Answered step by step

Verified Expert Solution

Question

1 Approved Answer

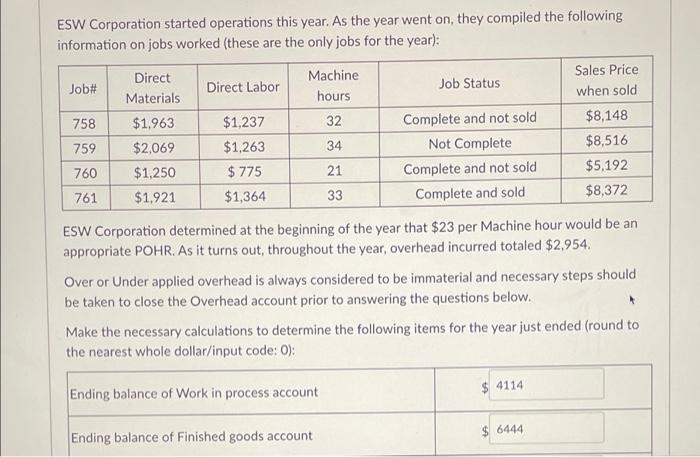

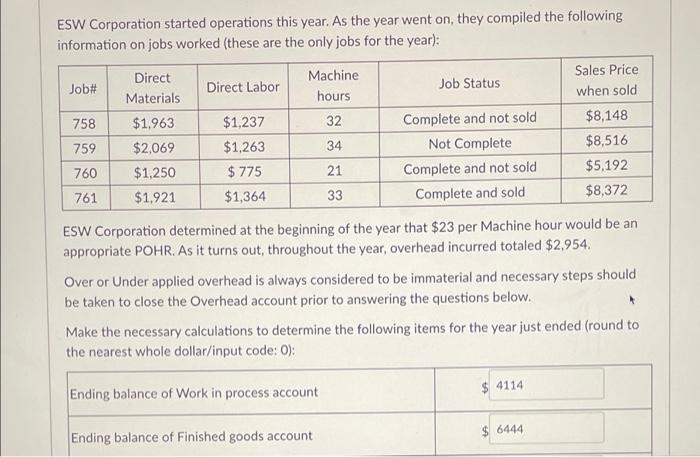

Please solve with numbers ESW Corporation started operations this year. As the year went on, they compiled the following information on jobs worked (these are

Please solve with numbers

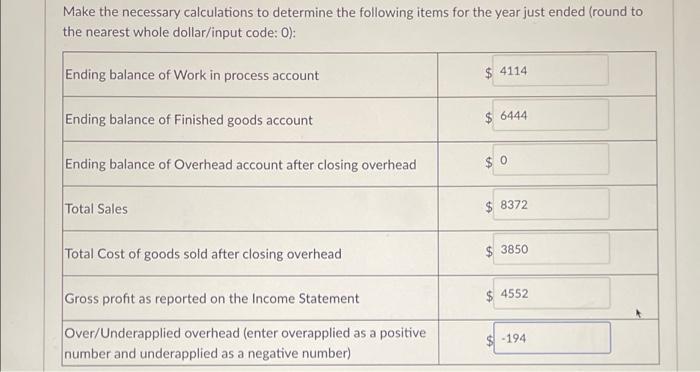

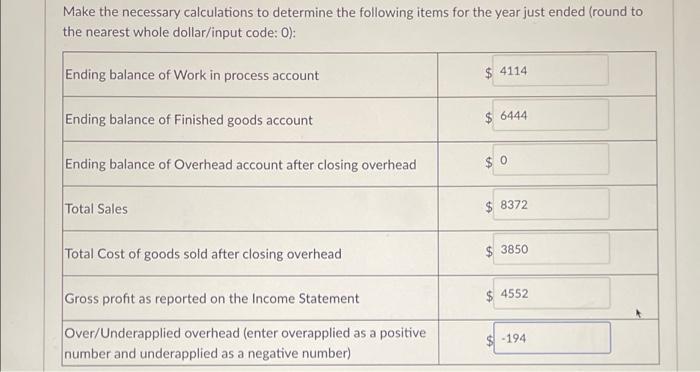

ESW Corporation started operations this year. As the year went on, they compiled the following information on jobs worked (these are the only jobs for the year): Job# Direct Materials Direct Labor Job Status 758 $1,237 $1,263 Machine hours 32 34 21 $1,963 $2,069 $1,250 $1,921 759 Sales Price when sold $8,148 $8,516 $5,192 $8,372 Complete and not sold Not Complete Complete and not sold Complete and sold $ 775 760 761 $1,364 33 ESW Corporation determined at the beginning of the year that $23 per Machine hour would be an appropriate POHR. As it turns out, throughout the year, overhead incurred totaled $2,954. Over or Under applied overhead is always considered to be immaterial and necessary steps should be taken to close the Overhead account prior to answering the questions below. Make the necessary calculations to determine the following items for the year just ended (round to the nearest whole dollar/input code: 0): $ 4114 Ending balance of Work in process account $ 6444 Ending balance of Finished goods account Make the necessary calculations to determine the following items for the year just ended (round to the nearest whole dollar/input code: 0): Ending balance of Work in process account $ 4114 Ending balance of Finished goods account $ 6444 Ending balance of Overhead account after closing overhead $ 0 Total Sales $ 8372 Total Cost of goods sold after closing overhead $ 3850 Gross profit as reported on the Income Statement $ 4552 Over/Underapplied overhead (enter overapplied as a positive number and underapplied as a negative number) $ -194

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started