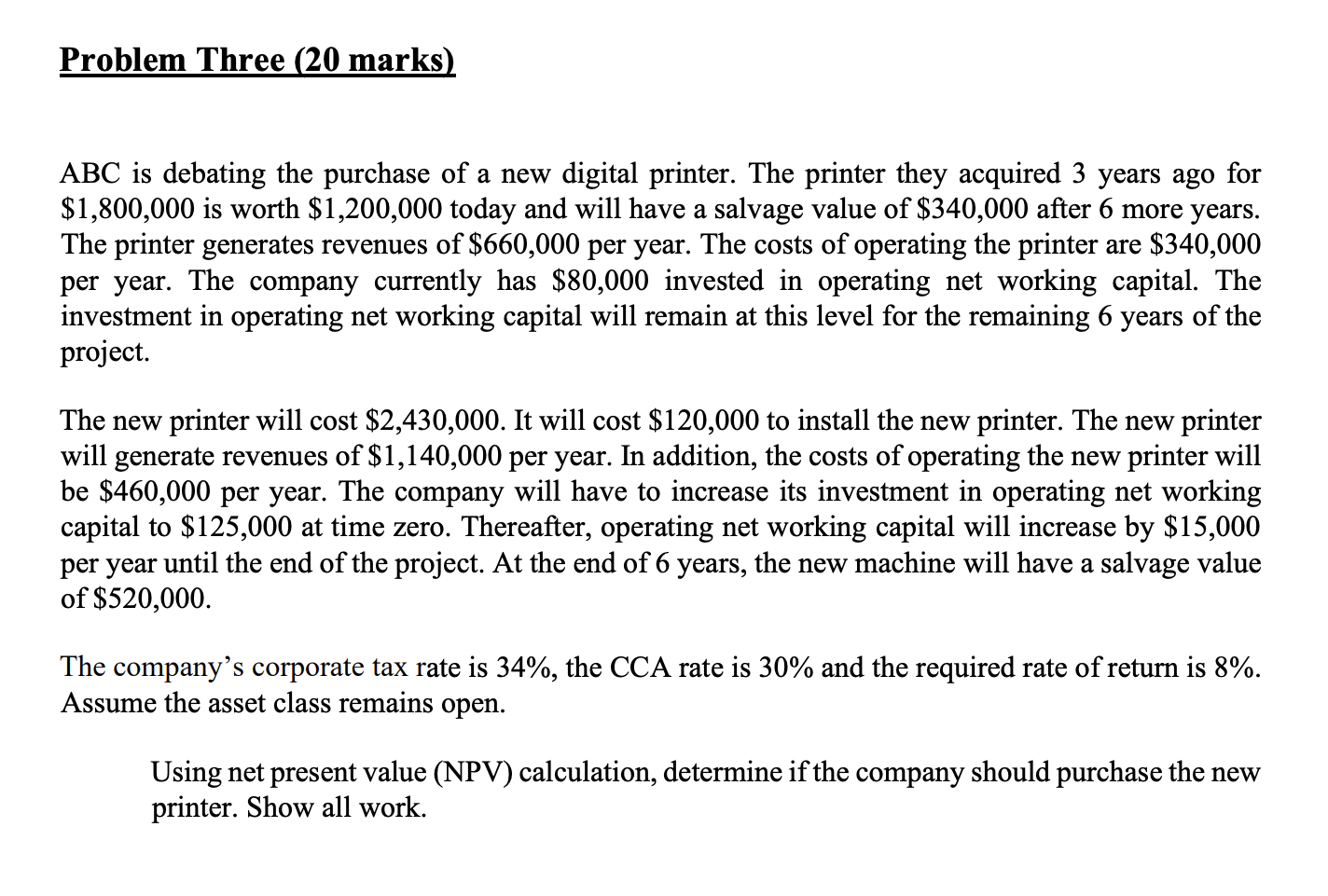

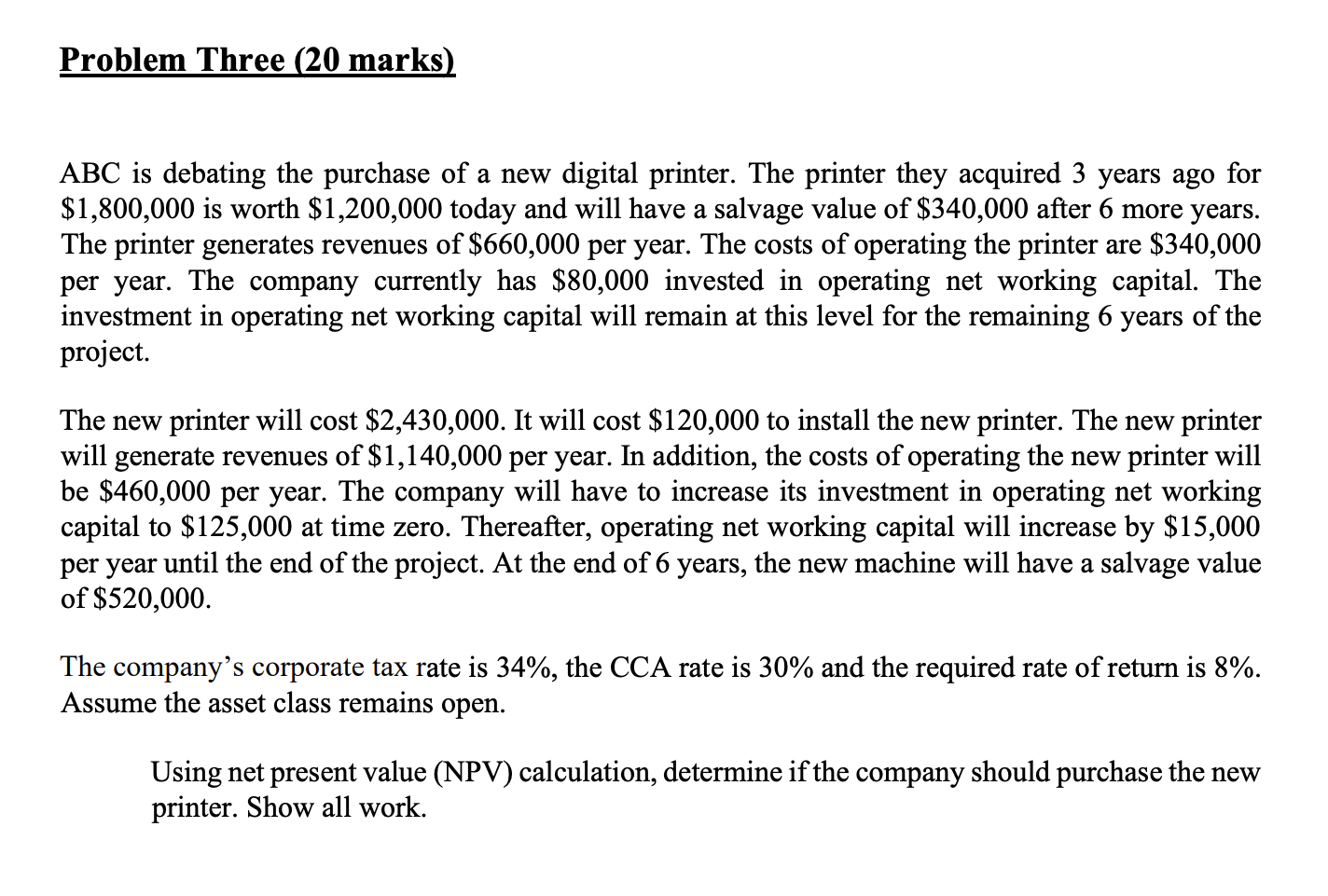

Problem Three (20 marks) ABC is debating the purchase of a new digital printer. The printer they acquired 3 years ago for $1,800,000 is worth $1,200,000 today and will have a salvage value of $340,000 after 6 more years. The printer generates revenues of $660,000 per year. The costs of operating the printer are $340,000 per year. The company currently has $80,000 invested in operating net working capital. The investment in operating net working capital will remain at this level for the remaining 6 years of the project. The new printer will cost $2,430,000. It will cost $120,000 to install the new printer. The new printer will generate revenues of $1,140,000 per year. In addition, the costs of operating the new printer will be $460,000 per year. The company will have to increase its investment in operating net working capital to $125,000 at time zero. Thereafter, operating net working capital will increase by $15,000 per year until the end of the project. At the end of 6 years, the new machine will have a salvage value of $520,000. The company's corporate tax rate is 34%, the CCA rate is 30% and the required rate of return is 8%. Assume the asset class remains open. Using net present value (NPV) calculation, determine if the company should purchase the new printer. Show all work. Problem Three (20 marks) ABC is debating the purchase of a new digital printer. The printer they acquired 3 years ago for $1,800,000 is worth $1,200,000 today and will have a salvage value of $340,000 after 6 more years. The printer generates revenues of $660,000 per year. The costs of operating the printer are $340,000 per year. The company currently has $80,000 invested in operating net working capital. The investment in operating net working capital will remain at this level for the remaining 6 years of the project. The new printer will cost $2,430,000. It will cost $120,000 to install the new printer. The new printer will generate revenues of $1,140,000 per year. In addition, the costs of operating the new printer will be $460,000 per year. The company will have to increase its investment in operating net working capital to $125,000 at time zero. Thereafter, operating net working capital will increase by $15,000 per year until the end of the project. At the end of 6 years, the new machine will have a salvage value of $520,000. The company's corporate tax rate is 34%, the CCA rate is 30% and the required rate of return is 8%. Assume the asset class remains open. Using net present value (NPV) calculation, determine if the company should purchase the new printer. Show all work

please solve using excel and show work

please solve using excel and show work