Answered step by step

Verified Expert Solution

Question

1 Approved Answer

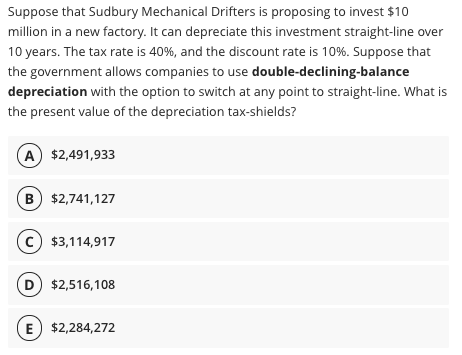

please solve with excel Suppose that Sudbury Mechanical Drifters is proposing to invest $10 million in a new factory. It can depreciate this investment straight-line

please solve with excel

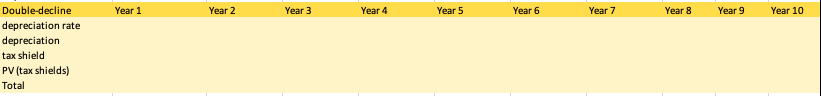

Suppose that Sudbury Mechanical Drifters is proposing to invest $10 million in a new factory. It can depreciate this investment straight-line over 10 years. The tax rate is 40%, and the discount rate is 10%. Suppose that the government allows companies to use double-declining-balance depreciation with the option to switch at any point to straight-line. What is the present value of the depreciation tax-shields? A $2,491,933 B) $2,741,127 C) $3,114,917 D) $2,516,108 E) $2,284,272 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Double-decline depreciation rate depreciation tax shield PV (tax shields) TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started