Answered step by step

Verified Expert Solution

Question

1 Approved Answer

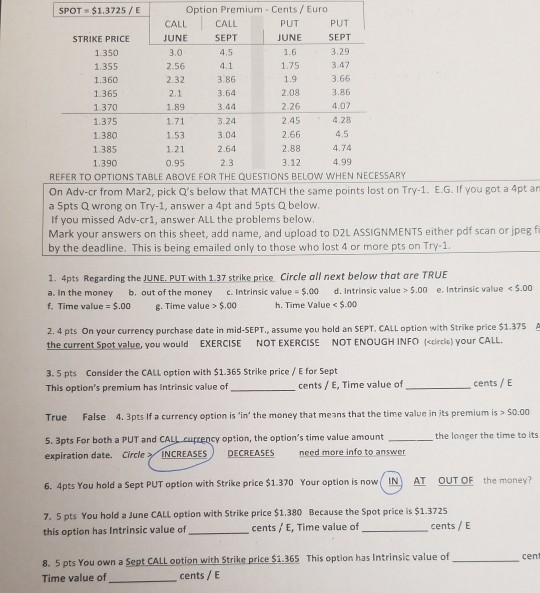

please someone assist with 7 and 8 SPOT - $1.3725 / E Option Premium - Cents / Euro CALL CALL PUT PUT STRIKE PRICE JUNE

please someone assist with 7 and 8

SPOT - $1.3725 / E Option Premium - Cents / Euro CALL CALL PUT PUT STRIKE PRICE JUNE SEPT JUNE SEPT 1.350 3.0 4.5 1.6 3.29 1.355 2.56 4.1 1.75 3.42 1.360 2.32 3.86 1.9 3.66 1.365 2.1 3.64 2.08 3.86 1.370 1.89 3.44 2.26 4.07 1.375 1.71 3.24 2.45 4.28 1.380 1.53 3.04 2.66 4.5 1.385 1.21 2.64 2.88 4.74 1.390 0.95 2.3 3.12 4.99 REFER TO OPTIONS TABLE ABOVE FOR THE QUESTIONS BELOW WHEN NECESSARY On Adv-cr from Mar2, pick Q's below that MATCH the same points lost on Try-1. E.G. If you got a 4ptan a 5pts Q wrong on Try-1, answer a 4pt and Spts Q below. If you missed Adv-cr1, answer ALL the problems below. Mark your answers on this sheet, add name, and upload to D2L ASSIGNMENTS either pdf an or jpeg ff by the deadline. This is being emailed only to those who lost 4 or more pts on Try-1. 1. 4pts Regarding the JUNE. PUT with 1.37 strike price Circle all next below that are TRUE a. In the money b. out of the money c. Intrinsic value $.00 d. Intrinsic value > $.00 e. Intrinsic value 5.00 h. Time Value INCREASES DECREASES need more info to answer AT OUT OF the money? 6. 4pts You hold a Sept PUT option with Strike price $1.370 Your option is now IN 7. 5 pts You hold a June CALL option with Strike price $1.380 Because the Spot price is $1.3725 this option has Intrinsic value of cents / E, Time value of cents / E cent 8. 5 pts You own a Sept CALL option with Strike price $1.365 This option has intrinsic value of Time value of cents / EStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started